Annual Report 2009 - Isagen

Annual Report 2009 - Isagen

Annual Report 2009 - Isagen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

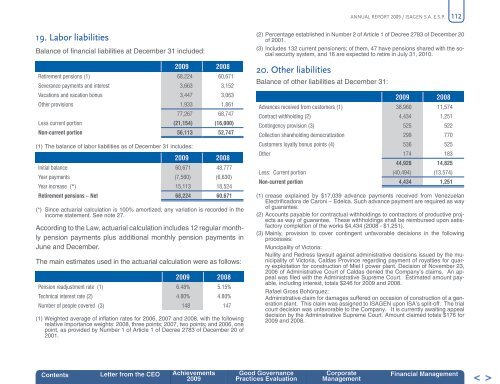

ANNUAL REPORT <strong>2009</strong> / ISAGEN S.A. E.S.P.11219. Labor liabilitiesBalance of financial liabilities at December 31 included:<strong>2009</strong> 2008Retirement pensions (1) 68,224 60,671Severance payments and interest 3,663 3,152Vacations and vacation bonus 3,447 3,063Other provisions 1,933 1,86177,267 68,747Less current portion (21,154) (16,000)Non-current portion 56,113 52,747(1) The balance of labor liabilities as of December 31 includes:<strong>2009</strong> 2008Initial balance 60,671 48,777Year payments (7,560) (6,630)Year increase (*) 15,113 18,524Retirement pensions – Net 68,224 60,671(*) Since actuarial calculation is 100% amortized, any variation is recorded in theincome statement. See note 27.According to the Law, actuarial calculation includes 12 regular monthlypension payments plus additional monthly pension payments inJune and December.The main estimates used in the actuarial calculation were as follows:<strong>2009</strong> 2008Pension readjustment rate (1) 6.48% 5.15%Technical interest rate (2) 4.80% 4.80%Number of people covered (3) 148 147(1) Weighted average of inflation rates for 2006, 2007 and 2008, with the followingrelative importance weights: 2008, three points; 2007, two points; and 2006, onepoint, as provided by Number 1 of Article 1 of Decree 2783 of December 20 of2001.(2) Percentage established in Number 2 of Article 1 of Decree 2783 of December 20of 2001.(3) Includes 132 current pensioners; of them, 47 have pensions shared with the socialsecurity system, and 16 are expected to retire in July 31, 2010.20. Other liabilitiesBalance of other liabilities at December 31:<strong>2009</strong> 2008Advances received from customers (1) 38,960 11,574Contract withholding (2) 4,434 1,251Contingency provision (3) 525 522Collection shareholding democratization 299 770Customers loyalty bonus points (4) 536 525Other 174 18344,928 14,825Less: Current portion (40,494) (13,574)Non-current portion 4,434 1,251(1) crease explained by $17,039 advance payments received from VenezuelanElectrificadora de Caroni – Edelca. Such advance payment are required as wayof guarantee.(2) Accounts payable for contractual withholdings to contractors of productive projectsas way of guarantee. These withholdings shall be reimbursed upon satisfactorycompletion of the works $4,434 (2008 - $1,251).(3) Mainly, provision to cover contingent unfavorable decisions in the followingprocesses:Muncipality of Victoria:Nullity and Redress lawsuit against administrative decisions issued by the municipalityof Victoria, Caldas Province regarding payment of royalties for quarryexploitation for construction of Miel I power plant. Decision of November 23,2006 of Administrative Court of Caldas denied the Company’s claims. An appealwas filed with the Administrative Supreme Court. Estimated amount payable,including interest, totals $246 for <strong>2009</strong> and 2008.Rafael Gross Bohórquez:Administrative claim for damages suffered on occasion of construction of a generationplant. This claim was assigned to ISAGEN upon ISA’s split-off. The trialcourt decision was unfavorable to the Company. It is currently awaiting appealdecision by the Administrative Supreme Court. Amount claimed totals $176 for<strong>2009</strong> and 2008.Contents Letter from the CEO Achievements<strong>2009</strong>Good GovernancePractices EvaluationCorporateManagementFinancial Management