Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

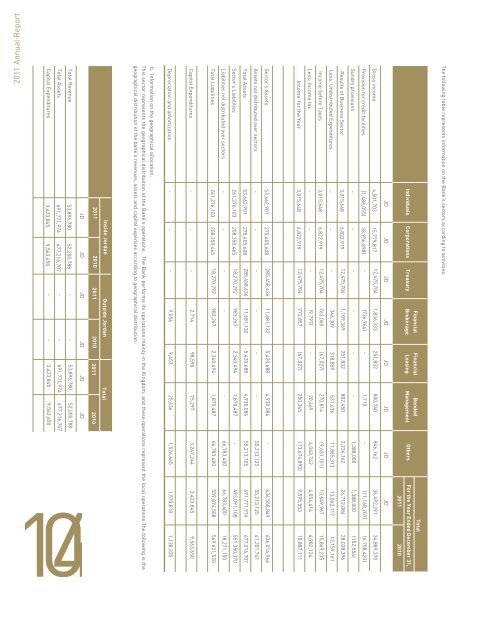

Capital Expenditures3,423,8459,563,650--3,423,8459,563,650Total Assets691,771,974677,216,707--691,771,974677,216,707Total Revenue53,896,78052,200,788--53,896,78052,200,788JD JD JD JD JDJD<strong>2011</strong> 2010<strong>2011</strong> 2010<strong>2011</strong> 2010104Inside <strong>Jordan</strong>Outside <strong>Jordan</strong>Totalgeographical distribution of the <strong>bank</strong>'s revenues, assets <strong>and</strong> capital expenses according to geographical distribution:This sector represents the geographical distribution of the Bank's operations. The Bank performs its operations mainly in the Kingdom, <strong>and</strong> these operations represent the local operations.The following is theb. Information on the geographical allocation:Depreciation <strong>and</strong> amortization---9,0569,45325,6361,526,665 1,570,810 1,138,335Capital Expenditures---2,71498,59075,2973,247,244 3,423,845 9,563,650Total Liabilities261,276,103 208,350,465 18,270,292 983,267 2,340,494 1,870,487 66,783,400 559,874,508 569,621,520Liabilities not distributed over sectors-----66,783,400 66,783,400 18,271,150Sector's Liabilities261,276,103 208,350,465 18,270,292 983,267 2,340,494 1,870,487 -493,091,108 551,350,370Total Assets53,662,901 275,405,608 285,458,436 11,681,132 5,420,688 4,930,084 55,213,125 691,771,974 677,216,707Assets not distributed over sectors------55,213,125 55,213,125 41,201,741Sector's Assets53,662,901 275,405,608 285,458,436 11,681,132 5,420,688 4,930,084 -636,558,849 636,014,966Income for the Year3,015,648 6,822,919 12,475,704 772,857 (67,027) 250,345(13,674,893) 9,595,553 10,887,111Less: Income tax---(9,797) -20,4694,043,742 4,054,414 4,982,124Income before Taxes3,015,648 6,822,919 12,475,704 763,060 (67,027) 270,814(9,631,151) 13,649,967 15,869,235Less: Undistributed Expenditures---346,309 318,859 531,63611,865,313 13,062,117 12,159,161Results of Business Sector3,015,648 6,822,919 12,475,704 1,109,369 251,832 802,4502,234,162 26,712,084 28,028,396Sundry provisions------1,388,000 1,388,000 (152,554)Provision for credit facilities(1,486,055) (8,956,898) -(726,964) -1,710-(11,168,207) (6,708,420)Gross income4,501,703 15,779,817 12,475,704 1,836,333 251,832 800,740846,16236,492,291 34,889,370JD JDJD JD JD JDJDJD<strong>2011</strong> 2010FinancialIndividuals Corporations Treasury BrokerageFinancialLeasingBondedManagement OthersFor the Year Ended December 31,TotalThe following table represents information on the Bank's sectors according to activities:46. Capital Managementa.Description of CapitalAccording to the Central Bank of <strong>Jordan</strong> Law <strong>and</strong> in compliance with thecapital adequacy requirements, capital consists of many parts:•Primary capital made up of paid-up capital, declared reserves, (includingstatutory reserve, voluntary reserve, share premium (discount), treasuryshare premium, <strong>and</strong> other reserves), retained earnings, <strong>and</strong> non-controllinginterest (if any) minus intangible assets, loss for the period, acquisition costsof treasury stock, provisions required by the Central Bank of <strong>Jordan</strong>, fullamount of goodwill, <strong>and</strong> any restricted amounts.•Supplementary capital provided that the general <strong>bank</strong>ing risk reserve doesnot exceed 1.25% of total credit risk weighted assets, subordinated debts, <strong>and</strong>the positive cumulative change in fair value at 45%, less the negative changebalance provided that this part of capital does not exceed 100% of regulatorycapital•The third part consists of short-term subordinated loans to meet marketrisks. This part supplements capital <strong>and</strong> is utilized to face the potential lossesfrom market risks.Additionally, the Bank complies with Article (62) of the Banks Law whichrequires the Bank to appropriate 10% of its net profits in the Kingdom <strong>and</strong>continue to do so until the reserve equals the Bank’s paid-up capital.b.Regulatory Authorities Requirements Concerning Capital <strong>and</strong> Method ofFulfilling ThemThe Bank considers the compatibility of the size of capital with the nature ofrisks it is exposed to provided that paid-up capital is not less than the minimumrequired by the Central Bank of <strong>Jordan</strong> <strong>and</strong> regulatory capital not less than12% of the weighted value of credit <strong>and</strong> operating market risks. Furthermore,the minimum leverage ratio (equity to total assets) should not be less than 6%.Moreover, not less than 28.5% of market risks should be covered by regulatorycapital.c. How to Achieve the Objectives of Capital ManagementThe Bank’s management aims at achieving the Bank’s capital managementobjectives, a surplus in operating income <strong>and</strong> revenues, <strong>and</strong> the optimalutilization of the available sources of funds so as to reach the targetedgrowth in shareholders’ equity through the increase in the statutory reserve,recognized profits, voluntary reserve, <strong>and</strong> retained earnings.Capital is allocated to work lines <strong>and</strong> various functions according to assetsweighted by risks. Moreover, capital <strong>and</strong> its adequacy are monitoredperiodically, <strong>and</strong> capital adequacy is calculated by the Risk Management <strong>and</strong>Compliance Department <strong>and</strong> reviewed by the internal auditor.105