Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

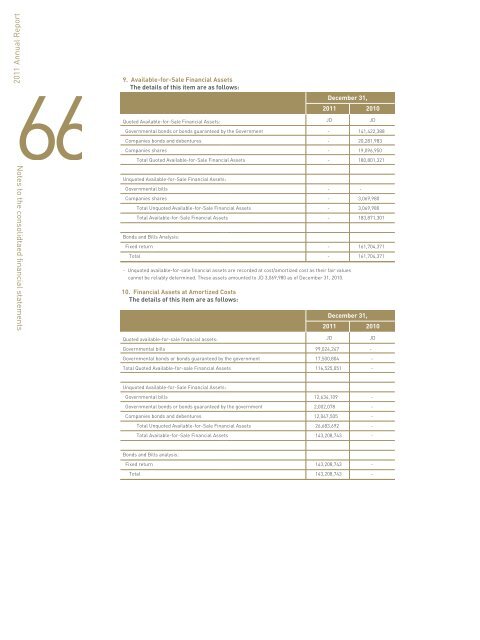

669. Available-for-Sale Financial AssetsThe details of this item are as follows:Quoted Available-for-Sale Financial Assets:Governmental bonds or bonds guaranteed by the GovernmentCompanies bonds <strong>and</strong> debenturesCompanies sharesDecember 31,<strong>2011</strong>JD---2010JD141,422,38820,281,98319,096,95011 . Direct Credit Facilities - NetThis item consists of the following:Individuals (retail)OverdraftDecember 31,<strong>2011</strong>2010JD11,698,281JD18,796,48067Total Quoted Available-for-Sale Financial Assets-180,801,321Loans <strong>and</strong> promissory notes*29,423,28926,661,223Notes to the consolidtaed financial statementsUnquoted Available-for-Sale Financial Assets:Governmental billsCompanies sharesTotal Unquoted Available-for-Sale Financial AssetsTotal Available-for-Sale Financial AssetsBonds <strong>and</strong> Bills Analysis:Fixed returnTotal- Unquoted available-for-sale financial assets are recorded at cost/amortized cost as their fair valuescannot be reliably determined. These assets amounted to JD 3,069,980 as of December 31, 2010.10. Financial Assets at Amortized CostsThe details of this item are as follows:Quoted available-for-sale financial assets:Governmental billsGovernmental bonds or bonds guaranteed by the governmentTotal Quoted Available-for-sale Financial AssetsUnquoted Available-for-Sale Financial Assets:Governmental billsGovernmental bonds or bonds guaranteed by the governmentCompanies bonds <strong>and</strong> debenturesTotal Unquoted Available-for-Sale Financial Assets-------3,069,9803,069,980183,871,301161,704,371161,704,371December 31,<strong>2011</strong>2010JD99,024,24717,500,804116,525,05112,634,1092,002,07812,047,50526,683,692JD-------Credit CardsReal estate loansCompaniesLarge CompaniesOverdraftLoans <strong>and</strong> promissory notes*Medium <strong>and</strong> small companiesOverdraftLoans <strong>and</strong> promissory notes*Government <strong>and</strong> public sectorTotalLess: Provision for impairment in direct credit facilitiesSuspended interestNet Direct Credit Facilities1,682,34060,882,50255,834,119195,075,29610,366,95520,723,575891,122386,577,47931,315,7755,253,182350,008,5221,761,02563,141,29356,413,540181,351,7309,715,41412,347,3803,627,843373,815,92820,590,4392,951,175350,274,314* Net after deducting interest <strong>and</strong> commissions received in advance of JD 5,008,566 as of December 31, <strong>2011</strong> against JD4,205,882 as of December31, 2010.- Non-performing credit facilities amounted to JD 50,776,611 which is equivalent to (13.1%) of total direct credit facilities asof December 31, <strong>2011</strong>against JD 41,434,644, which is equivalent to (11.1%) of total credit facilities as of December 31, 2010.- Non- performing credit facilities excluding interest <strong>and</strong> commissions in suspense amounted to JD 45,523,429 which isequivalent to (11.9%) of totaldirect credit facilities after excluding interest in suspense as of December 31, <strong>2011</strong> against JD JD38,483,471 which isequivalent to (10.4%) of totalcredit facilities after excluding interest in suspense as of December 31, 2010.- Direct credit facilities granted to / guaranteed by the Government of <strong>Jordan</strong> amounted to JD 891,122 which is equivalent to(0.2%) of total directfacilities against JD 3,627,843, which is equivalent to (1%) as of December 31, <strong>2011</strong>.Notes to the consolidtaed financial statementsTotal Available-for-Sale Financial Assets143,208,743-Bonds <strong>and</strong> Bills analysis:Fixed returnTotal143,208,743143,208,743--