Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

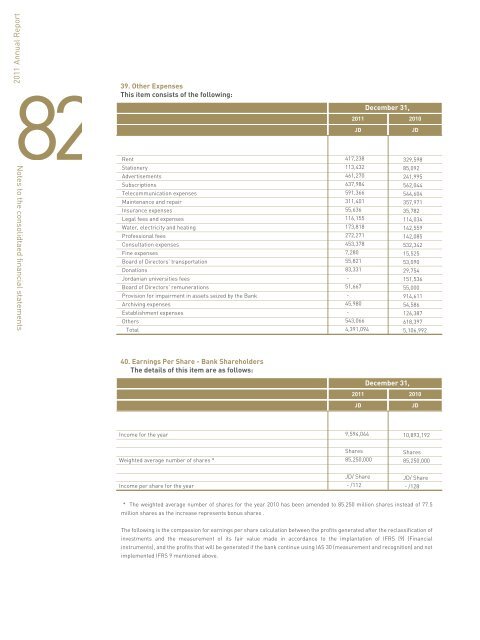

82Notes to the consolidtaed financial statements39. Other ExpensesThis item consists of the following:RentStationeryAdvertisementsSubscriptionsTelecommunication expensesMaintenance <strong>and</strong> repairInsurance expensesLegal fees <strong>and</strong> expensesWater, electricity <strong>and</strong> heatingProfessional feesConsultation expensesFine expensesBoard of Directors' transportationDonations<strong>Jordan</strong>ian universities feesBoard of Directors' remunerationsProvision for impairment in assets seized by the BankArchiving expensesEstablishment expensesOthersTotalDecember 31,<strong>2011</strong> 2010JDJD417,238329,598113,43285,092461,270241,995637,984562,044591,366544,604311,401357,97155,63635,782116,155114,034173,818142,559272,271142,085453,378532,3427,28015,52555,82153,09083,33129,754-151,53651,66755,000-914,61145,98054,586-126,387543,066618,3974,391,0945,106,992For the Year End December 31,Income for the yearWeighted average number of shares *Income per share for the year41. Cash <strong>and</strong> Cash EquivalentsThe details of this items are as follows:Balances at central <strong>bank</strong>s due within 3 monthsAdd: Balances at <strong>bank</strong>s <strong>and</strong> financial institutions due within 3 monthsLess: Banks <strong>and</strong> financial institutions deposits due within 3 monthsCash <strong>and</strong> Cash EquivalentsDecember 31,<strong>2011</strong> 2010JD39,366,57179,108,58218,270,292100,204,861For the Year EndDecember 31,<strong>2011</strong>IFRS (9)JD9,304,966Shares85,250,000JD/ Share- /109JD40,739,98152,851,81354,614,46038,977,33483Notes to the consolidtaed financial statements40. Earnings Per Share - Bank ShareholdersThe details of this item are as follows:December 31,<strong>2011</strong> 2010JDJDIncome for the year9,594,04410,893,192Weighted average number of shares *Shares85,250,000Shares85,250,000Income per share for the yearJD/ Share- /112JD/ Share- /128* The weighted average number of shares for the year 2010 has been amended to 85.250 million shares instead of 77.5million shares as the increase represents bonus shares .The following is the compassion for earnings per share calculation between the profits generated after the reclassification ofinvestments <strong>and</strong> the measurement of its fair value made in accordance to the implantation of IFRS (9) (Financialinstruments), <strong>and</strong> the profits that will be generated if the <strong>bank</strong> continue using IAS 30 (measurement <strong>and</strong> recognition) <strong>and</strong> notimplemented IFRS 9 mentioned above.