Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

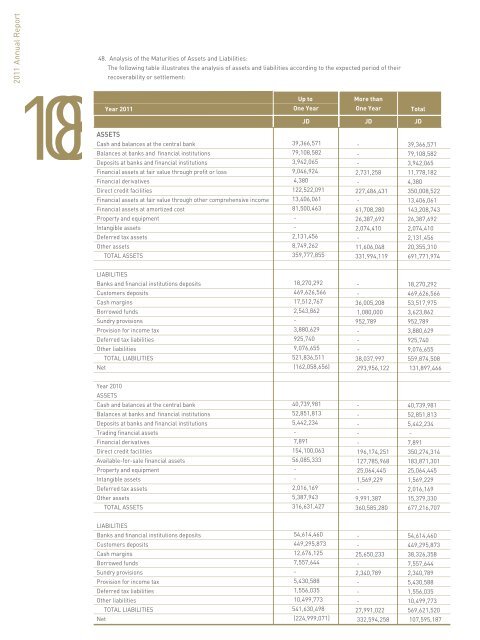

108ASSETS48. Analysis of the Maturities of Assets <strong>and</strong> Liabilities:The following table illustrates the analysis of assets <strong>and</strong> liabilities according to the expected period of theirrecoverability or settlement:Year <strong>2011</strong>Cash <strong>and</strong> balances at the central <strong>bank</strong>Balances at <strong>bank</strong>s <strong>and</strong> financial institutionsDeposits at <strong>bank</strong>s <strong>and</strong> financial institutionsFinancial assets at fair value through profit or lossFinancial derivativesDirect credit facilitiesFinancial assets at fair value through other comprehensive incomeFinancial assets at amortized costProperty <strong>and</strong> equipmentIntangible assetsDeferred tax assetsOther assetsTOTAL ASSETSUp toOne YearMore thanOne YearTotalJD JD JD39,366,571-39,366,57179,108,582-79,108,5823,942,065-3,942,0659,046,9242,731,258 11,778,1824,380-4,380122,522,091 227,486,431 350,008,52213,406,061-13,406,06181,500,46361,708,280 143,208,743-26,387,692 26,387,692-2,074,410 2,074,4102,131,456-2,131,4568,749,26211,606,048 20,355,310359,777,855 331,994,119 691,771,97449. Fair Value HierarchyThe table below analyzes financial instruments carried at fair value by the valuation method. The different levels have been defined asfollows:· Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;· Level 2: inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (i.e. asprices) or indirectly (i.e. derived from prices);· Level 3: inputs for the asset or liability that are not based on observable market data (unobservable inputs).December 31, <strong>2011</strong>Financial derivativesFinancial assets through profit or lossFinancial assets through other comprehensive incomeDecember 31, 2010Financial derivativesAvailable-for-sale financial assetsLevel 1JD JD JD JD4,380- -4,38011,778,182 - -11,778,18211,364,385 2,041,676 -13,406,06123,146,947 2,041,676 -25,188,623Level 1JD7,891180,801,321180,809,212Level 2 Level 3Level 2 Level 3JD------JDtotaltotalJD7,891180,801,321180,809,212- The available-for-sale financial assets with no available market values are stated at cost/amortized cost as it is impractical tomeasure their fair values reliably. They amounted to JD 3,069,980 as of December 31, 2010.50. Commitments <strong>and</strong> Contingent Liabilities (Off-Financial Position)109LIABILITIESBanks <strong>and</strong> financial institutions depositsCustomers depositsCash marginsBorrowed fundsSundry provisionsProvision for income taxDeferred tax liabilitiesOther liabilitiesTOTAL LIABILITIESNetYear 2010ASSETSCash <strong>and</strong> balances at the central <strong>bank</strong>Balances at <strong>bank</strong>s <strong>and</strong> financial institutionsDeposits at <strong>bank</strong>s <strong>and</strong> financial institutionsTrading financial assetsFinancial derivativesDirect credit facilitiesAvailable-for-sale financial assetsProperty <strong>and</strong> equipmentIntangible assetsDeferred tax assetsOther assetsTOTAL ASSETS18,270,292469,626,56617,512,7672,543,862-3,880,629925,7409,076,655521,836,511(162,058,656)40,739,98152,851,8135,442,234-7,891154,100,06356,085,333--2,016,1695,387,943316,631,427--36,005,2081,080,000952,789---38,037,997293,956,122-----196,174,251127,785,96825,064,4451,569,229-9,991,387360,585,28018,270,292469,626,56653,517,9753,623,862952,7893,880,629925,7409,076,655559,874,508131,897,46640,739,98152,851,8135,442,234-7,891350,274,314183,871,30125,064,4451,569,2292,016,16915,379,330677,216,707a. Credit commitments <strong>and</strong> contingencies:Letters of creditAcceptances <strong>and</strong> periodic withdrawalsLetters of guarantee:PaymentsPerformance bondsOtherUnutilized credit facilitiesTotalb. Contractual obligations:Contracts to purchase fixed assetsConstruction contractsTotalDecember 31,<strong>2011</strong>2010JDJD23,968,29926,392,4229,167,6636,422,35029,969,50919,933,70941,772,96150,520,29538,607,82842,953,8649,329,94050,408,284152,816,200196,630,924December 31,<strong>2011</strong>2010JDJD15,470948,462262,4792,402,397277,9493,350,859LIABILITIESBanks <strong>and</strong> financial institutions depositsCustomers depositsCash marginsBorrowed fundsSundry provisionsProvision for income taxDeferred tax liabilitiesOther liabilitiesTOTAL LIABILITIESNet54,614,460449,295,87312,676,1257,557,644-5,430,5881,556,03510,499,773541,630,498(224,999,071)--25,650,233-2,340,789---27,991,022332,594,25854,614,460449,295,87338,326,3587,557,6442,340,7895,430,5881,556,03510,499,773569,621,520107,595,187c. Operating leases amounted to JD 306,507 with periods ranging from 1 to 12 months51. Lawsuits Against the Banka. The Bank is a defendant in lawsuits amounting to JD 9,665,704 as of the consolidated financial statements date against JD 12,218,553in the prior year. The total provision booked against these lawsuits amounted to JD 695,253 as of December 31, <strong>2011</strong>. The Bank hasreversed a provision booked against a case filed by one of the <strong>Jordan</strong>ian Banks (under liquidation), based on the Bank’s legal advisoropinion. In which Amman’s Court of First Instance have dismissed the case <strong>and</strong> the court’s decision has become final <strong>and</strong> peremptory,as no appeal was filed <strong>and</strong> thus the case has ended <strong>and</strong> there is no need to book a provision for this lawsuit. As a result, a provision ofJD 1,765,000 was reversed to the consolidated statement of income ( JD 2,160,253 as of December 31, 2010).b. There were no lawsuits against the subsidiaries Tamkeen Leasing Company <strong>and</strong> Al Istethemari Letamweel Salselat Al Imdad as ofDecember 31, <strong>2011</strong> <strong>and</strong> 2010.c. There's one lawsuit in the stated amount above that includes Al-Mawared for financial brokerage for an amount of JD 300,000. In theopinion of the management <strong>and</strong> legal advisor, no liabilities would rise against the Company for this case.