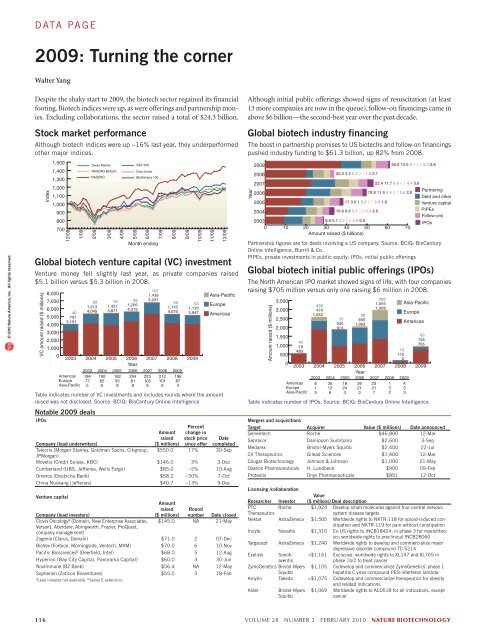

© 2010 Nature America, Inc. All rights reserved.data page2009: Turning the cornerWalter YangDespite the shaky start to 2009, the biotech sector regained its financialfooting. Biotech indices were up, as were offerings and partnership monies.Excluding collaborations, the sector raised a total of $24.3 billion.Stock market performanceAlthough biotech indices were up ~16% last year, they underperformedother major indices.Index1,5001,4001,3001,2001,1001,00090080070012/081/09Swiss MarketNASDAQ BiotechNASDAQ2/093/094/095/09S&P 500Dow JonesBioCentury 1006/09Month endingGlobal biotech venture capital (VC) investmentVenture money fell slightly last year, as private companies raised$5.1 billion versus $5.3 billion in 2008.VC amount raised ($ millions)1078,000 1,436Asia-Pacific7,00069 78 58 5,24155Europe1,213 1,451 1,206531,1456,00040 4,045 3,871 4,3151,1304,070 3,947 Americas5,000 7973,1514,0003,0002,0001,00002003AmericasEuropeAsia-Pacific7/098/092004 2005 2006 2007 2008Year2003 2004 2005 2006 2007 2008 2009184775190826182959204818223105921210161968749/092009Table indicates number of VC investments and includes rounds where the amountraised was not disclosed. Source: BCIQ: BioCentury Online IntelligenceNotable 2009 dealsIPOsPercentCompany (lead underwriters)Amountraised($ millions)change instock pricesince offerDatecompletedTalecris (Morgan Stanley, Goldman Sachs, Citigroup, $550.0 17% 30-SepJPMorgan)Movetis (Credit Suisse, KBC) $146.0 3% 3-DecCumberland (UBS, Jefferies, Wells Fargo) $85.0 –5% 10-AugOmeros (Deutsche Bank) $68.2 –30% 7-OctChina Nuokang (Jefferies) $40.7 –13% 9-DecVenture capitalAmountCompany (lead investors)raised($ millions)Roundnumber Date closedClovis Oncology a (Domain, New Enterprise Associates, $145.0 NA 21-MayVersant, Aberdare, Abingworth, Frazier, ProQuest,company management)Zogenix (Clarus, Domain) $71.0 2 07-DecBioVex (Forbion, Morningside, Ventech, MVM) $70.0 6 10-NovPacific Biosciences b (Deerfield, Intel) $68.0 5 12-AugHyperion (Bay City Capital, Panorama Capital) $60.0 3 30-JunNovImmune (BZ Bank) $56.4 NA 12-MaySopherion (Zoticon Bioventures) $55.0 3 18-Feba Lead investor not available. b Series E extension.10/0911/0912/09Although initial public offerings showed signs of resuscitation (at least13 more companies are now in the queue), follow-on financings came inabove $6 billion—the second-best year over the past decade.Global biotech industry financingThe boost in partnership promises to US biotechs and follow-on financingspushed industry funding to $61.3 billion, up 82% from 2008.Year20092008200720062005200420.0 3.2 5.3 3.1 1.9 0.117.3 6.1 5.4 2.7 4.8 1.910.9 8.8 5.3 2.9 3.3 2.620038.9 9.1 4.0 2.2 3.9 0.50 10 20 30 40 50 60 70Amount raised ($ billions)36.9 10.0 5.1 2.2 6.0 0.922.4 11.7 6.8 4.7 4.4 3.019.8 11.9 5.6 4.7 5.6 2.0PartneringDebt and otherVenture capitalPIPEsFollow-onsIPOsPartnership figures are for deals involving a US company. Source: BCIQ: BioCenturyOnline Intelligence, Burrill & Co.PIPEs, private investments in public equity; IPOs, initial public offeringsGlobal biotech initial public offerings (IPOs)The North American IPO market showed signs of life, with four companiesraising $705 million versus only one raising $6 million in 2008.Amount raised ($ millions)5853,5001,055 Asia-Pacific2301,3093,000474Europe1,852982,50015 869930Americas1,0632,0009131,5001,000500043194832003AmericasEuropeAsia-Pacific1211562004 2005 2006 2007 2008Year2003 2004 2005 2006 2007 2008 200981535126182432621323217132433651587052009Table indicates number of IPOs. Source: BCIQ: BioCentury Online IntelligenceMergers and acquisitionsTarget Acquirer Value ($ millions) Date announcedGenentech Roche $46,800 12-MarSepracor Dainippon Sumitomo $2,600 3-SepMedarex Bristol-Myers Squibb $2,400 22-JulCV Therapeutics Gilead Sciences $1,400 12-MarCougar Biotechnology Johnson & Johnson $1,000 21-MayOvation Pharmaceuticals H. Lundbeck $900 09-FebProteolix Onyx Pharmaceuticals $851 12-OctLicensing /collaborationResearcher InvestorValue($ millions) Deal descriptionPTCTherapeuticsRoche $1,924 Develop small molecules against four central nervoussystem disease targetsNektar AstraZeneca $1,505 Worldwide rights to NKTR-118 for opioid-induced constipationand NKTR-119 for pain without constipationIncyte Novartis $1,310 Ex-US rights to INCB18424; in phase 3 for myelofibrosis;worldwide rights to preclinical INCB28060Targacept AstraZeneca $1,240 Worldwide rights to develop and commercialize majordepressive disorder compound TC-5214Exelixis Sanofiaventis>$1,161 Exclusive, worldwide rights to XL147 and XL765 inphase 1b/2 to treat cancerZymoGenetics Bristol-MyersSquibb$1,105 Codevelop and commercialize ZymoGenetics’ phase 1hepatitis C virus compound PEG-interferon lambdaAmylin Takeda >$1,075 Codevelop and commercialize therapeutics for obesityand related indicationsAlder Bristol-MyersSquibb$1,069 Worldwide rights to ALD518 for all indications, exceptcancer116 volume 28 number 2 february 2010 nature biotechnology

news feature© 2010 Nature America, Inc. All rights reserved.The HER2 testing conundrumProblems in interpreting diagnostic tests for HER2 may becompromising patient access to effective treatments. As newversions of therapies targeting HER2 work their way throughclinical trials, will the situation get even murkier? Malorye Allisoninvestigates.A recent study from the University of California,San Francisco, reveals that one in five HER2tests gives the wrong answer 1 . Furthermore, thearticle, which reviews the medical literature,reports that as many as two-thirds of breastcancer patients who should be tested for HER2are not, and consequently a significant fractionof women treated with Genentech’s Herceptin(trastuzumab) have never been tested for HER2overexpression.The health benefit provider Wellpoint,of Indianapolis, might dispute that finding.According to Genentech staff scientist MarkSliwkowski, the insurer has data showing that98% of its breast cancer patients are tested.However, doctors differ in their views on testingbefore prescribing Herceptin. “Some doctorsdon’t know how to interpret test results,Table 1 Selected HER2 testsCompanyLocationBiogenexSan Ramon, CaliforniaDakoGlostrup, DenmarkDakoGenomic HealthInvitrogenCarlsbad, CaliforniaMonogram BiosciencesSiemens Healthcare DiagnosticsErlangen, GermanyVentana-RocheTucsonVentana-RocheVysis (Abbott)Name of testStatusInSite HER2/neu CB11FDA approvedHER2 FISH pharmDx KitFDA approvedHercepTestFDA approvedOncotype DXCLIA validatedSPOT-Light HER2 CISH KitFDA approvedHERmark Breast Cancer AssayCLIA-validatedHER2/neu ELISAFDA approvedthey prefer just to prescribe it and assess thepatient’s progress,” says Michael Liebman ofthe patient stratification company StrategicMedicine of Kennett Square, Pennsylvania.More than a decade after the drug receivedUS Food and Drug Administration (FDA)approval, the personalized medicine paradigmclearly has holes. Many experts are frustratedand troubled by the state of HER2 testing, especiallyas new opportunities for tests are on thehorizon. And as trials testing Herceptin at earlierstages and in combination with other drugscontinue, experts are starting to wonder whatbesides HER2 overexpression might be influencingan individual’s response to the drug.These questions promise to not only spur thedevelopment of a range of new tests to guidebreast cancer therapy but also fundamentallyInform HER2 Silver in situ HybridizationApproved in Europe and elsewhere but notby FDAPathway anti-HER2/neu (Clone CB11)FDA approvedPathVysion HER2 DNA Probe KitFDA approvedCLIA, Clinical Laboratory Improvement Amendment; ELISA, enzyme-linked immunosorbent assay.change understanding of this disease, lead tonew treatments and potentially have an impacton treatment of other cancers.Testing tempestPersonalized medicine proponents point toHerceptin as a paradigm changer: the monoclonalantibody targeting HER2 (also referredto as HER2/neu and ERBB2) evens the playingfield for breast cancer patients overexpressingHER2, whose tumors are typically more aggressive.But testing was problematic from thestart, due to either sloppy execution or complextumor biology. “Giving Herceptin earlyimproves outcome so dramatically that it is anabsolute tragedy to miss patients who shouldbe getting it,” says Jeffrey Ross, from AlbanyMedical College in Albany, New York, whohelped develop a fluorescent in situ hybridization(FISH) HER2 test marketed by DownersGrove, Illinois–based Vysis (Table 1). FISH testsare currently considered the gold standard.As more data become available and theHER2 story evolves, it’s becoming clear thatsome pieces don’t fit together quite as wellas they might. For example, patients whosetumors have progressed on the drug, sometimesrespond to Herceptin when it is givenlater with chemotherapy. Furthermore, fewerthan 50% of HER2-positive metastatic breastTechnologyImmunohistochemistry assay using a monoclonal antibody directed against the internaldomain of HER2/neu available either in automated or manual formatsFISH assay to determine HER2 gene amplification in formalin-fixed, paraffin-embeddedbreast cancer specimens. Gene amplification is determined from the ratio between thenumber of signals from the hybridization of the HER2 gene probe and the number ofsignals from the hybridization of the reference chromosome 17 probe (green signals)Semi-quantitative immunohistochemistry assay for determination of HER2 proteinoverexpression in breast cancer tissues routinely processed for histological evaluationRT PCR–based assay analyzes the expression of a panel of 21 genes, among themHER2. Oncotype DX predicts disease recurrence and assesses benefit from certaintypes of chemotherapyChromogenic in situ hybridization (CISH) using a DNA probe. Quantifiable results arevisualized under a standard brightfield microscope.Proximity-based assay, which provides direct quantitative measurements of HER2total protein and HER2 homodimer levelsSandwich enzyme immunoassay using mouse monoclonal for capture and a differentbiotinylated mouse monoclonal antibody for the detection of human HER2/neu protein.Detection is by direct chemiluminescence. Protein is quantified by spectrophotometryFully automated silver in situ hybridization assay for HER2 and chromosome 17detection. Chromogenic signals are detected through the use of silver depositiontechnology. Results and morphological significance can be interpreted using conventionalbrightfield microscopySemiquantitative immunohistochemistry assay using a monoclonal antibody for thedetection of c-erbB-2 (HER2) antigen using Ventana’s family of automated instrumentplatformsFluorescence in situ hybridization (FISH) assay to determine HER2 amplification,using LSI HER2 probe, which spans HER2, and CEP 17 probe, which hybridizes tothe alpha satellite DNA located at the centromere of chromosomenature biotechnology volume 28 number 2 february 2010 117

- Page 3 and 4: volume 28 number 2 february 2010COM

- Page 5 and 6: in this issue© 2010 Nature America

- Page 7 and 8: © 2010 Nature America, Inc. All ri

- Page 10 and 11: NEWS© 2010 Nature America, Inc. Al

- Page 12 and 13: NEWS© 2010 Nature America, Inc. Al

- Page 14 and 15: NEWS© 2010 Nature America, Inc. Al

- Page 16 and 17: © 2010 Nature America, Inc. All ri

- Page 18 and 19: © 2010 Nature America, Inc. All ri

- Page 22 and 23: NEWS feature© 2010 Nature America,

- Page 24 and 25: uilding a businessComing to termsDa

- Page 26 and 27: uilding a business© 2010 Nature Am

- Page 28 and 29: correspondence© 2010 Nature Americ

- Page 30 and 31: correspondence© 2010 Nature Americ

- Page 32 and 33: correspondence© 2010 Nature Americ

- Page 34 and 35: correspondence© 2010 Nature Americ

- Page 36 and 37: case studyNever againcommentaryChri

- Page 38 and 39: COMMENTARY© 2010 Nature America, I

- Page 40 and 41: COMMENTARY© 2010 Nature America, I

- Page 42 and 43: patents© 2010 Nature America, Inc.

- Page 44 and 45: patents© 2010 Nature America, Inc.

- Page 46 and 47: news and viewsChIPs and regulatory

- Page 48 and 49: news and viewsFrom genomics to crop

- Page 50 and 51: news and views© 2010 Nature Americ

- Page 52 and 53: news and views© 2010 Nature Americ

- Page 54 and 55: e s o u r c eRational association o

- Page 56 and 57: e s o u r c e© 2010 Nature America

- Page 58 and 59: e s o u r c e© 2010 Nature America

- Page 60 and 61: e s o u r c e© 2010 Nature America

- Page 62 and 63: © 2010 Nature America, Inc. All ri

- Page 64 and 65: B r i e f c o m m u n i c at i o n

- Page 66 and 67: i e f c o m m u n i c at i o n sAUT

- Page 68 and 69: lettersa1.5 kb hVPrIntron 112.5 kbA

- Page 70 and 71:

letters© 2010 Nature America, Inc.

- Page 72 and 73:

letters© 2010 Nature America, Inc.

- Page 74 and 75:

l e t t e r sReal-time imaging of h

- Page 76 and 77:

l e t t e r sFigure 2 Time-lapse li

- Page 78 and 79:

l e t t e r s© 2010 Nature America

- Page 80 and 81:

l e t t e r sRational design of cat

- Page 82 and 83:

l e t t e r s© 2010 Nature America

- Page 84 and 85:

l e t t e r s© 2010 Nature America

- Page 86 and 87:

sample fluorescence was measured as

- Page 88 and 89:

careers and recruitmentFourth quart