Foreign Direct Investment in Latin America and the Caribbean 2015

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2015</strong><br />

FDI <strong>in</strong>flows to El Salvador <strong>in</strong>creased by 53% from US$ 179 million <strong>in</strong> 2013 to US$ 275 million <strong>in</strong> 2014. A portion<br />

of that <strong>in</strong>vestment came from <strong>the</strong> ongo<strong>in</strong>g <strong>in</strong>vestment by Sensity Systems of <strong>the</strong> United States, an LED manufacturer<br />

that committed <strong>in</strong> 2013 to build<strong>in</strong>g a US$ 490 million factory to supply <strong>the</strong> region. Colombia’s Procaps acquired<br />

Laboratorios López, which is <strong>the</strong> country’s largest pharmaceuticals laboratory. Hyatt Hotels of <strong>the</strong> United States<br />

announced that it would <strong>in</strong>vest US$ 36 million <strong>in</strong> its first hotel <strong>in</strong> El Salvador, which is scheduled to open <strong>in</strong> 2016.<br />

Italy’s ENEL, through its subsidiary Enel Green Power, announced a deal <strong>in</strong> December to sell its 36.2% stake <strong>in</strong><br />

<strong>the</strong> La Geo geo<strong>the</strong>rmal jo<strong>in</strong>t venture to its State-owned partner INE for US$ 280 million. This large negative <strong>in</strong>flow<br />

is offset by some major <strong>in</strong>vestments <strong>in</strong> <strong>the</strong> telecommunications sector, where <strong>in</strong>flows totalled US$ 334 million <strong>in</strong><br />

2014. The year’s largest telecommunications <strong>in</strong>vestment came from Sweden’s Millicom, through its local Tigo br<strong>and</strong>.<br />

Also <strong>in</strong> telecommunications, Jamaica’s Digicel announced a US$ 45 million upgrade of its network <strong>in</strong> early 2014.<br />

E. FDI <strong>and</strong> <strong>the</strong> current account balance<br />

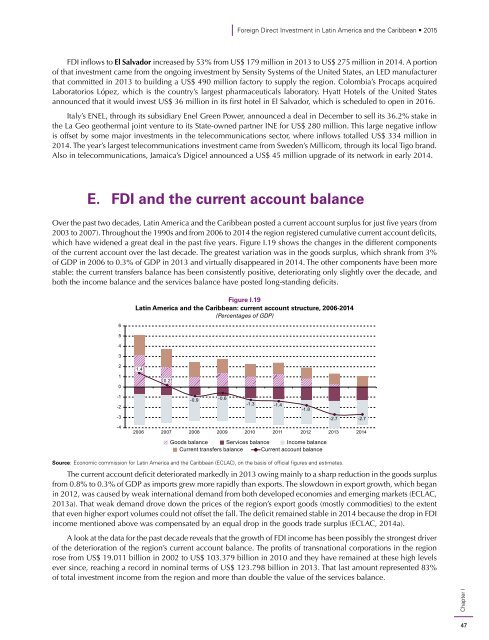

Over <strong>the</strong> past two decades, Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> posted a current account surplus for just five years (from<br />

2003 to 2007). Throughout <strong>the</strong> 1990s <strong>and</strong> from 2006 to 2014 <strong>the</strong> region registered cumulative current account deficits,<br />

which have widened a great deal <strong>in</strong> <strong>the</strong> past five years. Figure I.19 shows <strong>the</strong> changes <strong>in</strong> <strong>the</strong> different components<br />

of <strong>the</strong> current account over <strong>the</strong> last decade. The greatest variation was <strong>in</strong> <strong>the</strong> goods surplus, which shrank from 3%<br />

of GDP <strong>in</strong> 2006 to 0.3% of GDP <strong>in</strong> 2013 <strong>and</strong> virtually disappeared <strong>in</strong> 2014. The o<strong>the</strong>r components have been more<br />

stable: <strong>the</strong> current transfers balance has been consistently positive, deteriorat<strong>in</strong>g only slightly over <strong>the</strong> decade, <strong>and</strong><br />

both <strong>the</strong> <strong>in</strong>come balance <strong>and</strong> <strong>the</strong> services balance have posted long-st<strong>and</strong><strong>in</strong>g deficits.<br />

6<br />

5<br />

4<br />

3<br />

Figure I.19<br />

Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>: current account structure, 2006-2014<br />

(Percentages of GDP)<br />

2<br />

1<br />

0<br />

1.4<br />

0.2<br />

-1<br />

-2<br />

-3<br />

-4<br />

-0.9 -0.6<br />

-1.3 -1.4<br />

-1.8<br />

Goods balance Services balance Income balance<br />

Current transfers balance Current account balance<br />

-2.7 -2.7<br />

2006 2007 2008 2009 2010 2011 2012 2013 2014<br />

Source: Economic commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of official figures <strong>and</strong> estimates.<br />

The current account deficit deteriorated markedly <strong>in</strong> 2013 ow<strong>in</strong>g ma<strong>in</strong>ly to a sharp reduction <strong>in</strong> <strong>the</strong> goods surplus<br />

from 0.8% to 0.3% of GDP as imports grew more rapidly than exports. The slowdown <strong>in</strong> export growth, which began<br />

<strong>in</strong> 2012, was caused by weak <strong>in</strong>ternational dem<strong>and</strong> from both developed economies <strong>and</strong> emerg<strong>in</strong>g markets (ECLAC,<br />

2013a). That weak dem<strong>and</strong> drove down <strong>the</strong> prices of <strong>the</strong> region’s export goods (mostly commodities) to <strong>the</strong> extent<br />

that even higher export volumes could not offset <strong>the</strong> fall. The deficit rema<strong>in</strong>ed stable <strong>in</strong> 2014 because <strong>the</strong> drop <strong>in</strong> FDI<br />

<strong>in</strong>come mentioned above was compensated by an equal drop <strong>in</strong> <strong>the</strong> goods trade surplus (ECLAC, 2014a).<br />

A look at <strong>the</strong> data for <strong>the</strong> past decade reveals that <strong>the</strong> growth of FDI <strong>in</strong>come has been possibly <strong>the</strong> strongest driver<br />

of <strong>the</strong> deterioration of <strong>the</strong> region’s current account balance. The profits of transnational corporations <strong>in</strong> <strong>the</strong> region<br />

rose from US$ 19.011 billion <strong>in</strong> 2002 to US$ 103.379 billion <strong>in</strong> 2010 <strong>and</strong> <strong>the</strong>y have rema<strong>in</strong>ed at <strong>the</strong>se high levels<br />

ever s<strong>in</strong>ce, reach<strong>in</strong>g a record <strong>in</strong> nom<strong>in</strong>al terms of US$ 123.798 billion <strong>in</strong> 2013. That last amount represented 83%<br />

of total <strong>in</strong>vestment <strong>in</strong>come from <strong>the</strong> region <strong>and</strong> more than double <strong>the</strong> value of <strong>the</strong> services balance.<br />

Chapter I<br />

47