Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

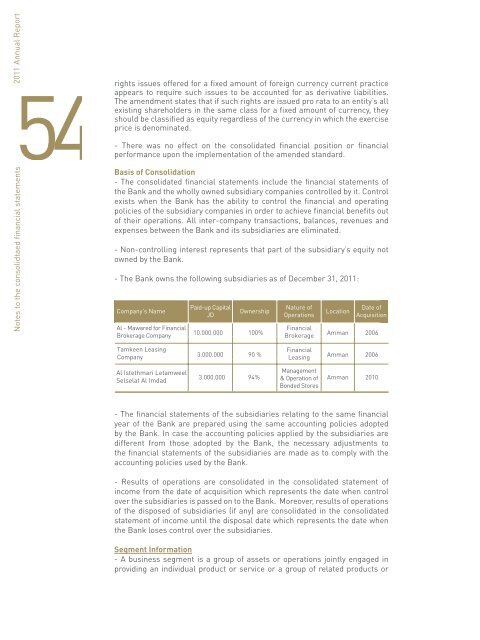

54rightsNotes to the consolidtaed financial statementsissues offered for a fixed amount of foreign currency current practiceappears to require such issues to be accounted for as derivative liabilities.The amendment states that if such rights are issued pro rata to an entity’s allexisting shareholders in the same class for a fixed amount of currency, theyshould be classified as equity regardless of the currency in which the exerciseprice is denominated.- There was no effect on the consolidated financial position or financialperformance upon the implementation of the amended st<strong>and</strong>ard.Basis of Consolidation- The consolidated financial statements include the financial statements ofthe Bank <strong>and</strong> the wholly owned subsidiary companies controlled by it. Controlexists when the Bank has the ability to control the financial <strong>and</strong> operatingpolicies of the subsidiary companies in order to achieve financial benefits outof their operations. All inter-company transactions, balances, revenues <strong>and</strong>expenses between the Bank <strong>and</strong> its subsidiaries are eliminated.- Non-controlling interest represents that part of the subsidiary’s equity notowned by the Bank.- The Bank owns the following subsidiaries as of December 31, <strong>2011</strong>:services subject to risks <strong>and</strong> returns different from those of other businesssegments. It is measured according to the reports used by the GeneralManager or other key decision – makers at the Bank.- A geographical segment is a distinguishable component of an entity engagedin providing products or services within a particular economic environmentsubject to risks <strong>and</strong> returns different from those of components operating inother economic environments.Financial Assets Held for TradingPolicy applied before 1 January <strong>2011</strong>:Financial assets held for trading represent investments in stocks, funds <strong>and</strong>bonds of companies in active markets. Moreover, the purpose of keeping theseinvestments is to generate profits from the fluctuation in short-term marketprices or a trading profit margin.- Financial assets held for trading are initially recognized at fair value whenpurchased (acquisition costs are taken to the consolidated statement ofincome). They are subsequently re-measured to fair value as of the date ofthe consolidated financial statements, <strong>and</strong> the resulting changes are includedin the consolidated statement of income in the period in which they arise.Moreover, fair value differences resulting from the translation of foreigncurrency non-monetary assets are taken to the consolidated statement ofincome.- Distributed income or realized interest is recorded in the consolidatedstatement of income.55Notes to the consolidtaed financial statements- The financial statements of the subsidiaries relating to the same financialyear of the Bank are prepared using the same accounting policies adoptedby the Bank. In case the accounting policies applied by the subsidiaries aredifferent from those adopted by the Bank, the necessary adjustments tothe financial statements of the subsidiaries are made as to comply with theaccounting policies used by the Bank.- Results of operations are consolidated in the consolidated statement ofincome from the date of acquisition which represents the date when controlover the subsidiaries is passed on to the Bank. Moreover, results of operationsof the disposed of subsidiaries (if any) are consolidated in the consolidatedstatement of income until the disposal date which represents the date whenthe Bank loses control over the subsidiaries.Segment Information- A business segment is a group of assets or operations jointly engaged inproviding an individual product or service or a group of related products orDirect Credit Facilities- A provision for the impairment in direct credit facilities is recognized whenit is obvious that the financial assets of the Bank can not be recovered, thereis an objective evidence of the existence of an event negatively affecting thefuture cash flows of the direct credit facilities, <strong>and</strong> the impairment amount canbe estimated. The provision is taken to the consolidated statement of income.- Interest <strong>and</strong> commissions on non-performing credit facilities are suspendedin accordance with the regulations of the Central Bank of <strong>Jordan</strong>.- Impaired credit facilities, for which specific provisions have been taken,are written off by charging the provision after all efforts have been made torecover the assets. Any surplus in the provisions is taken to the consolidatedstatement of income, while debt recoveries are taken to income.Available-for-Sale Financial AssetsPolicy applied before 1 January <strong>2011</strong>:Available-for-sale financial assets are financial assets held by the Bank <strong>and</strong>classified as neither trading nor held-to-maturity financial assets.- Available-for-sale financial assets are initially recorded at fair valueincluding acquisition costs. They are subsequently re-measured at fair valueas of the date of the consolidated financial statements. Moreover, change infair value is recorded in a separate account within the consolidated statementof comprehensive income <strong>and</strong> within shareholders’ equity. In case these