Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

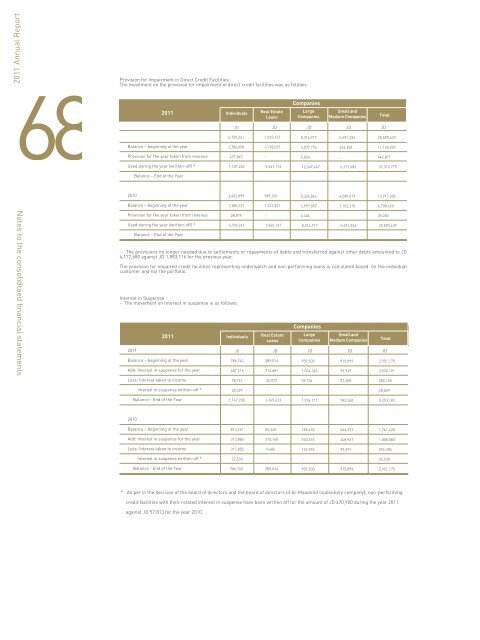

68Notes to the consolidtaed financial statementsProvision for Impairment in Direct Credit Facilities:The movement on the provision for impairment in direct credit facilities was as follows:<strong>2011</strong>Balance – beginning of the yearProvision for the year taken from revenueUsed during the year (written-off) *Balance – End of the Year2010Balance – beginning of the yearProvision for the year taken from revenueUsed during the year (written-off) *Balance – End of the YearIndividualsJD4,759,2412,786,058437,8477,107,4523,402,8991,385,22128,8794,759,241Real EstateLoansJD JD JD JD1,823,1473,718,027-5,541,1748,316,7174,037,7745,02412,349,4675,691,334626,348-6,317,68220,590,43911,168,207442,87131,315,775599,3201,223,827-1,823,147CompaniesLargeCompanies5,326,0642,997,0576,4048,316,717Small <strong>and</strong>Medium Companies4,589,0191,102,315-5,691,33413,917,3026,708,42035,28320,590,439- The provisions no longer needed due to settlements or repayments of debts <strong>and</strong> transferred against other debts amounted to JD4,172,680 against JD 1,883,116 for the previous year.The provision for impaired credit facilities representing underwatch <strong>and</strong> non-performing loans is calculated based on the individualcustomer <strong>and</strong> not the portfolio.Interest in Suspense- The movement on interest in suspense is as follows:<strong>2011</strong><strong>2011</strong>Balance – beginning of the yearAdd: Interest in suspense for the yearLess: Interest taken to incomeInterest in suspense written-off *Balance - End of the Year2010Balance – beginning of the yearAdd: Interest in suspense for the yearLess: Interest taken to incomeInterest in suspense written-off *Balance - End of the YearIndividualsJD786,762487,21678,74128,0291,167,208813,267313,880317,85522,530786,762Real EstateLoans* As per in the decision of the board of directors <strong>and</strong> the board of directors of Al-Mawared (subsidiary company), non-performingTotalJD JD JD JD289,014914,68134,072-1,169,623959,5001,034,34559,734-1,934,111915,89993,94927,608-982,2402,951,1752,530,191200,15528,0295,253,18283,340215,1609,486-289,014CompaniesLargeCompanies198,498930,576169,574-959,500Small <strong>and</strong>Medium Companies666,323348,96799,391-915,899Total1,761,4281,808,583596,30622,5302,951,175location) <strong>and</strong> its two branches at Emar Towers <strong>and</strong> bonded which are still under construction as of the statement of financial position date.* This item represents down payments for the purchase of furniture, fixtures <strong>and</strong> equipment for the purposes of the <strong>bank</strong>s branch at Shmesani (newJD 4,611,815 as of December 31, 2010.- Property <strong>and</strong> Equipment as of December 31, <strong>2011</strong> include an amount of JD 5,311,293 representing fully depreciated property <strong>and</strong> equipmentNet Book Value of Fixed Assets6,030,272 1,247,157 1,667,648216,394 323,324 15,579,650 25,064,445Balance - End of the year-1,082,608 1,498,767115,470 247,635 -2,944,480Disposals--316,22268,198 69,048-453,468Additions-133,377 380,91172,644 75,419-662,351Balance - beginning of the year-949,231 1,434,078111,024 241,264 -2,735,597Accumulated Depreciation:Balance - End of the year6,030,272 2,329,765 3,166,415331,864 570,959 15,579,650 28,008,925Transfers639,026 (548,821) 1,134,410-8,658(1,233,273) -Disposals--328,23068,198 69,048-465,476Additions1,746,910 -268,149111,436 153,001 6,492,727 8,772,223Balance - beginning of the year3,644,336 2,878,586 2,092,086288,626 478,348 10,320,196 19,702,178Cost:Year 2010Net Book Value of Fixed Assets10,976,945 9,293,003 1,946,220166,029 753,943 3,251,552 26,387,692Balance - End of the year-1,225,758 2,225,708148,720 409,096 -4,009,282Disposals--14,27818,145 --32,423Additions-143,150 741,21951,395 161,461 -1,097,225Balance - beginning of the year-1,082,608 1,498,767115,470 247,635 -2,944,480Accumulated Depreciation:Balance - End of the year10,976,945 10,518,761 4,171,928314,749 1,163,039 3,251,552 30,396,974Transfers4,946,673 8,188,996 656,291-455,540 (14,247,500) -Disposals--17,03040,000 --57,030Additions--366,25222,885 136,540 1,919,402 2,445,079Balance - beginning of the year6,030,272 2,329 ,765 3,166,415331,864 570,959 15,579,650 28,008,925Cost:JD JD JD JD JDJDJD<strong>2011</strong>Down Payment forFurniture,Purchaseing FixedL<strong>and</strong>Assets & ProjectsBuildings Fixtures <strong>and</strong> Vehicles Computers under ConstructionTotalEquipment*12. Property <strong>and</strong> Equipment - NetThe details of this item are as follows:Notes to the consolidtaed financial statementscredit facilities with their related interest in suspense have been written off for the amount of JD 470,900 during the year <strong>2011</strong>against JD 57,813 for the year 2010.69