Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

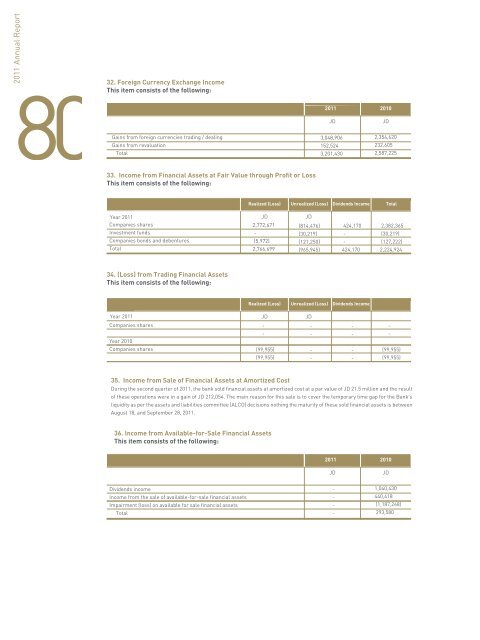

8032.Foreign Currency Exchange IncomeThis item consists of the following:Gains from foreign currencies trading / dealingGains from revaluationTotal33. Income from Financial Assets at Fair Value through Profit or LossThis item consists of the following:Year <strong>2011</strong>Companies shares<strong>Investment</strong> fundsCompanies bonds <strong>and</strong> debenturesTotal34. (Loss) from Trading Financial AssetsThis item consists of the following:Year <strong>2011</strong>Companies sharesYear 2010Companies sharesRealized (Loss)JD2,772,671-(5,972)2,766,699Realized (Loss)JD--(99,955)(99,955)<strong>2011</strong>JD3,048,906152,5243,201,4302010JD2,354,620232,6052,587,225Unrealized (Loss) Dividends Income TotalJD(814,476)(30,219)(121,250)(965,945)Unrealized (Loss)JD----424,170--424,170Dividends Income----2,382,365(30,219)(127,222)2,224,924--(99,955)(99,955)37. Other IncomeThis item consists of the following:Rental of safe deposit boxesBonded incomeTelex incomeIncome from sale of assets seized by the <strong>bank</strong>Other *TotalSalaries, bonuses <strong>and</strong> employees' benefitsBank’s share in social securityMedical expensesPer diemsTravel expensesTraining <strong>and</strong> researchEmployees life insuranceTotal<strong>2011</strong>JD14,210432,122292,58913,524547,6451,300,090<strong>2011</strong>JD6,172,342558,366292,1343,89523,14930,68519,6427,100,2132010JD7,100218,894407,581185,2111,663,7192,482,505* This item includes a net amount of JD 1.6 million for the year 2010 as a result of acquiring real estates from one of thecustomers who had previously written off debts against zero in <strong>2011</strong>.38. Employees ExpensesThis item consists of the following:2010JD5,237,086452,572133,0303,23624,35646,98016,5745,913,83481Notes to the consolidtaed financial statements35. Income from Sale of Financial Assets at Amortized CostDuring the second quarter of <strong>2011</strong>, the <strong>bank</strong> sold financial assets at amortized cost at a par value of JD 21.5 million <strong>and</strong> the resultof these operations were in a gain of JD 212,054. The main reason for this sale is to cover the temporary time gap for the Bank'sliquidity as per the assets <strong>and</strong> liabilities committee (ALCO) decisions nothing the maturity of these sold financial assets is betweenAugust 18, <strong>and</strong> September 28, <strong>2011</strong>.36. Income from Available-for-Sale Financial AssetsThis item consists of the following:<strong>2011</strong>JD2010JDDividends incomeIncome from the sale of available-for-sale financial assetsImpairment (loss) on available for sale financial assetsTotal----1,040,430440,418(1,187,268)293,580