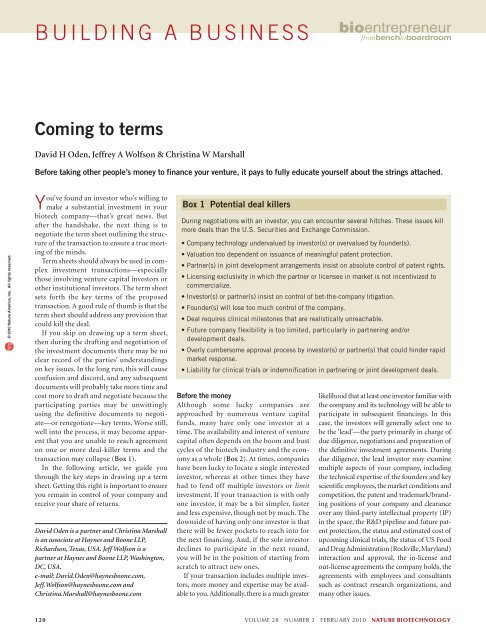

uilding a businessComing to termsDavid H Oden, Jeffrey A Wolfson & Christina W MarshallBefore taking other people’s money to finance your venture, it pays to fully educate yourself about the strings attached.© 2010 Nature America, Inc. All rights reserved.You’ve found an investor who’s willing tomake a substantial investment in yourbiotech company—that’s great news. Butafter the handshake, the next thing is tonegotiate the term sheet outlining the structureof the transaction to ensure a true meetingof the minds.Term sheets should always be used in complexinvestment transactions—especiallythose involving venture capital investors orother institutional investors. The term sheetsets forth the key terms of the proposedtransaction. A good rule of thumb is that theterm sheet should address any provision thatcould kill the deal.If you skip on drawing up a term sheet,then during the drafting and negotiation ofthe investment documents there may be noclear record of the parties’ understandingson key issues. In the long run, this will causeconfusion and discord, and any subsequentdocuments will probably take more time andcost more to draft and negotiate because theparticipating parties may be unwittinglyusing the definitive documents to negotiate—orrenegotiate—key terms. Worse still,well into the process, it may become apparentthat you are unable to reach agreementon one or more deal-killer terms and thetransaction may collapse (Box 1).In the following article, we guide youthrough the key steps in drawing up a termsheet. Getting this right is important to ensureyou remain in control of your company andreceive your share of returns.David Oden is a partner and Christina Marshallis an associate at Haynes and Boone LLP,Richardson, Texas, USA. Jeff Wolfson is apartner at Haynes and Boone LLP, Washington,DC, USA.e-mail: David.Oden@haynesboone.com,Jeff.Wolfson@haynesboone.com andChristina.Marshall@haynesboone.comBox 1 Potential deal killersDuring negotiations with an investor, you can encounter several hitches. These issues killmore deals than the U.S. Securities and Exchange Commission.• Company technology undervalued by investor(s) or overvalued by founder(s).• Valuation too dependent on issuance of meaningful patent protection.• Partner(s) in joint development arrangements insist on absolute control of patent rights.• Licensing exclusivity in which the partner or licensee in market is not incentivized tocommercialize.• Investor(s) or partner(s) insist on control of bet-the-company litigation.• Founder(s) will lose too much control of the company.• Deal requires clinical milestones that are realistically unreachable.• Future company flexibility is too limited, particularly in partnering and/ordevelopment deals.• Overly cumbersome approval process by investor(s) or partner(s) that could hinder rapidmarket response.• Liability for clinical trials or indemnification in partnering or joint development deals.Before the moneyAlthough some lucky companies areapproached by numerous venture capitalfunds, many have only one investor at atime. The availability and interest of venturecapital often depends on the boom and bustcycles of the biotech industry and the economyas a whole (Box 2). At times, companieshave been lucky to locate a single interestedinvestor, whereas at other times they havehad to fend off multiple investors or limitinvestment. If your transaction is with onlyone investor, it may be a bit simpler, fasterand less expensive, though not by much. Thedownside of having only one investor is thatthere will be fewer pockets to reach into forthe next financing. And, if the sole investordeclines to participate in the next round,you will be in the position of starting fromscratch to attract new ones.If your transaction includes multiple investors,more money and expertise may be availableto you. Additionally, there is a much greaterlikelihood that at least one investor familiar withthe company and its technology will be able toparticipate in subsequent financings. In thiscase, the investors will generally select one tobe the ‘lead’—the party primarily in charge ofdue diligence, negotiations and preparation ofthe definitive investment agreements. Duringdue diligence, the lead investor may examinemultiple aspects of your company, includingthe technical expertise of the founders and keyscientific employees, the market conditions andcompetition, the patent and trademark/brandingpositions of your company and clearanceover any third-party intellectual property (IP)in the space, the R&D pipeline and future patentprotection, the status and estimated cost ofupcoming clinical trials, the status of US Foodand Drug Administration (Rockville, Maryland)interaction and approval, the in-license andout-license agreements the company holds, theagreements with employees and consultantssuch as contract research organizations, andmany other issues.120 volume 28 number 2 FEBRUARY 2010 nature biotechnology

uilding a business© 2010 Nature America, Inc. All rights reserved.That’s a lot to handle, so to ensure a smoothdiligence process with the lead investor, youshould have your legal counsel (preferablyindependent from your regular IP counsel)pre-evaluate the portfolio and IP-related agreementsto help identify and remedy any potentialroadblock issues (like ownership of technology)before seeking investment.The lead investor is usually the one investingthe most money, and that group should bethe main contact for you and your counsel. Inthis situation, a term sheet is absolutely essential,and all investors should participate in thedrafting and negotiation of the term sheet.When all are comfortable with the terms, theother investors should step back and let thelead investor negotiate the rest of the documentsbased on the term sheet.The next step is dealing with the type ofsecurity your investors will be purchasing inreturn for their financing: common stock,preferred stock, a promissory note (normallyconvertible into equity) or some combinationof these (Box 3).But perhaps the most important thing foryou is the valuation the investors assign to yourcompany. Before consummation of the deal, theinvestor and your firm will go through a verydetailed evaluation to determine what portionof the company’s total equity the investor willpurchase. This valuation will involve looking atthe company and its prospects, the values forcomparable companies, the current investmentclimate and the general economic conditions.Valuation is a combination of art and scienceand therefore is open to substantial disagreementand negotiation. It can be particularlydependent on the results of a thorough duediligence investigation.It’s important because the total value willdetermine what percentage of the companythe investor will purchase in exchange for theinvestment. To use a simple example, if theinvestor is investing $1 million in a companywith a pre-money valuation of $1 million, thenthe investor will own 50% of the company afterthe investment (assuming that the company willhave a value of $2 million post-money). If thecompany has a pre-money value of $4 million,then the investor will own 20% of the companypost-money ($1 million being 20% of a $5 millionpost-money value).This determination of value is a key areaof conflict between founders and investors.Not surprisingly, founders usually want ahigher valuation and investors typically seeka lower one.Living with investorsMost founders are familiar with vesting—theconcept that stock options will become exercis-Box 2 Term sheet trendsDuring the past boom for biotech companies (about 9–10 years ago), companies could nothave asked for more advantageous term sheets. At that time, investors were more fearful ofmissing out on a great opportunity than of losing their investment.But the pendulum has inevitably swung back to reflect market conditions, so todayterm sheets tend to be very investor friendly. Biopharma venture capital funding hassubstantially decreased since the boom days, squeezed by conditions in the financialmarkets and, more recently, burned by the global economic downturn. With less biotechventure funding available, companies have had to give up more. Unless your companyis an unusually attractive investment opportunity, do not expect much negotiatingpower at the term sheet stage.able (that is, they will ‘vest’) over time. Vestingis also typical in a venture capital investment,but in a different way: the founder will typicallybe asked to put his or her equity ownership atrisk of being repurchased by the company in theevent that the founder is no longer associatedwith the company for any reason.The rationale behind vesting is that the ventureinvestor is really betting on people (you andyour team) as well as the company and the technology.If you leave, retire, decide to go in a differentdirection or get fired, then you’ll no longerbe in a position to push the company forward.And if you still own a substantial portion of thecompany, this is untenable for your investors.For protection, an investor will typically askyou, the founder, to enter a vesting agreement,whereby all your stock is subject to repurchase bythe company at a nominal price per share (typically,the price originally paid by the founder).The company’s right to repurchase the stock willbe triggered if the founder leaves the companyfor any reason, including the termination ofemployment. This right of repurchase generallydecreases over time, so that at some pointnone of your stock is subject to repurchase. Forexample, in a five-year vesting (which is fairlytypical), the company will have the right (butnot the obligation) to repurchase 100% of thefounder’s stock for the first year after the investment,80% in year two, 60% in year three and soon. After five years, none of the founder’s stockwill be subject to repurchase.As a founder, your risk is the concern overbeing ousted by investors, perhaps to bring ona more business-savvy CEO. This often occurseven if you’re performing well as chief executive.Many founders will seek provisions guaranteeingtheir position for a sufficiently long time,ensuring immediate vesting of rights or otherprotective measures like specifying a reasonablerepurchase price for their stock if involuntarilyor unexpectedly separated from the company.Also up for discussion is the amount of controlinvestors will have over the daily operationsand major decisions of the company. Specifically,particular attention in negotiations should bepaid to whether the investor gains a seat on thecompany’s board, the power the investor has onthe board and the voting rights the investor mayhave as a stockholder.It is fairly normal for an investor to obtain oneor more seats on the company’s board of directorsif the investment is a substantial amount ofmoney and especially if the investor or a designeehas expertise that will be helpful to thefounders. The rationale here is that the investorwants the right to help control the company(and, in turn, try to protect his or her investment)and you want professional assistance inrunning the company.Venture investors specialize in running andgrowing companies—most founders do not. Aventure firm’s presence on the board can reallyhelp those companies that need assistance withbusiness aspects. When properly arranged, thiscan provide founders with a renewed opportunityto focus on what may be their core competency—thetechnology or science.Still, the issue remains of how many boardseats the investor is entitled to and the total sizeof the board. It would be common and expectedthat a large investor would be entitled to at leastone board seat but uncommon to give the investorenough seats to control the board.Investors normally require an agreementwith the company and the other stockholdersregarding the investors’ rights as a stockholder.These voting agreements usually contain provisionspermitting the investor to designate boardmembers and prohibiting the company fromtaking certain actions without the investor’sapproval. Remember to heavily negotiate theseaspects at the term sheet stage of the transactionas they will restrict your ability to run thecompany as you see fit.Exit strategiesBecause an investor’s primary goal is to obtaina substantial return on his or her initial investment,the term sheet will include multipleprovisions focused on how the investor willget the money back—the ‘exit strategy’. Theserights may include a liquidation preference,nature biotechnology volume 28 number 2 FEBRUARY 2010 121

- Page 3 and 4: volume 28 number 2 february 2010COM

- Page 5 and 6: in this issue© 2010 Nature America

- Page 7 and 8: © 2010 Nature America, Inc. All ri

- Page 10 and 11: NEWS© 2010 Nature America, Inc. Al

- Page 12 and 13: NEWS© 2010 Nature America, Inc. Al

- Page 14 and 15: NEWS© 2010 Nature America, Inc. Al

- Page 16 and 17: © 2010 Nature America, Inc. All ri

- Page 18 and 19: © 2010 Nature America, Inc. All ri

- Page 20 and 21: © 2010 Nature America, Inc. All ri

- Page 22 and 23: NEWS feature© 2010 Nature America,

- Page 26 and 27: uilding a business© 2010 Nature Am

- Page 28 and 29: correspondence© 2010 Nature Americ

- Page 30 and 31: correspondence© 2010 Nature Americ

- Page 32 and 33: correspondence© 2010 Nature Americ

- Page 34 and 35: correspondence© 2010 Nature Americ

- Page 36 and 37: case studyNever againcommentaryChri

- Page 38 and 39: COMMENTARY© 2010 Nature America, I

- Page 40 and 41: COMMENTARY© 2010 Nature America, I

- Page 42 and 43: patents© 2010 Nature America, Inc.

- Page 44 and 45: patents© 2010 Nature America, Inc.

- Page 46 and 47: news and viewsChIPs and regulatory

- Page 48 and 49: news and viewsFrom genomics to crop

- Page 50 and 51: news and views© 2010 Nature Americ

- Page 52 and 53: news and views© 2010 Nature Americ

- Page 54 and 55: e s o u r c eRational association o

- Page 56 and 57: e s o u r c e© 2010 Nature America

- Page 58 and 59: e s o u r c e© 2010 Nature America

- Page 60 and 61: e s o u r c e© 2010 Nature America

- Page 62 and 63: © 2010 Nature America, Inc. All ri

- Page 64 and 65: B r i e f c o m m u n i c at i o n

- Page 66 and 67: i e f c o m m u n i c at i o n sAUT

- Page 68 and 69: lettersa1.5 kb hVPrIntron 112.5 kbA

- Page 70 and 71: letters© 2010 Nature America, Inc.

- Page 72 and 73: letters© 2010 Nature America, Inc.

- Page 74 and 75:

l e t t e r sReal-time imaging of h

- Page 76 and 77:

l e t t e r sFigure 2 Time-lapse li

- Page 78 and 79:

l e t t e r s© 2010 Nature America

- Page 80 and 81:

l e t t e r sRational design of cat

- Page 82 and 83:

l e t t e r s© 2010 Nature America

- Page 84 and 85:

l e t t e r s© 2010 Nature America

- Page 86 and 87:

sample fluorescence was measured as

- Page 88 and 89:

careers and recruitmentFourth quart