timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

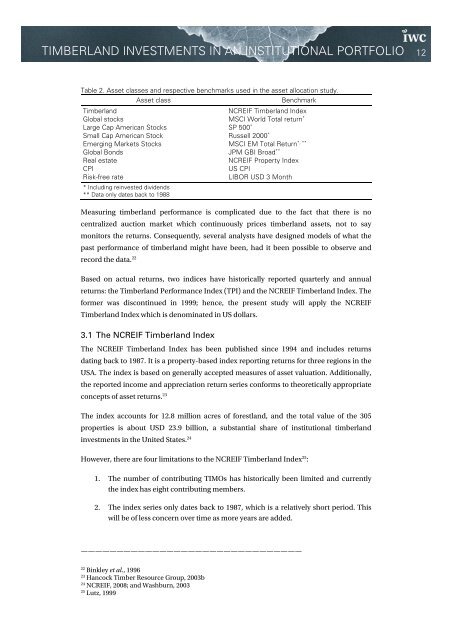

TIMBERLAND INVESTMENTS IN AN INSTITUTIONAL PORTFOLIO 12Table 2. Asset classes <strong>an</strong>d respective benchmarks used <strong>in</strong> the asset allocation study.Asset classBenchmarkTimberl<strong>an</strong>dGlobal stocksLarge Cap Americ<strong>an</strong> StocksSmall Cap Americ<strong>an</strong> StockEmerg<strong>in</strong>g Markets StocksGlobal BondsReal estateCPIRisk-free rate* Includ<strong>in</strong>g re<strong>in</strong>vested dividends** Data only dates back to 1988NCREIF Timberl<strong>an</strong>d IndexMSCI World Total return *SP 500 *Russell 2000 **, **MSCI EM Total ReturnJPM GBI Broad **NCREIF Property IndexUS CPILIBOR USD 3 MonthMeasur<strong>in</strong>g <strong>timberl<strong>an</strong>d</strong> perform<strong>an</strong>ce is complicated due to the fact that there is nocentralized auction market which cont<strong>in</strong>uously prices <strong>timberl<strong>an</strong>d</strong> assets, not to saymonitors the returns. Consequently, several <strong>an</strong>alysts have designed models of what thepast perform<strong>an</strong>ce of <strong>timberl<strong>an</strong>d</strong> might have been, had it been possible to observe <strong>an</strong>drecord the data. 22Based on actual returns, two <strong>in</strong>dices have historically reported quarterly <strong>an</strong>d <strong>an</strong>nualreturns: the Timberl<strong>an</strong>d Perform<strong>an</strong>ce Index (TPI) <strong>an</strong>d the NCREIF Timberl<strong>an</strong>d Index. Theformer was discont<strong>in</strong>ued <strong>in</strong> 1999; hence, the present study will apply the NCREIFTimberl<strong>an</strong>d Index which is denom<strong>in</strong>ated <strong>in</strong> US dollars.3.1 The NCREIF Timberl<strong>an</strong>d IndexThe NCREIF Timberl<strong>an</strong>d Index has been published s<strong>in</strong>ce 1994 <strong>an</strong>d <strong>in</strong>cludes returnsdat<strong>in</strong>g back to 1987. It is a property-based <strong>in</strong>dex report<strong>in</strong>g returns for three regions <strong>in</strong> theUSA. The <strong>in</strong>dex is based on generally accepted measures of asset valuation. Additionally,the reported <strong>in</strong>come <strong>an</strong>d appreciation return series conforms to theoretically appropriateconcepts of asset returns. 23The <strong>in</strong>dex accounts for 12.8 million acres of forestl<strong>an</strong>d, <strong>an</strong>d the total value of the 305properties is about USD 23.9 billion, a subst<strong>an</strong>tial share of <strong>in</strong>stitutional <strong>timberl<strong>an</strong>d</strong><strong><strong>in</strong>vestments</strong> <strong>in</strong> the United States. 24However, there are four limitations to the NCREIF Timberl<strong>an</strong>d Index 25 :1. The number of contribut<strong>in</strong>g TIMOs has historically been limited <strong>an</strong>d currentlythe <strong>in</strong>dex has eight contribut<strong>in</strong>g members.2. The <strong>in</strong>dex series only dates back to 1987, which is a relatively short period. Thiswill be of less concern over time as more years are added.———————————————————————————————22B<strong>in</strong>kley et al., 199623H<strong>an</strong>cock Timber Resource Group, 2003b24NCREIF, 2008; <strong>an</strong>d Washburn, 200325Lutz, 1999