timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

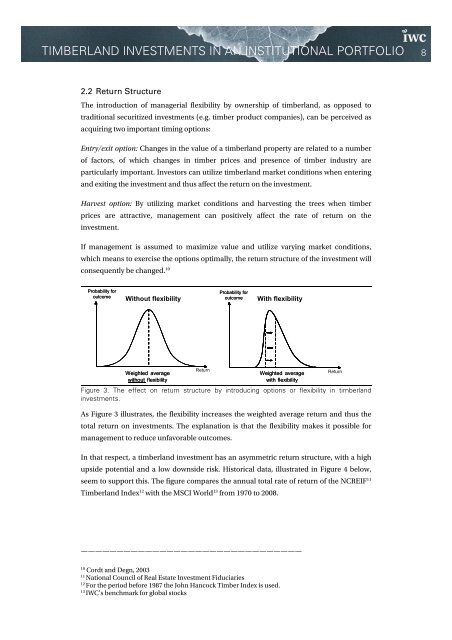

TIMBERLAND INVESTMENTS IN AN INSTITUTIONAL PORTFOLIO 82.2 Return StructureThe <strong>in</strong>troduction of m<strong>an</strong>agerial flexibility by ownership of <strong>timberl<strong>an</strong>d</strong>, as opposed totraditional securitized <strong><strong>in</strong>vestments</strong> (e.g. timber product comp<strong>an</strong>ies), c<strong>an</strong> be perceived asacquir<strong>in</strong>g two import<strong>an</strong>t tim<strong>in</strong>g options:Entry/exit option: Ch<strong>an</strong>ges <strong>in</strong> the value of a <strong>timberl<strong>an</strong>d</strong> property are related to a numberof factors, of which ch<strong>an</strong>ges <strong>in</strong> timber prices <strong>an</strong>d presence of timber <strong>in</strong>dustry areparticularly import<strong>an</strong>t. Investors c<strong>an</strong> utilize <strong>timberl<strong>an</strong>d</strong> market conditions when enter<strong>in</strong>g<strong>an</strong>d exit<strong>in</strong>g the <strong>in</strong>vestment <strong>an</strong>d thus affect the return on the <strong>in</strong>vestment.Harvest option: By utiliz<strong>in</strong>g market conditions <strong>an</strong>d harvest<strong>in</strong>g the trees when timberprices are attractive, m<strong>an</strong>agement c<strong>an</strong> positively affect the rate of return on the<strong>in</strong>vestment.If m<strong>an</strong>agement is assumed to maximize value <strong>an</strong>d utilize vary<strong>in</strong>g market conditions,which me<strong>an</strong>s to exercise the options optimally, the return structure of the <strong>in</strong>vestment willconsequently be ch<strong>an</strong>ged. 10Probability foroutcomeWithout flexibilityProbability foroutcomeWith flexibilityWeighted averagewithout flexibilityReturnWeighted averagewith flexibilityReturnFigure 3. The effect on return structure by <strong>in</strong>troduc<strong>in</strong>g options or flexibility <strong>in</strong> <strong>timberl<strong>an</strong>d</strong><strong><strong>in</strong>vestments</strong>.As Figure 3 illustrates, the flexibility <strong>in</strong>creases the weighted average return <strong>an</strong>d thus thetotal return on <strong><strong>in</strong>vestments</strong>. The expl<strong>an</strong>ation is that the flexibility makes it possible form<strong>an</strong>agement to reduce unfavorable outcomes.In that respect, a <strong>timberl<strong>an</strong>d</strong> <strong>in</strong>vestment has <strong>an</strong> asymmetric return structure, with a highupside potential <strong>an</strong>d a low downside risk. Historical data, illustrated <strong>in</strong> Figure 4 below,seem to support this. The figure compares the <strong>an</strong>nual total rate of return of the NCREIF 11Timberl<strong>an</strong>d Index 12 with the MSCI World 13 from 1970 to 2008.———————————————————————————————10Cordt <strong>an</strong>d Degn, 200311National Council of Real Estate Investment Fiduciaries12For the period before 1987 the John H<strong>an</strong>cock Timber Index is used.13IWC’s benchmark for global stocks