Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

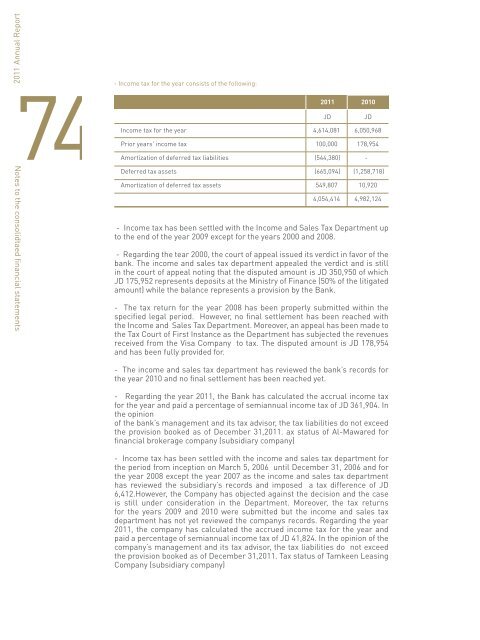

74Notes to the consolidtaed financial statements- Income tax for the year consists of the following: -Tamkeen Leasing company (a subsidiary) has not submitted its tax return forthe period from inception on October 31, 2006 to December 31, 2007 <strong>and</strong> for<strong>2011</strong> 2010the years 2008 <strong>and</strong> 2009. In the opinion of management <strong>and</strong> the tax advisor,the Company will not have any tax liabilities as it has not conducted anyJDJDactivities yet.Income tax for the year4,614,081 6,050,968- The company submitted its tax return for the year 2010 but the income <strong>and</strong>Prior years' income tax100,000 178,954sales tax department has not yet reviewed the company’s records.Amortization of deferred tax liabilities(544,380) -- Regarding the year <strong>2011</strong> given that the company made a loss, in the opinionDeferred tax assets(665,094) (1,258,718)of the company’s management <strong>and</strong> the tax advisor, the Company will not haveAmortization of deferred tax assets549,807 10,920any tax liabilities as it has incurred losses for the period. Tax status of AL-Istethmari Letamweel Selselat Al Imdad (subsidiary company)4,054,414 4,982,124-The company has submitted its tax return for the period from inceptionon February 11, 2010 to December 31, 2010 but the income <strong>and</strong> sales tax- Income tax has been settled with the Income <strong>and</strong> Sales Tax Department updepartment has not yet reviewed the company’s records. Regarding theto the end of the year 2009 except for the years 2000 <strong>and</strong> 2008.year <strong>2011</strong>, the company has calculated the accrued income tax <strong>and</strong> in theopinion of management <strong>and</strong> the tax advisor, the Company will not have any- Regarding the tear 2000, the court of appeal issued its verdict in favor of thetax liabilities as it has incurred losses for the period.<strong>bank</strong>. The income <strong>and</strong> sales tax department appealed the verdict <strong>and</strong> is stillin the court of appeal noting that the disputed amount is JD 350,950 of whichb. Deffered tax Assets/LiabilitiesJD 175,952 represents deposits at the Ministry of <strong>Finance</strong> (50% of the litigatedThe details of this item are as follows:amount) while the balance represents a provision by the Bank.- The tax return for the year 2008 has been properly submitted within thespecified legal period. However, no final settlement has been reached withthe Income <strong>and</strong> Sales Tax Department. Moreover, an appeal has been made tothe Tax Court of First Instance as the Department has subjected the revenuesreceived from the Visa Company to tax. The disputed amount is JD 178,954<strong>and</strong> has been fully provided for.- The income <strong>and</strong> sales tax department has reviewed the <strong>bank</strong>’s records forthe year 2010 <strong>and</strong> no final settlement has been reached yet.- Regarding the year <strong>2011</strong>, the Bank has calculated the accrual income taxfor the year <strong>and</strong> paid a percentage of semiannual income tax of JD 361,904. Inthe opinionof the <strong>bank</strong>’s management <strong>and</strong> its tax advisor, the tax liabilities do not exceedthe provision booked as of December 31,<strong>2011</strong>. ax status of Al-Mawared forfinancial brokerage company (subsidiary company)- Income tax has been settled with the income <strong>and</strong> sales tax department forthe period from inception on March 5, 2006 until December 31, 2006 <strong>and</strong> forthe year 2008 except the year 2007 as the income <strong>and</strong> sales tax departmenthas reviewed the subsidiary’s records <strong>and</strong> imposed a tax difference of JD6,412.However, the Company has objected against the decision <strong>and</strong> the caseis still under consideration in the Department. Moreover, the tax returnsfor the years 2009 <strong>and</strong> 2010 were submitted but the income <strong>and</strong> sales taxdepartment has not yet reviewed the companys records. Regarding the year<strong>2011</strong>, the company has calculated the accrued income tax for the year <strong>and</strong>paid a percentage of semiannual income tax of JD 41,824. In the opinion of thecompany’s management <strong>and</strong> its tax advisor, the tax liabilities do not exceedthe provision booked as of December 31,<strong>2011</strong>. Tax status of Tamkeen LeasingCompany (subsidiary company)Accounts Included1. Deferred Tax AssetsProvision for impairment in credit facilities (before the year 2000)Provision for employees end -of-service indemnitiesProvisions for lawsuits against the BankProvisions for debts under watchProvision for impairment in assets seized by the BankProvision for impairment in financial brokerage2-Deffred Tax liabilitiesEffect of early adoption of IFRS (9)Change in fair value reserveCumulative change in fair valueBeginning BalanceAdditionsDeductionsEnding BalanceBeginningBalanceReleased<strong>2011</strong>AmountsAdditionsEndingBalance<strong>2011</strong>JD JDJD JD JD JD513,3163,8232,160,2532,182,761914,6111,182,2506,957,0143,421,5341,765,250-5,186,7842,016,169770,177654,8902,131,456--1,765,000920,76767,691437,8473,191,3051,814,6011,342,744-3,157,3451,556,035316,909947,209925,740--300,0002,000,460-1,484,4553,784,915-1,056,362-1,056,362768,3711,258,71810,9202,016,169513,3163,823695,2533,262,454846,9202,228,8587,550,6241,606,9331,478,868-3,085,801843,1851,186,626473,7761,556,03575December 31,DeferredTax153,9951,147208,576978,736254,076534,9262,131,456482,080443,660-925,7402010DefferredTaxDeffered tax liabilities include an amount of JD 443,660 as of December 31,<strong>2011</strong> (JD 1,556,035 prior year) which represents tax liabilities against gains on theevaluation of financial assets at fair value through other comprehensive income which is shown under fair value reserve in owners equity. In addition, there's anamount of JD 482,080 for deffered tax liabilities on gain on financial assets at fair value through profit or loss which is shown under retained earnings as a result ofthe early adoption of IFRS (9)The movement on deffered tax assets / liabilities was as follows:AssetsJD<strong>2011</strong>2012Liabilities Assets LiabilitiesJDJDJD153,9951,147648,076654,828274,383283,7402,016,169--1,556,0351,556,035Notes to the consolidtaed financial statements