Foreign Direct Investment in Latin America and the Caribbean 2015

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

In its latest edition, the Foreign Direct Investment in Latin America and the Caribbean report analyzes in-depth the FDI received by the Caribbean, where these flows are much more significant than in the rest of the region as a proportion of Gross Domestic Product (GDP). The study also examines the impact of FDI on the environment, which has not been measured or regulated sufficiently by countries in the region.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Foreign</strong> <strong>Direct</strong> <strong>Investment</strong> <strong>in</strong> Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> • <strong>2015</strong><br />

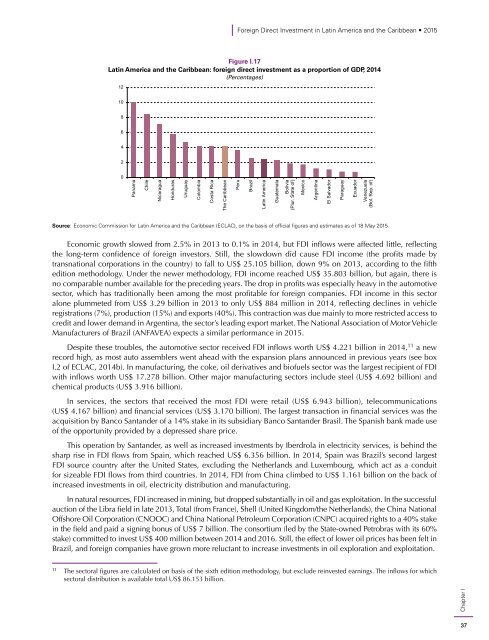

Figure I.17<br />

Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong>: foreign direct <strong>in</strong>vestment as a proportion of GDP, 2014<br />

(Percentages)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Chapter I<br />

Panama<br />

Chile<br />

Nicaragua<br />

Honduras<br />

Uruguay<br />

Colombia<br />

Costa Rica<br />

The <strong>Caribbean</strong><br />

Peru<br />

Brazil<br />

Lat<strong>in</strong> <strong>America</strong><br />

Guatemala<br />

Bolivia<br />

(Plur. State of)<br />

Mexico<br />

Argent<strong>in</strong>a<br />

El Salvador<br />

Paraguay<br />

Ecuador<br />

Venezuela<br />

(Bol. Rep. of)<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of official figures <strong>and</strong> estimates as of 18 May <strong>2015</strong>.<br />

Economic growth slowed from 2.5% <strong>in</strong> 2013 to 0.1% <strong>in</strong> 2014, but FDI <strong>in</strong>flows were affected little, reflect<strong>in</strong>g<br />

<strong>the</strong> long-term confidence of foreign <strong>in</strong>vestors. Still, <strong>the</strong> slowdown did cause FDI <strong>in</strong>come (<strong>the</strong> profits made by<br />

transnational corporations <strong>in</strong> <strong>the</strong> country) to fall to US$ 25.105 billion, down 9% on 2013, accord<strong>in</strong>g to <strong>the</strong> fifth<br />

edition methodology. Under <strong>the</strong> newer methodology, FDI <strong>in</strong>come reached US$ 35.803 billion, but aga<strong>in</strong>, <strong>the</strong>re is<br />

no comparable number available for <strong>the</strong> preced<strong>in</strong>g years. The drop <strong>in</strong> profits was especially heavy <strong>in</strong> <strong>the</strong> automotive<br />

sector, which has traditionally been among <strong>the</strong> most profitable for foreign companies. FDI <strong>in</strong>come <strong>in</strong> this sector<br />

alone plummeted from US$ 3.29 billion <strong>in</strong> 2013 to only US$ 884 million <strong>in</strong> 2014, reflect<strong>in</strong>g decl<strong>in</strong>es <strong>in</strong> vehicle<br />

registrations (7%), production (15%) <strong>and</strong> exports (40%). This contraction was due ma<strong>in</strong>ly to more restricted access to<br />

credit <strong>and</strong> lower dem<strong>and</strong> <strong>in</strong> Argent<strong>in</strong>a, <strong>the</strong> sector’s lead<strong>in</strong>g export market. The National Association of Motor Vehicle<br />

Manufacturers of Brazil (ANFAVEA) expects a similar performance <strong>in</strong> <strong>2015</strong>.<br />

Despite <strong>the</strong>se troubles, <strong>the</strong> automotive sector received FDI <strong>in</strong>flows worth US$ 4.221 billion <strong>in</strong> 2014, 11 a new<br />

record high, as most auto assemblers went ahead with <strong>the</strong> expansion plans announced <strong>in</strong> previous years (see box<br />

I.2 of ECLAC, 2014b). In manufactur<strong>in</strong>g, <strong>the</strong> coke, oil derivatives <strong>and</strong> biofuels sector was <strong>the</strong> largest recipient of FDI<br />

with <strong>in</strong>flows worth US$ 17.278 billion. O<strong>the</strong>r major manufactur<strong>in</strong>g sectors <strong>in</strong>clude steel (US$ 4.692 billion) <strong>and</strong><br />

chemical products (US$ 3.916 billion).<br />

In services, <strong>the</strong> sectors that received <strong>the</strong> most FDI were retail (US$ 6.943 billion), telecommunications<br />

(US$ 4.167 billion) <strong>and</strong> f<strong>in</strong>ancial services (US$ 3.170 billion). The largest transaction <strong>in</strong> f<strong>in</strong>ancial services was <strong>the</strong><br />

acquisition by Banco Sant<strong>and</strong>er of a 14% stake <strong>in</strong> its subsidiary Banco Sant<strong>and</strong>er Brasil. The Spanish bank made use<br />

of <strong>the</strong> opportunity provided by a depressed share price.<br />

This operation by Sant<strong>and</strong>er, as well as <strong>in</strong>creased <strong>in</strong>vestments by Iberdrola <strong>in</strong> electricity services, is beh<strong>in</strong>d <strong>the</strong><br />

sharp rise <strong>in</strong> FDI flows from Spa<strong>in</strong>, which reached US$ 6.356 billion. In 2014, Spa<strong>in</strong> was Brazil’s second largest<br />

FDI source country after <strong>the</strong> United States, exclud<strong>in</strong>g <strong>the</strong> Ne<strong>the</strong>rl<strong>and</strong>s <strong>and</strong> Luxembourg, which act as a conduit<br />

for sizeable FDI flows from third countries. In 2014, FDI from Ch<strong>in</strong>a climbed to US$ 1.161 billion on <strong>the</strong> back of<br />

<strong>in</strong>creased <strong>in</strong>vestments <strong>in</strong> oil, electricity distribution <strong>and</strong> manufactur<strong>in</strong>g.<br />

In natural resources, FDI <strong>in</strong>creased <strong>in</strong> m<strong>in</strong><strong>in</strong>g, but dropped substantially <strong>in</strong> oil <strong>and</strong> gas exploitation. In <strong>the</strong> successful<br />

auction of <strong>the</strong> Libra field <strong>in</strong> late 2013, Total (from France), Shell (United K<strong>in</strong>gdom/<strong>the</strong> Ne<strong>the</strong>rl<strong>and</strong>s), <strong>the</strong> Ch<strong>in</strong>a National<br />

Offshore Oil Corporation (CNOOC) <strong>and</strong> Ch<strong>in</strong>a National Petroleum Corporation (CNPC) acquired rights to a 40% stake<br />

<strong>in</strong> <strong>the</strong> field <strong>and</strong> paid a sign<strong>in</strong>g bonus of US$ 7 billion. The consortium (led by <strong>the</strong> State-owned Petrobras with its 60%<br />

stake) committed to <strong>in</strong>vest US$ 400 million between 2014 <strong>and</strong> 2016. Still, <strong>the</strong> effect of lower oil prices has been felt <strong>in</strong><br />

Brazil, <strong>and</strong> foreign companies have grown more reluctant to <strong>in</strong>crease <strong>in</strong>vestments <strong>in</strong> oil exploration <strong>and</strong> exploitation.<br />

11<br />

The sectoral figures are calculated on basis of <strong>the</strong> sixth edition methodology, but exclude re<strong>in</strong>vested earn<strong>in</strong>gs. The <strong>in</strong>flows for which<br />

sectoral distribution is available total US$ 86.153 billion.<br />

37