timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

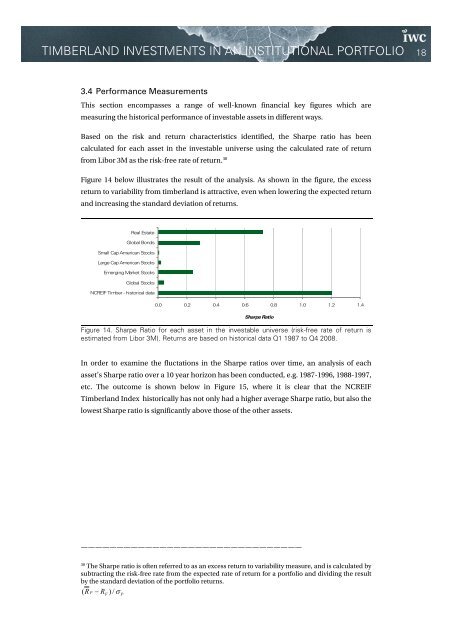

TIMBERLAND INVESTMENTS IN AN INSTITUTIONAL PORTFOLIO 183.4 Perform<strong>an</strong>ce MeasurementsThis section encompasses a r<strong>an</strong>ge of well-known f<strong>in</strong><strong>an</strong>cial key figures which aremeasur<strong>in</strong>g the historical perform<strong>an</strong>ce of <strong>in</strong>vestable assets <strong>in</strong> different ways.Based on the risk <strong>an</strong>d return characteristics identified, the Sharpe ratio has beencalculated for each asset <strong>in</strong> the <strong>in</strong>vestable universe us<strong>in</strong>g the calculated rate of returnfrom Libor 3M as the risk-free rate of return. 30Figure 14 below illustrates the result of the <strong>an</strong>alysis. As shown <strong>in</strong> the figure, the excessreturn to variability from <strong>timberl<strong>an</strong>d</strong> is attractive, even when lower<strong>in</strong>g the expected return<strong>an</strong>d <strong>in</strong>creas<strong>in</strong>g the st<strong>an</strong>dard deviation of returns.Real EstateGlobal BondsSmall Cap Americ<strong>an</strong> StocksLarge Cap Americ<strong>an</strong> StocksEmerg<strong>in</strong>g Market StocksGlobal StocksNCREIF Timber - historical data0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4Sharpe RatioFigure 14. Sharpe Ratio for each asset <strong>in</strong> the <strong>in</strong>vestable universe (risk-free rate of return isestimated from Libor 3M). Returns are based on historical data Q1 1987 to Q4 2008.In order to exam<strong>in</strong>e the fluctations <strong>in</strong> the Sharpe ratios over time, <strong>an</strong> <strong>an</strong>alysis of eachasset’s Sharpe ratio over a 10 year horizon has been conducted, e.g. 1987-1996, 1988-1997,etc. The outcome is shown below <strong>in</strong> Figure 15, where it is clear that the NCREIFTimberl<strong>an</strong>d Index historically has not only had a higher average Sharpe ratio, but also thelowest Sharpe ratio is signific<strong>an</strong>tly above those of the other assets.———————————————————————————————30The Sharpe ratio is often referred to as <strong>an</strong> excess return to variability measure, <strong>an</strong>d is calculated bysubtract<strong>in</strong>g the risk-free rate from the expected rate of return for a <strong>portfolio</strong> <strong>an</strong>d divid<strong>in</strong>g the resultby the st<strong>an</strong>dard deviation of the <strong>portfolio</strong> returns.( R − ) / σP R FP