Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Annual Report 2011 - Jordan Investment and Finance bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

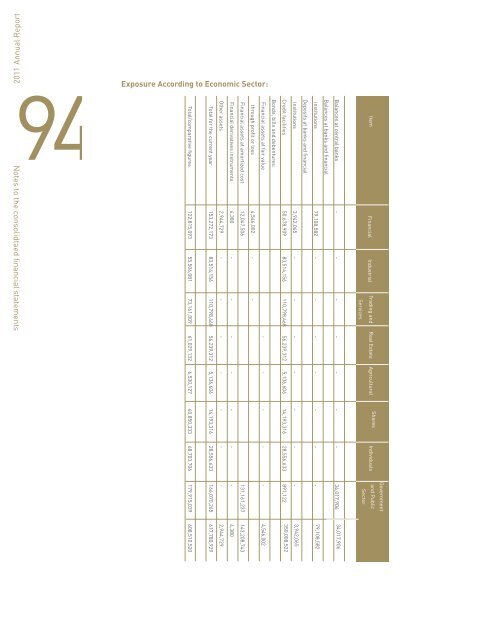

94ExposureNotes to the consolidtaed financial statementsAccording to Economic Sector:Financial assets at fair valuethrough profit or lossFinancial assets at amortized costFinancial derivatives instrumentsOther assetsTotal for the current yearTotal/comparative figures4,546,00212,047,5064,3802,944,729153,272,173122,815,093---83,514,15655,506,081---110,798,46873,161,009---56,239,31261,029,132---5,136,6066,530,127---14,193,31640,850,333---28,556,63368,703,706-131,161,237--166,070,265179,915,0394,546,002143,208,7434,3802,944,729617,780,929608,510,520Bonds, bills <strong>and</strong> debentures:Deposits at <strong>bank</strong>s <strong>and</strong> financialinstitutionsCredit facilities3,942,06550,678,909-83,514,156-110,798,468-56,239,312-5,136,606-14,193,316-28,556,633-891,1223,942,065350,008,522Balances at <strong>bank</strong>s <strong>and</strong> financialinstitutions79,108,582 -------79,108,582Balances at central <strong>bank</strong>s-------34,017,906 34,017,906ServicesSectorItem Financial Industrial Trading <strong>and</strong> Real EstateSharesAgricultural Individuals<strong>and</strong> PublicGovernment44. b. Operational RiskOperating risk is defined as “the loss resulting from the failure or inadequacyof the internal procedures, the human factor, <strong>and</strong> systems, or from externalevents including legal risks.Operational risks at <strong>bank</strong>s constitute from 15% to 20% of the risks <strong>bank</strong>s areexposed to. These risks directly or indirectly impact the <strong>bank</strong>s net profitsthrough either decreasing the expected profits or increasing the expectedexpenses. To manage these risks, the Bank has set up an automatic systemfor the identification of these risks, determination of the adequacy of theinternal control system <strong>and</strong> procedures, <strong>and</strong> efficiency of the human elementto mitigate these risks, in addition to the identification of operating risks thatconfronted the Bank or other <strong>bank</strong>s in the past, <strong>and</strong> consequently, spottingthe events causing them. This is to enable the Bank to remedy them <strong>and</strong> tobenefit from the mistakes causing these risks. In this regard, the Bank hasimplemented the following:•Control & Risk Self Assessment (CRSA).•Key Risk Indicator (KRI).•Key Risk Driver (KRD).Compliance RiskThis represents the risks that arise from the probability that the Bankmay not comply with (violate / transgress) the prevailing laws, regulations,instructions, <strong>bank</strong>s laws, <strong>and</strong> code of ethics issued by international <strong>and</strong> localregulatory authorities.Compliance with the regulations <strong>and</strong> prevailing laws issued by the regulatoryauthorities represents one of the most important risks which the Bank mightbe exposed to, due to the major financial losses resulting from the violation ofthe laws <strong>and</strong> instructions that affect the Bank›s reputation. Moreover, the pastfew years witnessed many new regulations, instructions <strong>and</strong> laws organizingthe work of the various institutions. Accordingly, the need for managing thecompliance risk of the Bank is necessary. Moreover, compliance enhances theefficiency of managing risks <strong>and</strong> decreases the risk the Bank might be exposedto as a result of noncompliance with the prevailing laws <strong>and</strong> instructions.44.c Market RiskMarket risk is the potential losses that may arise from the changes in marketprices such as the change in interest rates, foreign currency exchange rates,<strong>and</strong> prices of shares <strong>and</strong> products.The Board of Directors has set limits for the acceptable risk levels for managingthe financial portfolio market risks. Moreover, the Bank periodically appliesthe appropriate methodology to evaluate market risks <strong>and</strong> sets estimates forthe probable economic losses based on a set of assumptions <strong>and</strong> changesin market conditions. The following are the methods used by the Bank tomeasure market risks:95Notes to the consolidtaed financial statements