View full report - NEEC

View full report - NEEC

View full report - NEEC

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

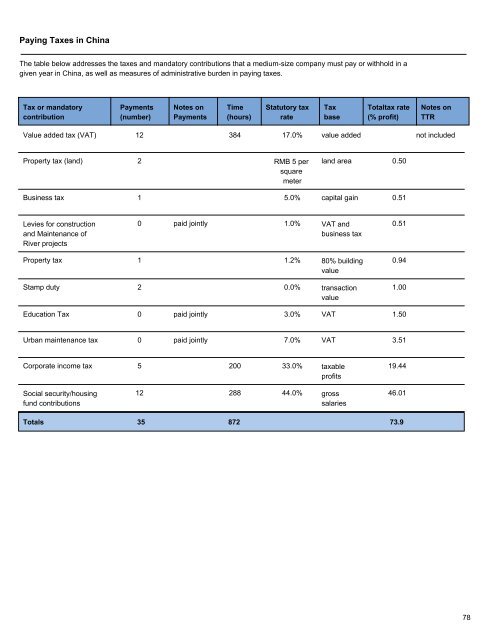

Paying Taxes in ChinaThe table below addresses the taxes and mandatory contributions that a medium-size company must pay or withhold in agiven year in China, as well as measures of administrative burden in paying taxes.Tax or mandatorycontributionPayments(number)Notes onPaymentsTime(hours)Statutory taxrateTaxbaseTotaltax rate(% profit)Notes onTTRValue added tax (VAT)1238417.0%value addednot includedProperty tax (land)2RMB 5 persquaremeterland area0.50Business tax15.0%capital gain0.51Levies for constructionand Maintenance ofRiver projects0paid jointly1.0%VAT andbusiness tax0.51Property tax11.2%80% buildingvalue0.94Stamp duty20.0%transactionvalue1.00Education Tax0paid jointly3.0%VAT1.50Urban maintenance tax0paid jointly7.0%VAT3.51Corporate income tax520033.0%taxableprofits19.44Social security/housingfund contributions1228844.0%grosssalaries46.01Totals 35 872 73.978