Foreign Direct Investment in Latin America and the Caribbean 2015

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Introduction<br />

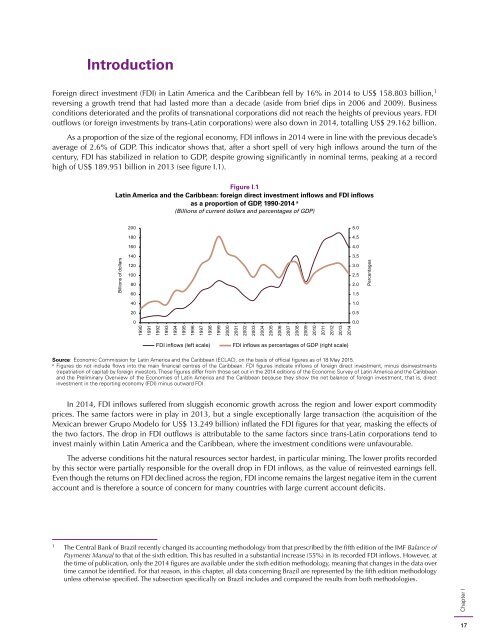

<strong>Foreign</strong> direct <strong>in</strong>vestment (FDI) <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> fell by 16% <strong>in</strong> 2014 to US$ 158.803 billion, 1<br />

revers<strong>in</strong>g a growth trend that had lasted more than a decade (aside from brief dips <strong>in</strong> 2006 <strong>and</strong> 2009). Bus<strong>in</strong>ess<br />

conditions deteriorated <strong>and</strong> <strong>the</strong> profits of transnational corporations did not reach <strong>the</strong> heights of previous years. FDI<br />

outflows (or foreign <strong>in</strong>vestments by trans-Lat<strong>in</strong> corporations) were also down <strong>in</strong> 2014, totall<strong>in</strong>g US$ 29.162 billion.<br />

As a proportion of <strong>the</strong> size of <strong>the</strong> regional economy, FDI <strong>in</strong>flows <strong>in</strong> 2014 were <strong>in</strong> l<strong>in</strong>e with <strong>the</strong> previous decade’s<br />

average of 2.6% of GDP. This <strong>in</strong>dicator shows that, after a short spell of very high <strong>in</strong>flows around <strong>the</strong> turn of <strong>the</strong><br />

century, FDI has stabilized <strong>in</strong> relation to GDP, despite grow<strong>in</strong>g significantly <strong>in</strong> nom<strong>in</strong>al terms, peak<strong>in</strong>g at a record<br />

high of US$ 189.951 billion <strong>in</strong> 2013 (see figure I.1).<br />

Figure I.1<br />

Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>: foreign direct <strong>in</strong>vestment <strong>in</strong>flows <strong>and</strong> FDI <strong>in</strong>flows<br />

as a proportion of GDP, 1990-2014 a<br />

(Billions of current dollars <strong>and</strong> percentages of GDP)<br />

200<br />

5.0<br />

180<br />

4.5<br />

160<br />

4.0<br />

Billions of dollars<br />

140<br />

120<br />

100<br />

80<br />

60<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

Percentages<br />

40<br />

1.0<br />

20<br />

0.5<br />

0<br />

0.0<br />

Chapter I<br />

1990<br />

1991<br />

1992<br />

1993<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

FDI <strong>in</strong>flows (left scale)<br />

FDI <strong>in</strong>flows as percentages of GDP (right scale)<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of official figures as of 18 May <strong>2015</strong>.<br />

a<br />

Figures do not <strong>in</strong>clude flows <strong>in</strong>to <strong>the</strong> ma<strong>in</strong> f<strong>in</strong>ancial centres of <strong>the</strong> <strong>Caribbean</strong>. FDI figures <strong>in</strong>dicate <strong>in</strong>flows of foreign direct <strong>in</strong>vestment, m<strong>in</strong>us dis<strong>in</strong>vestments<br />

(repatriation of capital) by foreign <strong>in</strong>vestors. These figures differ from those set out <strong>in</strong> <strong>the</strong> 2014 editions of <strong>the</strong> Economic Survey of Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong><br />

<strong>and</strong> <strong>the</strong> Prelim<strong>in</strong>ary Overview of <strong>the</strong> Economies of Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> because <strong>the</strong>y show <strong>the</strong> net balance of foreign <strong>in</strong>vestment, that is, direct<br />

<strong>in</strong>vestment <strong>in</strong> <strong>the</strong> report<strong>in</strong>g economy (FDI) m<strong>in</strong>us outward FDI.<br />

In 2014, FDI <strong>in</strong>flows suffered from sluggish economic growth across <strong>the</strong> region <strong>and</strong> lower export commodity<br />

prices. The same factors were <strong>in</strong> play <strong>in</strong> 2013, but a s<strong>in</strong>gle exceptionally large transaction (<strong>the</strong> acquisition of <strong>the</strong><br />

Mexican brewer Grupo Modelo for US$ 13.249 billion) <strong>in</strong>flated <strong>the</strong> FDI figures for that year, mask<strong>in</strong>g <strong>the</strong> effects of<br />

<strong>the</strong> two factors. The drop <strong>in</strong> FDI outflows is attributable to <strong>the</strong> same factors s<strong>in</strong>ce trans-Lat<strong>in</strong> corporations tend to<br />

<strong>in</strong>vest ma<strong>in</strong>ly with<strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>, where <strong>the</strong> <strong>in</strong>vestment conditions were unfavourable.<br />

The adverse conditions hit <strong>the</strong> natural resources sector hardest, <strong>in</strong> particular m<strong>in</strong><strong>in</strong>g. The lower profits recorded<br />

by this sector were partially responsible for <strong>the</strong> overall drop <strong>in</strong> FDI <strong>in</strong>flows, as <strong>the</strong> value of re<strong>in</strong>vested earn<strong>in</strong>gs fell.<br />

Even though <strong>the</strong> returns on FDI decl<strong>in</strong>ed across <strong>the</strong> region, FDI <strong>in</strong>come rema<strong>in</strong>s <strong>the</strong> largest negative item <strong>in</strong> <strong>the</strong> current<br />

account <strong>and</strong> is <strong>the</strong>refore a source of concern for many countries with large current account deficits.<br />

1<br />

The Central Bank of Brazil recently changed its account<strong>in</strong>g methodology from that prescribed by <strong>the</strong> fifth edition of <strong>the</strong> IMF Balance of<br />

Payments Manual to that of <strong>the</strong> sixth edition. This has resulted <strong>in</strong> a substantial <strong>in</strong>crease (55%) <strong>in</strong> its recorded FDI <strong>in</strong>flows. However, at<br />

<strong>the</strong> time of publication, only <strong>the</strong> 2014 figures are available under <strong>the</strong> sixth edition methodology, mean<strong>in</strong>g that changes <strong>in</strong> <strong>the</strong> data over<br />

time cannot be identified. For that reason, <strong>in</strong> this chapter, all data concern<strong>in</strong>g Brazil are represented by <strong>the</strong> fifth edition methodology<br />

unless o<strong>the</strong>rwise specified. The subsection specifically on Brazil <strong>in</strong>cludes <strong>and</strong> compared <strong>the</strong> results from both methodologies.<br />

17