Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

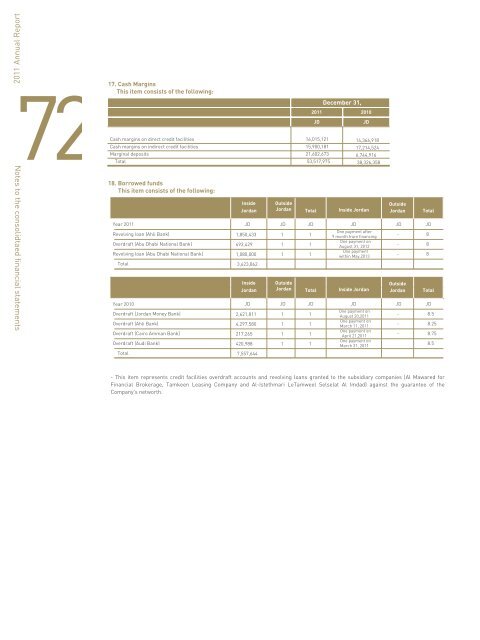

17. Cash MarginsThis item consists of the following:19. Sundry ProvisionsThis item consists of the following:72Notes to the consolidtaed financial statementsCash margins on direct credit facilitiesCash margins on indirect credit facilitiesMarginal depositsTotal18. Borrowed fundsThis item consists of the following:Year <strong>2011</strong>Revolving loan (Ahli Bank)Overdraft (Abu Dhabi National Bank)Revolving loan (Abu Dhabi National Bank)TotalYear 2010Overdraft (<strong>Jordan</strong> Money Bank)Overdraft (Ahli Bank)Overdraft (Cairo Amman Bank)Overdraft (Audi Bank)TotalInside<strong>Jordan</strong>1,850,433693,4291,080,0003,623,862Outside<strong>Jordan</strong>December 31,<strong>2011</strong> 2010JD16,015,12115,900,18121,602,67353,517,975JD14,366,91817,214,5246,744,91638,326,358- This item represents credit facilities overdraft accounts <strong>and</strong> revolving loans granted to the subsidiary companies (Al Mawared forFinancial Brokerage, Tamkeen Leasing Company <strong>and</strong> Al-Istethmari LeTamweel Selselat Al Imdad) against the guarantee of theCompany's networth.TotalInside <strong>Jordan</strong>Outside<strong>Jordan</strong>JD JD JD JD JD JDInside<strong>Jordan</strong>2,621,8114,297,580217,265420,9887,557,644111Outside<strong>Jordan</strong>111TotalOne payment after9 month from financingOne payment onAugust 31, 2012One paymentwithin May,2013Inside <strong>Jordan</strong>---Outside<strong>Jordan</strong>JD JD JD JD JD JD11111111One payment onAugust 20,<strong>2011</strong>One payment onMarch 11, <strong>2011</strong>One payment onApril 21,<strong>2011</strong>One payment onMarch 31, <strong>2011</strong>---Total888Total8.58.258.758.5Year <strong>2011</strong>Provision for employees end-of-service indemnityProvision for lawsuits against the Bank (Note 51)Provision for contingent liabilitiesTotalYear 2010Provision for employees end-of-service indemnityProvision for lawsuits against the BankProvision for contingent liabilitiesTotal20. Income TaxA. Provision for income tax:The movement on the provision for income tax was as follows:Beginning balanceIncome tax paidPrior years' income taxIncome tax for the yearEnding BalanceBeginningBalanceJD3,8232,160,253176,7132,340,789BeginningBalance4,3942,043,528176,7132,224,635Additions Disposals Returnedto IncomeJD JD JD JD-300,00077,000377,000-----1,765,000-1,765,0003,823695,253253,713952,789Additions Disposals Returnedto Income379152,175-152,554<strong>2011</strong>JD5,430,588(6,264,040)100,0004,614,0813,880,62995035,450-36,4002010JD3,484,443(4,283,777)178,9546,050,9685,430,588----EndingBalanceEndingBalance3,8232,160,253176,7132,340,78973Notes to the consolidtaed financial statements