Foreign Direct Investment in Latin America and the Caribbean 2015

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2015</strong><br />

Region group<strong>in</strong>g<br />

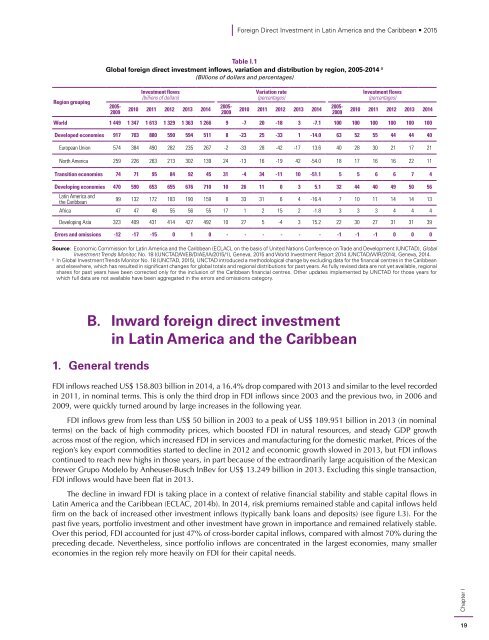

Table I.1<br />

Global foreign direct <strong>in</strong>vestment <strong>in</strong>flows, variation <strong>and</strong> distribution by region, 2005-2014 a<br />

(Billions of dollars <strong>and</strong> percentages)<br />

2005-<br />

2009<br />

<strong>Investment</strong> flows<br />

(billions of dollars)<br />

2010 2011 2012 2013 2014<br />

2005-<br />

2009<br />

Variation rate<br />

(percentages)<br />

2010 2011 2012 2013 2014<br />

2005-<br />

2009<br />

<strong>Investment</strong> flows<br />

(percentages)<br />

2010 2011 2012 2013 2014<br />

World 1 449 1 347 1 613 1 329 1 363 1 266 9 -7 20 -18 3 -7.1 100 100 100 100 100 100<br />

Developed economies 917 703 880 590 594 511 8 -23 25 -33 1 -14.0 63 52 55 44 44 40<br />

European Union 574 384 490 282 235 267 -2 -33 28 -42 -17 13.6 40 28 30 21 17 21<br />

North <strong>America</strong> 259 226 263 213 302 139 24 -13 16 -19 42 -54.0 18 17 16 16 22 11<br />

Transition economies 74 71 95 84 92 45 31 -4 34 -11 10 -51.1 5 5 6 6 7 4<br />

Develop<strong>in</strong>g economies 470 590 653 655 676 710 10 26 11 0 3 5.1 32 44 40 49 50 56<br />

Lat<strong>in</strong> <strong>America</strong> <strong>and</strong><br />

<strong>the</strong> <strong>Caribbean</strong><br />

99 132 172 183 190 159 8 33 31 6 4 -16.4 7 10 11 14 14 13<br />

Africa 47 47 48 55 56 55 17 1 2 15 2 -1.8 3 3 3 4 4 4<br />

Develop<strong>in</strong>g Asia 323 409 431 414 427 492 10 27 5 -4 3 15.2 22 30 27 31 31 39<br />

Errors <strong>and</strong> omissions -12 -17 -15 0 1 0 - - - - - - -1 -1 -1 0 0 0<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of United Nations Conference on Trade <strong>and</strong> Development (UNCTAD), Global<br />

<strong>Investment</strong> Trends Monitor, No. 18 ((UNCTAD/WEB/DIAE/IA/<strong>2015</strong>/1), Geneva, <strong>2015</strong> <strong>and</strong> World <strong>Investment</strong> Report 2014 (UNCTAD/WIR/2014), Geneva, 2014.<br />

a<br />

In Global <strong>Investment</strong> Trends Monitor No. 18 (UNCTAD, <strong>2015</strong>), UNCTAD <strong>in</strong>troduced a methodological change by exclud<strong>in</strong>g data for <strong>the</strong> f<strong>in</strong>ancial centres <strong>in</strong> <strong>the</strong> <strong>Caribbean</strong><br />

<strong>and</strong> elsewhere, which has resulted <strong>in</strong> significant changes for global totals <strong>and</strong> regional distributions for past years. As fully revised data are not yet available, regional<br />

shares for past years have been corrected only for <strong>the</strong> <strong>in</strong>clusion of <strong>the</strong> <strong>Caribbean</strong> f<strong>in</strong>ancial centres. O<strong>the</strong>r updates implemented by UNCTAD for those years for<br />

which full data are not available have been aggregated <strong>in</strong> <strong>the</strong> errors <strong>and</strong> omissions category.<br />

B. Inward foreign direct <strong>in</strong>vestment<br />

<strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong><br />

1. General trends<br />

FDI <strong>in</strong>flows reached US$ 158.803 billion <strong>in</strong> 2014, a 16.4% drop compared with 2013 <strong>and</strong> similar to <strong>the</strong> level recorded<br />

<strong>in</strong> 2011, <strong>in</strong> nom<strong>in</strong>al terms. This is only <strong>the</strong> third drop <strong>in</strong> FDI <strong>in</strong>flows s<strong>in</strong>ce 2003 <strong>and</strong> <strong>the</strong> previous two, <strong>in</strong> 2006 <strong>and</strong><br />

2009, were quickly turned around by large <strong>in</strong>creases <strong>in</strong> <strong>the</strong> follow<strong>in</strong>g year.<br />

FDI <strong>in</strong>flows grew from less than US$ 50 billion <strong>in</strong> 2003 to a peak of US$ 189.951 billion <strong>in</strong> 2013 (<strong>in</strong> nom<strong>in</strong>al<br />

terms) on <strong>the</strong> back of high commodity prices, which boosted FDI <strong>in</strong> natural resources, <strong>and</strong> steady GDP growth<br />

across most of <strong>the</strong> region, which <strong>in</strong>creased FDI <strong>in</strong> services <strong>and</strong> manufactur<strong>in</strong>g for <strong>the</strong> domestic market. Prices of <strong>the</strong><br />

region’s key export commodities started to decl<strong>in</strong>e <strong>in</strong> 2012 <strong>and</strong> economic growth slowed <strong>in</strong> 2013, but FDI <strong>in</strong>flows<br />

cont<strong>in</strong>ued to reach new highs <strong>in</strong> those years, <strong>in</strong> part because of <strong>the</strong> extraord<strong>in</strong>arily large acquisition of <strong>the</strong> Mexican<br />

brewer Grupo Modelo by Anheuser-Busch InBev for US$ 13.249 billion <strong>in</strong> 2013. Exclud<strong>in</strong>g this s<strong>in</strong>gle transaction,<br />

FDI <strong>in</strong>flows would have been flat <strong>in</strong> 2013.<br />

The decl<strong>in</strong>e <strong>in</strong> <strong>in</strong>ward FDI is tak<strong>in</strong>g place <strong>in</strong> a context of relative f<strong>in</strong>ancial stability <strong>and</strong> stable capital flows <strong>in</strong><br />

Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC, 2014b). In 2014, risk premiums rema<strong>in</strong>ed stable <strong>and</strong> capital <strong>in</strong>flows held<br />

firm on <strong>the</strong> back of <strong>in</strong>creased o<strong>the</strong>r <strong>in</strong>vestment <strong>in</strong>flows (typically bank loans <strong>and</strong> deposits) (see figure I.3). For <strong>the</strong><br />

past five years, portfolio <strong>in</strong>vestment <strong>and</strong> o<strong>the</strong>r <strong>in</strong>vestment have grown <strong>in</strong> importance <strong>and</strong> rema<strong>in</strong>ed relatively stable.<br />

Over this period, FDI accounted for just 47% of cross-border capital <strong>in</strong>flows, compared with almost 70% dur<strong>in</strong>g <strong>the</strong><br />

preced<strong>in</strong>g decade. Never<strong>the</strong>less, s<strong>in</strong>ce portfolio <strong>in</strong>flows are concentrated <strong>in</strong> <strong>the</strong> largest economies, many smaller<br />

economies <strong>in</strong> <strong>the</strong> region rely more heavily on FDI for <strong>the</strong>ir capital needs.<br />

Chapter I<br />

19