- Page 1 and 2: OWCP Basic Training

- Page 3 and 4: OWCP Structure and JurisdictionThe

- Page 5 and 6: Information and RecordsIndividual c

- Page 7 and 8: PenaltiesThe regulations set forth

- Page 9 and 10: Program BenefitsFECA provides for f

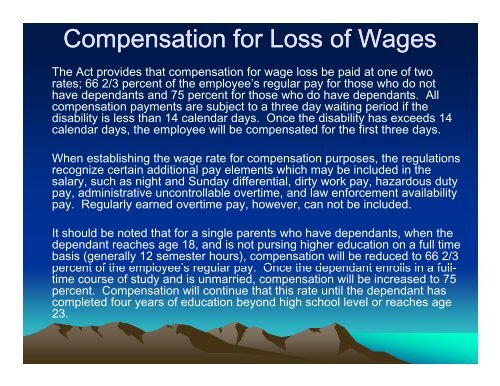

- Page 11: Compensation BenefitsFederal employ

- Page 15 and 16: Schedule AwardThe Act provides for

- Page 17 and 18: Other BenefitsAttendant AllowanceUn

- Page 19 and 20: Federal WorkersCompensationoClaims

- Page 21 and 22: Traumatic Injuries (CA-1• Back st

- Page 23 and 24: Agency Processing of Traumatic Inju

- Page 25 and 26: Tips for CA-1 Form Completion- Agen

- Page 27 and 28: Form CA-16• Only used in Traumati

- Page 29 and 30: Form CA-16 Instructions cont.

- Page 31 and 32: Occupational Diseases (Form CA-2)OW

- Page 33 and 34: Agency Processing of an Occupationa

- Page 35 and 36: Tips for CA-2 Form Completion- Agen

- Page 37 and 38: Recurrence of Disability Cont.It do

- Page 39 and 40: Form CA-2a Notice of Recurrence

- Page 41 and 42: What if the wrong form issubmitted?

- Page 43 and 44: Form CA-7 Claim for Compensation

- Page 45 and 46: Tips for CA-7 Form Completion- Agen

- Page 47 and 48: Form CA-7b Leave Buy Back

- Page 49 and 50: The Basic Elements of a Claim

- Page 52 and 53: Statements/Comments• In cases inv

- Page 54 and 55: A note about property vs.premises (

- Page 56 and 57: Pre-existing existing Conditions•

- Page 58 and 59: Three Statutory ExclusionsWillful M

- Page 60 and 61: Three Statutory ExclusionsIntoxicat

- Page 62 and 63:

Withdrawal of a Claim

- Page 64 and 65:

Continuation of Pay

- Page 66 and 67:

Continuation of Pay (COP)The 1974 a

- Page 69 and 70:

Controverting COP vs.Challenging th

- Page 71 and 72:

9 Reasons an Agency May Controvert

- Page 73 and 74:

CONTROVERTING COP (CONT’D)OTHER R

- Page 75 and 76:

INVESTIGATING ENTITLEMENT TO COP

- Page 77 and 78:

INVESTIGATIONS (CONT’D)SUBMIT OBJ

- Page 79 and 80:

INVESTIGATIONS (CONT’D)CREDIBLE W

- Page 81 and 82:

INVESTIGATIONS (CONT’D)Providing

- Page 84:

“NO TIME LOST” (NTL) CASES ANDC

- Page 87 and 88:

COUNTING COP DAYS

- Page 89 and 90:

Portion of DayIf the employee stops

- Page 91 and 92:

End of PeriodThe claimant's entitle

- Page 93 and 94:

Counting COP Entitlement - Example

- Page 95 and 96:

RETURNING INJURED EMPLOYEES TO MODI

- Page 97 and 98:

Requesting Medical ReportsA. The fi

- Page 99 and 100:

Weight of Medical EvidenceWhen OWCP

- Page 101 and 102:

Preparing the Job OfferHowever, if

- Page 103 and 104:

Suitable OffersTo find an offer of

- Page 105 and 106:

Disqualifying FactorsVerify that no

- Page 107 and 108:

What to do when a job offer is vali

- Page 109 and 110:

If the reasons for refusal are not

- Page 111 and 112:

Moving ExpensesMoving Expenses and

- Page 113 and 114:

AUTHORIZATION LEVELS• LEVEL 1: Pr

- Page 115 and 116:

What requires authorization?• Whe

- Page 117 and 118:

Info Required for Auth Requests:Rou

- Page 119 and 120:

Info Required for DME Auth• Claim

- Page 121 and 122:

No Authorization• Certain procedu

- Page 123 and 124:

Authorization EOB Code• Your clai

- Page 125 and 126:

Authorization Approval• If a requ

- Page 127 and 128:

AUTHORIZATION LETTER

- Page 129 and 130:

Medical Bill Processing

- Page 131 and 132:

Claimant Eligibilityibilit• Each

- Page 133 and 134:

Treatment t Suite• Services that

- Page 135 and 136:

Unreported Earnings or ActivitiesFo

- Page 137 and 138:

The Road to ForfeitureIf the employ

- Page 139 and 140:

Evidence Required to Establish Forf

- Page 141 and 142:

Administrative ActionsOnce the offi

- Page 143 and 144:

Other ECAB cases…..• The Office

- Page 145 and 146:

Office Decision Affirmed• The Boa

- Page 147 and 148:

Office Decision Affirmed• Appella

- Page 149 and 150:

Cases that do NOT lead to Forfeitur

- Page 151 and 152:

FECA Fraudand Criminal Prosecution

- Page 153 and 154:

§8148 Forfeiture of benefits by co

- Page 155 and 156:

18 U.S.C. 1920"§1920. False statem

- Page 157 and 158:

Pretrial DiversionDuring pretrial d

- Page 159 and 160:

FECA Program Highlightsht‣Electro

- Page 161 and 162:

CA-7 and CA-3 3e-Filing‣ Effectiv

- Page 163 and 164:

Overview• Forms to be filed via A

- Page 165 and 166:

Benefits of E-filing‣ Early recei

- Page 167 and 168:

How Will the ICS E-file forms?•Th

- Page 169 and 170:

What the ICS will seeICS willcomple

- Page 171 and 172:

How will the ICS know it worked?In

- Page 173 and 174:

Major Differences Web form vs. Pape

- Page 175 and 176:

Fields onCA-7aPre-Populated Populat

- Page 177 and 178:

RequiredFields on CA-3Pre-Populated

- Page 179 and 180:

CQS - Claimant Query SystemCQS will

- Page 181 and 182:

CQS case summary and status will di

- Page 183 and 184:

Description:DFEC Centralized IVRThe

- Page 185 and 186:

IVR Continued‣ Reduced staff work

- Page 187:

COP/RTW Redesign Features‣ COP As