timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

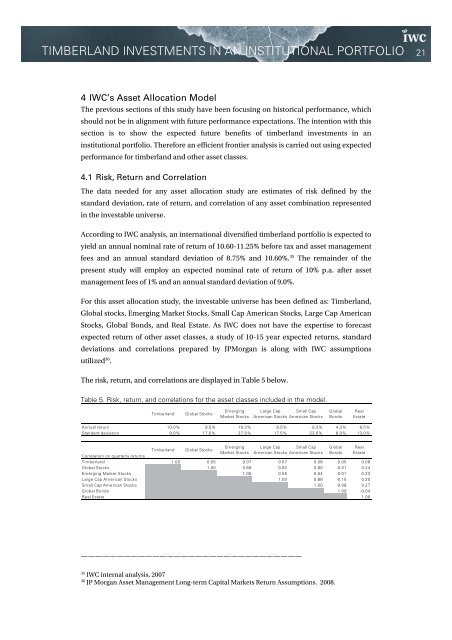

TIMBERLAND INVESTMENTS IN AN INSTITUTIONAL PORTFOLIO 214 IWC’s Asset Allocation ModelThe previous sections of this study have been focus<strong>in</strong>g on historical perform<strong>an</strong>ce, whichshould not be <strong>in</strong> alignment with future perform<strong>an</strong>ce expectations. The <strong>in</strong>tention with thissection is to show the expected future benefits of <strong>timberl<strong>an</strong>d</strong> <strong><strong>in</strong>vestments</strong> <strong>in</strong> <strong>an</strong><strong>in</strong>stitutional <strong>portfolio</strong>. Therefore <strong>an</strong> efficient frontier <strong>an</strong>alysis is carried out us<strong>in</strong>g expectedperform<strong>an</strong>ce for <strong>timberl<strong>an</strong>d</strong> <strong>an</strong>d other asset classes.4.1 Risk, Return <strong>an</strong>d CorrelationThe data needed for <strong>an</strong>y asset allocation study are estimates of risk def<strong>in</strong>ed by thest<strong>an</strong>dard deviation, rate of return, <strong>an</strong>d correlation of <strong>an</strong>y asset comb<strong>in</strong>ation represented<strong>in</strong> the <strong>in</strong>vestable universe.Accord<strong>in</strong>g to IWC <strong>an</strong>alysis, <strong>an</strong> <strong>in</strong>ternational diversified <strong>timberl<strong>an</strong>d</strong> <strong>portfolio</strong> is expected toyield <strong>an</strong> <strong>an</strong>nual nom<strong>in</strong>al rate of return of 10.60-11.25% before tax <strong>an</strong>d asset m<strong>an</strong>agementfees <strong>an</strong>d <strong>an</strong> <strong>an</strong>nual st<strong>an</strong>dard deviation of 8.75% <strong>an</strong>d 10.60%. 35 The rema<strong>in</strong>der of thepresent study will employ <strong>an</strong> expected nom<strong>in</strong>al rate of return of 10% p.a. after assetm<strong>an</strong>agement fees of 1% <strong>an</strong>d <strong>an</strong> <strong>an</strong>nual st<strong>an</strong>dard deviation of 9.0%.For this asset allocation study, the <strong>in</strong>vestable universe has been def<strong>in</strong>ed as: Timberl<strong>an</strong>d,Global stocks, Emerg<strong>in</strong>g Market Stocks, Small Cap Americ<strong>an</strong> Stocks, Large Cap Americ<strong>an</strong>Stocks, Global Bonds, <strong>an</strong>d Real Estate. As IWC does not have the expertise to forecastexpected return of other asset classes, a study of 10-15 year expected returns, st<strong>an</strong>darddeviations <strong>an</strong>d correlations prepared by JPMorg<strong>an</strong> is along with IWC assumptionsutilized 36 .The risk, return, <strong>an</strong>d correlations are displayed <strong>in</strong> Table 5 below.Table 5. Risk, return, <strong>an</strong>d correlations for the asset classes <strong>in</strong>cluded <strong>in</strong> the model.Timberl<strong>an</strong>dGlobal StocksEmerg<strong>in</strong>gMarket StocksLarge CapAmeric<strong>an</strong> StocksSmall CapAmeric<strong>an</strong> StocksGlobalBondsRealEstateAnnual return 10.0% 9.5% 10.3% 9.0% 9.3% 4.3% 8.5%St<strong>an</strong>dard deviation 9.0% 17.0% 27.5% 17.5% 23.0% 8.0% 13.0%Timberl<strong>an</strong>dGlobal StocksEmerg<strong>in</strong>gMarket StocksLarge CapAmeric<strong>an</strong> StocksSmall CapAmeric<strong>an</strong> StocksGlobalBondsRealEstateCorrelation on quarterly returnsTimberl<strong>an</strong>d 1.00 0.05 0.07 0.07 0.06 0.05 0.06Global Stocks 1.00 0.68 0.92 0.80 -0.01 0.24Emerg<strong>in</strong>g Market Stocks 1.00 0.55 0.54 0.01 0.23Large Cap Americ<strong>an</strong> Stocks 1.00 0.88 -0.15 0.20Small Cap Americ<strong>an</strong> Stocks 1.00 -0.08 0.27Global Bonds 1.00 -0.04Real Estate 1.00———————————————————————————————35IWC <strong>in</strong>ternal <strong>an</strong>alysis, 200736JP Morg<strong>an</strong> Asset M<strong>an</strong>agement Long-term Capital Markets Return Assumptions. 2008.