The Bulletin - George Washington University Law School

The Bulletin - George Washington University Law School

The Bulletin - George Washington University Law School

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

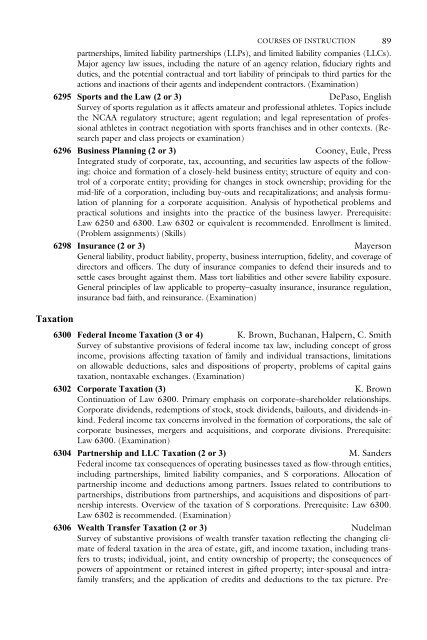

COURSES OF INSTRUCTION 89partnerships, limited liability partnerships (LLPs), and limited liability companies (LLCs).Major agency law issues, including the nature of an agency relation, fiduciary rights andduties, and the potential contractual and tort liability of principals to third parties for theactions and inactions of their agents and independent contractors. (Examination)6295 Sports and the <strong>Law</strong> (2 or 3) DePaso, EnglishSurvey of sports regulation as it affects amateur and professional athletes. Topics includethe NCAA regulatory structure; agent regulation; and legal representation of professionalathletes in contract negotiation with sports franchises and in other contexts. (Researchpaper and class projects or examination)6296 Business Planning (2 or 3) Cooney, Eule, PressIntegrated study of corporate, tax, accounting, and securities law aspects of the following:choice and formation of a closely-held business entity; structure of equity and controlof a corporate entity; providing for changes in stock ownership; providing for themid-life of a corporation, including buy-outs and recapitalizations; and analysis formulationof planning for a corporate acquisition. Analysis of hypothetical problems andpractical solutions and insights into the practice of the business lawyer. Prerequisite:<strong>Law</strong> 6250 and 6300. <strong>Law</strong> 6302 or equivalent is recommended. Enrollment is limited.(Problem assignments) (Skills)6298 Insurance (2 or 3) MayersonGeneral liability, product liability, property, business interruption, fidelity, and coverage ofdirectors and officers. <strong>The</strong> duty of insurance companies to defend their insureds and tosettle cases brought against them. Mass tort liabilities and other severe liability exposure.General principles of law applicable to property–casualty insurance, insurance regulation,insurance bad faith, and reinsurance. (Examination)Taxation6300 Federal Income Taxation (3 or 4) K. Brown, Buchanan, Halpern, C. SmithSurvey of substantive provisions of federal income tax law, including concept of grossincome, provisions affecting taxation of family and individual transactions, limitationson allowable deductions, sales and dispositions of property, problems of capital gainstaxation, nontaxable exchanges. (Examination)6302 Corporate Taxation (3) K. BrownContinuation of <strong>Law</strong> 6300. Primary emphasis on corporate–shareholder relationships.Corporate dividends, redemptions of stock, stock dividends, bailouts, and dividends-inkind.Federal income tax concerns involved in the formation of corporations, the sale ofcorporate businesses, mergers and acquisitions, and corporate divisions. Prerequisite:<strong>Law</strong> 6300. (Examination)6304 Partnership and LLC Taxation (2 or 3) M. SandersFederal income tax consequences of operating businesses taxed as flow-through entities,including partnerships, limited liability companies, and S corporations. Allocation ofpartnership income and deductions among partners. Issues related to contributions topartnerships, distributions from partnerships, and acquisitions and dispositions of partnershipinterests. Overview of the taxation of S corporations. Prerequisite: <strong>Law</strong> 6300.<strong>Law</strong> 6302 is recommended. (Examination)6306 Wealth Transfer Taxation (2 or 3) NudelmanSurvey of substantive provisions of wealth transfer taxation reflecting the changing climateof federal taxation in the area of estate, gift, and income taxation, including transfersto trusts; individual, joint, and entity ownership of property; the consequences ofpowers of appointment or retained interest in gifted property; inter-spousal and intrafamilytransfers; and the application of credits and deductions to the tax picture. Pre-