View full report - NEEC

View full report - NEEC

View full report - NEEC

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

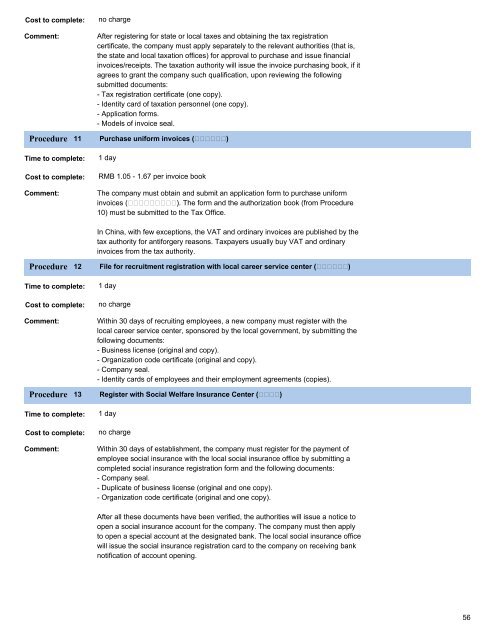

Cost to complete:Comment:no chargeAfter registering for state or local taxes and obtaining the tax registrationcertificate, the company must apply separately to the relevant authorities (that is,the state and local taxation offices) for approval to purchase and issue financialinvoices/receipts. The taxation authority will issue the invoice purchasing book, if itagrees to grant the company such qualification, upon reviewing the followingsubmitted documents:- Tax registration certificate (one copy).- Identity card of taxation personnel (one copy).- Application forms.- Models of invoice seal.Procedure 11 Purchase uniform invoices ( 开 开 开 开 开 开 )Time to complete:Cost to complete:Comment:1 dayRMB 1.05 - 1.67 per invoice bookThe company must obtain and submit an application form to purchase uniforminvoices ( 建 建 建 建 建 建 建 建 建 ). The form and the authorization book (from Procedure10) must be submitted to the Tax Office.In China, with few exceptions, the VAT and ordinary invoices are published by thetax authority for antiforgery reasons. Taxpayers usually buy VAT and ordinaryinvoices from the tax authority.Procedure 12 File for recruitment registration with local career service center ( 开 开 开 开 开 开 )Time to complete:Cost to complete:Comment:1 dayno chargeWithin 30 days of recruiting employees, a new company must register with thelocal career service center, sponsored by the local government, by submitting thefollowing documents:- Business license (original and copy).- Organization code certificate (original and copy).- Company seal.- Identity cards of employees and their employment agreements (copies).Procedure 13 Register with Social Welfare Insurance Center ( 开 开 开 开 )Time to complete:Cost to complete:Comment:1 dayno chargeWithin 30 days of establishment, the company must register for the payment ofemployee social insurance with the local social insurance office by submitting acompleted social insurance registration form and the following documents:- Company seal.- Duplicate of business license (original and one copy).- Organization code certificate (original and one copy).After all these documents have been verified, the authorities will issue a notice toopen a social insurance account for the company. The company must then applyto open a special account at the designated bank. The local social insurance officewill issue the social insurance registration card to the company on receiving banknotification of account opening.56