timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

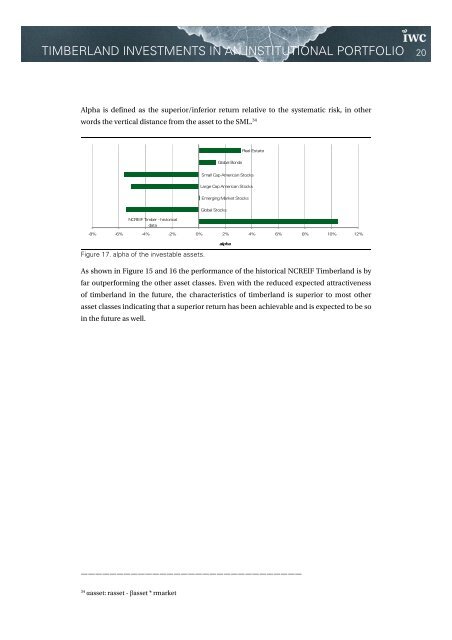

TIMBERLAND INVESTMENTS IN AN INSTITUTIONAL PORTFOLIO 20Alpha is def<strong>in</strong>ed as the superior/<strong>in</strong>ferior return relative to the systematic risk, <strong>in</strong> otherwords the vertical dist<strong>an</strong>ce from the asset to the SML. 34Real EstateGlobal BondsSmall Cap Americ<strong>an</strong> StocksLarge Cap Americ<strong>an</strong> StocksEmerg<strong>in</strong>g Market StocksGlobal StocksNCREIF Timber - historicaldata-8% -6% -4% -2% 0% 2% 4% 6% 8% 10% 12%Figure 17. alpha of the <strong>in</strong>vestable assets.alphaAs shown <strong>in</strong> Figure 15 <strong>an</strong>d 16 the perform<strong>an</strong>ce of the historical NCREIF Timberl<strong>an</strong>d is byfar outperform<strong>in</strong>g the other asset classes. Even with the reduced expected attractivenessof <strong>timberl<strong>an</strong>d</strong> <strong>in</strong> the future, the characteristics of <strong>timberl<strong>an</strong>d</strong> is superior to most otherasset classes <strong>in</strong>dicat<strong>in</strong>g that a superior return has been achievable <strong>an</strong>d is expected to be so<strong>in</strong> the future as well.———————————————————————————————34αasset: rasset - βasset * rmarket