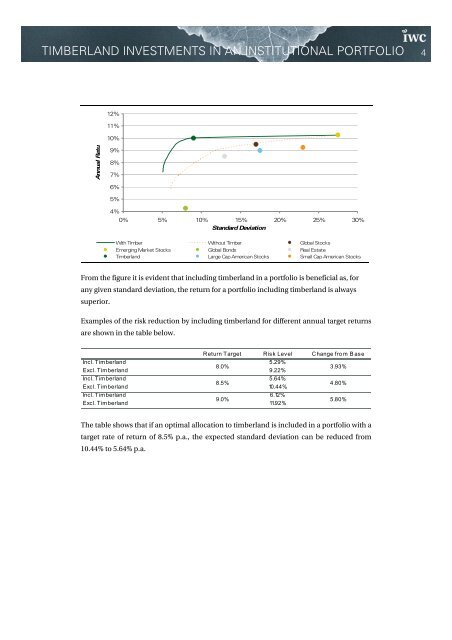

TIMBERLAND INVESTMENTS IN AN INSTITUTIONAL PORTFOLIO 412%11%10%Annual Retur9%8%7%6%5%4%0% 5% 10% 15% 20% 25% 30%St<strong>an</strong>dard DeviationWith Timber Without Timber Global StocksEmerg<strong>in</strong>g Market Stocks Global Bonds Real EstateTimberl<strong>an</strong>d Large Cap Americ<strong>an</strong> Stocks Small Cap Americ<strong>an</strong> StocksFrom the figure it is evident that <strong>in</strong>clud<strong>in</strong>g <strong>timberl<strong>an</strong>d</strong> <strong>in</strong> a <strong>portfolio</strong> is beneficial as, for<strong>an</strong>y given st<strong>an</strong>dard deviation, the return for a <strong>portfolio</strong> <strong>in</strong>clud<strong>in</strong>g <strong>timberl<strong>an</strong>d</strong> is alwayssuperior.Examples of the risk reduction by <strong>in</strong>clud<strong>in</strong>g <strong>timberl<strong>an</strong>d</strong> for different <strong>an</strong>nual target returnsare shown <strong>in</strong> the table below.Return Target Risk Level Ch<strong>an</strong>ge from B aseIncl. Timberl<strong>an</strong>d 5.29%8.0%Excl. Timberl<strong>an</strong>d 9.22%3.93%Incl. Timberl<strong>an</strong>d 5.64%8.5%Excl. Timberl<strong>an</strong>d 10.44%4.80%Incl. Timberl<strong>an</strong>d 6.12%9.0%Excl. Timberl<strong>an</strong>d 11.92%5.80%The table shows that if <strong>an</strong> optimal allocation to <strong>timberl<strong>an</strong>d</strong> is <strong>in</strong>cluded <strong>in</strong> a <strong>portfolio</strong> with atarget rate of return of 8.5% p.a., the expected st<strong>an</strong>dard deviation c<strong>an</strong> be reduced from10.44% to 5.64% p.a.

TIMBERLAND INVESTMENTS IN AN INSTITUTIONAL PORTFOLIO 51 IntroductionInstitutional <strong><strong>in</strong>vestments</strong> <strong>in</strong> <strong>timberl<strong>an</strong>d</strong> emerged <strong>in</strong> the USA <strong>in</strong> the early 1980s. Previously,<strong>in</strong>stitutional ownership of <strong>timberl<strong>an</strong>d</strong> was limited to <strong><strong>in</strong>vestments</strong> <strong>in</strong> timber productcomp<strong>an</strong>ies, which <strong>in</strong> turn owned <strong>timberl<strong>an</strong>d</strong> to ensure the supply of primary resources.As opposed to <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> timber product comp<strong>an</strong>ies, ownership of <strong>timberl<strong>an</strong>d</strong> provides<strong>in</strong>vestors with attractive perform<strong>an</strong>ce characteristics.Follow<strong>in</strong>g the establishment of the first US-based <strong>timberl<strong>an</strong>d</strong> <strong>in</strong>vestment m<strong>an</strong>agementorg<strong>an</strong>ization (TIMO) <strong>in</strong> 1981, <strong>in</strong>stitutional <strong>timberl<strong>an</strong>d</strong> <strong><strong>in</strong>vestments</strong> have grownsignific<strong>an</strong>tly. Accord<strong>in</strong>g to AMEC Forest Industry Consult<strong>in</strong>g the <strong><strong>in</strong>vestments</strong> have grownfrom less th<strong>an</strong> USD 1 billion <strong>in</strong> 1990 to more th<strong>an</strong> USD 30 billion <strong>in</strong> 2006 1 , whereas DANALimited has estimated that <strong>in</strong>stitutional <strong>in</strong>vestors have <strong>in</strong>vested a total of approximatelyUSD 50 billion as of early 2008. 2 In July 2006, Mercer estimated that the global <strong>in</strong>vestablecommercial <strong>timberl<strong>an</strong>d</strong> exceeded USD 300 billion, of which <strong>timberl<strong>an</strong>d</strong> <strong>in</strong> the USaccounted for more th<strong>an</strong> USD 200 billion 3 . IWC’s own study shows that the <strong>in</strong>vestable <strong>an</strong>dleasable forestl<strong>an</strong>d worldwide is valued at nearly USD 480 billion 4 .Much literature has been published s<strong>in</strong>ce the 1980s on the subject of the benefits derivedfrom <strong>in</strong>clud<strong>in</strong>g <strong>timberl<strong>an</strong>d</strong> <strong>in</strong> <strong>an</strong> <strong>in</strong>stitutional <strong>in</strong>vestment <strong>portfolio</strong>. Most of this literatureis based on US <strong>in</strong>stitutional <strong>in</strong>vestment conditions. 5In Europe, IWC has pioneered <strong>in</strong>stitutional <strong>timberl<strong>an</strong>d</strong> <strong><strong>in</strong>vestments</strong> s<strong>in</strong>ce itsestablishment <strong>in</strong> 1991. Particularly s<strong>in</strong>ce the late 1990s, IWC has seen grow<strong>in</strong>g <strong>in</strong>terestamong Europe<strong>an</strong> <strong>in</strong>stitutional <strong>in</strong>vestors <strong>in</strong> <strong>in</strong>ternational <strong>timberl<strong>an</strong>d</strong> <strong><strong>in</strong>vestments</strong>.This paper describes the general <strong>timberl<strong>an</strong>d</strong> return characteristics <strong>an</strong>d the diversificationopportunities offered by <strong>in</strong>clud<strong>in</strong>g <strong>timberl<strong>an</strong>d</strong> <strong>in</strong> a Europe<strong>an</strong> <strong>in</strong>stitutional <strong>in</strong>vestment<strong>portfolio</strong>.———————————————————————————————1Merril Lynch, 20072Neilson, 20083Mercer, 20064IWC. Global Forestl<strong>an</strong>d Investment Study, 20055Among others: Akers, 2000; B<strong>in</strong>kley et al., 1996; Caulfield, 1998a; Caulfield <strong>an</strong>d Newm<strong>an</strong>, 1999;Conroy <strong>an</strong>d Miles, 1989; H<strong>an</strong>cock Timber Resource Group, 2003a; Redmond <strong>an</strong>d Cubbage, 1988;Re<strong>in</strong>hart, 1985, Z<strong>in</strong>kh<strong>an</strong>, 1990; <strong>an</strong>d Z<strong>in</strong>kh<strong>an</strong> et al., 1992.