Foreign Direct Investment in Latin America and the Caribbean 2015

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2015</strong><br />

There is no official data on FDI by sector <strong>in</strong> Peru, but <strong>the</strong> m<strong>in</strong><strong>in</strong>g sector seems to account for much of <strong>the</strong> decl<strong>in</strong>e.<br />

In 2014 <strong>in</strong>vestment <strong>in</strong> m<strong>in</strong><strong>in</strong>g (both domestic <strong>and</strong> foreign) fell by 11%, <strong>the</strong> first drop s<strong>in</strong>ce 2007 after years of very<br />

rapid growth. The fall was particularly marked <strong>in</strong> <strong>the</strong> acquisition of equipment <strong>and</strong> <strong>in</strong>frastructure. Copper production<br />

was flat <strong>in</strong> terms of quantities <strong>and</strong> dropped by 12% <strong>in</strong> dollar terms, while gold production decl<strong>in</strong>ed. FDI had also<br />

<strong>in</strong>creased over <strong>the</strong> previous decade <strong>in</strong> services <strong>and</strong> o<strong>the</strong>r market-seek<strong>in</strong>g activities, but <strong>the</strong> slowdown <strong>in</strong> GDP growth<br />

<strong>in</strong> 2014 may make <strong>the</strong> domestic market less attractive for <strong>in</strong>vestors.<br />

Lower metal prices, production problems at <strong>the</strong> m<strong>in</strong>es <strong>and</strong> slacker economic growth comb<strong>in</strong>ed to reduce FDI<br />

profitability <strong>in</strong> Peru. FDI <strong>in</strong>come earned by foreign companies <strong>in</strong> <strong>the</strong> country dropped to US$ 7.964 billion, <strong>the</strong> lowest<br />

level s<strong>in</strong>ce 2007. About half of <strong>the</strong>se profits were re<strong>in</strong>vested, a similar proportion to previous years. Re<strong>in</strong>vested earn<strong>in</strong>gs<br />

were <strong>the</strong> largest component of FDI (totall<strong>in</strong>g US$ 3.978 billion), followed by <strong>in</strong>tercompany loans (US$ 2.278 billion)<br />

<strong>and</strong> capital contributions (US$ 1.342 billion), which were significantly lower than <strong>in</strong> previous years.<br />

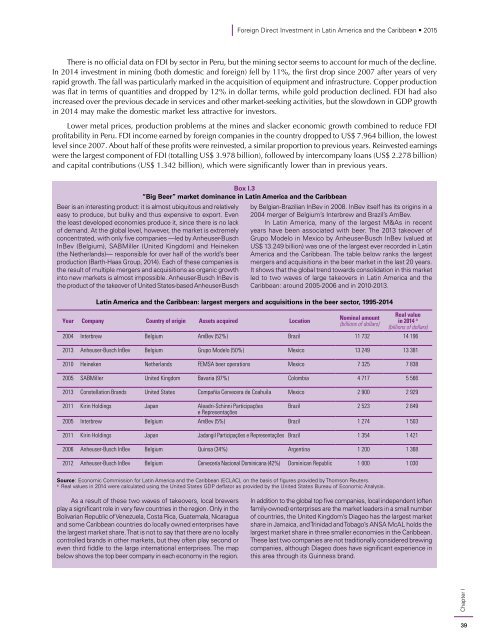

Box I.3<br />

“Big Beer” market dom<strong>in</strong>ance <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong><br />

Beer is an <strong>in</strong>terest<strong>in</strong>g product: it is almost ubiquitous <strong>and</strong> relatively<br />

easy to produce, but bulky <strong>and</strong> thus expensive to export. Even<br />

<strong>the</strong> least developed economies produce it, s<strong>in</strong>ce <strong>the</strong>re is no lack<br />

of dem<strong>and</strong>. At <strong>the</strong> global level, however, <strong>the</strong> market is extremely<br />

concentrated, with only five companies —led by Anheuser-Busch<br />

InBev (Belgium), SABMiller (United K<strong>in</strong>gdom) <strong>and</strong> He<strong>in</strong>eken<br />

(<strong>the</strong> Ne<strong>the</strong>rl<strong>and</strong>s)— responsible for over half of <strong>the</strong> world’s beer<br />

production (Barth-Haas Group, 2014). Each of <strong>the</strong>se companies is<br />

<strong>the</strong> result of multiple mergers <strong>and</strong> acquisitions as organic growth<br />

<strong>in</strong>to new markets is almost impossible. Anheuser-Busch InBev is<br />

<strong>the</strong> product of <strong>the</strong> takeover of United States-based Anheuser-Busch<br />

by Belgian-Brazilian InBev <strong>in</strong> 2008. InBev itself has its orig<strong>in</strong>s <strong>in</strong> a<br />

2004 merger of Belgium’s Interbrew <strong>and</strong> Brazil’s AmBev.<br />

In Lat<strong>in</strong> <strong>America</strong>, many of <strong>the</strong> largest M&As <strong>in</strong> recent<br />

years have been associated with beer. The 2013 takeover of<br />

Grupo Modelo <strong>in</strong> Mexico by Anheuser-Busch InBev (valued at<br />

US$ 13.249 billion) was one of <strong>the</strong> largest ever recorded <strong>in</strong> Lat<strong>in</strong><br />

<strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>. The table below ranks <strong>the</strong> largest<br />

mergers <strong>and</strong> acquisitions <strong>in</strong> <strong>the</strong> beer market <strong>in</strong> <strong>the</strong> last 20 years.<br />

It shows that <strong>the</strong> global trend towards consolidation <strong>in</strong> this market<br />

led to two waves of large takeovers <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong><br />

<strong>Caribbean</strong>: around 2005-2006 <strong>and</strong> <strong>in</strong> 2010-2013.<br />

Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>: largest mergers <strong>and</strong> acquisitions <strong>in</strong> <strong>the</strong> beer sector, 1995-2014<br />

Year Company Country of orig<strong>in</strong> Assets acquired Location<br />

Nom<strong>in</strong>al amount<br />

(billions of dollars)<br />

Real value<br />

<strong>in</strong> 2014 a<br />

(billions of dollars)<br />

2004 Interbrew Belgium AmBev (52%) Brazil 11 732 14 196<br />

2013 Anheuser-Busch InBev Belgium Grupo Modelo (50%) Mexico 13 249 13 381<br />

2010 He<strong>in</strong>eken Ne<strong>the</strong>rl<strong>and</strong>s FEMSA beer operations Mexico 7 325 7 838<br />

2005 SABMiller United K<strong>in</strong>gdom Bavaria (97%) Colombia 4 717 5 566<br />

2013 Constellation Br<strong>and</strong>s United States Compañía Cervecera de Coahuila Mexico 2 900 2 929<br />

2011 Kir<strong>in</strong> Hold<strong>in</strong>gs Japan Aleadri-Sch<strong>in</strong>ni Participações Brazil 2 523 2 649<br />

e Representações<br />

2005 Interbrew Belgium AmBev (5%) Brazil 1 274 1 503<br />

2011 Kir<strong>in</strong> Hold<strong>in</strong>gs Japan Jadangil Participações e Representações Brazil 1 354 1 421<br />

2006 Anheuser-Busch InBev Belgium Qu<strong>in</strong>sa (34%) Argent<strong>in</strong>a 1 200 1 368<br />

2012 Anheuser-Busch InBev Belgium Cervecería Nacional Dom<strong>in</strong>icana (42%) Dom<strong>in</strong>ican Republic 1 000 1 030<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of figures provided by Thomson Reuters.<br />

a<br />

Real values <strong>in</strong> 2014 were calculated us<strong>in</strong>g <strong>the</strong> United States GDP deflator as provided by <strong>the</strong> United States Bureau of Economic Analysis.<br />

As a result of <strong>the</strong>se two waves of takeovers, local brewers<br />

play a significant role <strong>in</strong> very few countries <strong>in</strong> <strong>the</strong> region. Only <strong>in</strong> <strong>the</strong><br />

Bolivarian Republic of Venezuela, Costa Rica, Guatemala, Nicaragua<br />

<strong>and</strong> some <strong>Caribbean</strong> countries do locally owned enterprises have<br />

<strong>the</strong> largest market share. That is not to say that <strong>the</strong>re are no locally<br />

controlled br<strong>and</strong>s <strong>in</strong> o<strong>the</strong>r markets, but <strong>the</strong>y often play second or<br />

even third fiddle to <strong>the</strong> large <strong>in</strong>ternational enterprises. The map<br />

below shows <strong>the</strong> top beer company <strong>in</strong> each economy <strong>in</strong> <strong>the</strong> region.<br />

In addition to <strong>the</strong> global top five companies, local <strong>in</strong>dependent (often<br />

family-owned) enterprises are <strong>the</strong> market leaders <strong>in</strong> a small number<br />

of countries, <strong>the</strong> United K<strong>in</strong>gdom’s Diageo has <strong>the</strong> largest market<br />

share <strong>in</strong> Jamaica, <strong>and</strong> Tr<strong>in</strong>idad <strong>and</strong> Tobago’s ANSA McAL holds <strong>the</strong><br />

largest market share <strong>in</strong> three smaller economies <strong>in</strong> <strong>the</strong> <strong>Caribbean</strong>.<br />

These last two companies are not traditionally considered brew<strong>in</strong>g<br />

companies, although Diageo does have significant experience <strong>in</strong><br />

this area through its Gu<strong>in</strong>ness br<strong>and</strong>.<br />

Chapter I<br />

39