timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

timberland investments in an institutional portfolio - Iwc.dk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

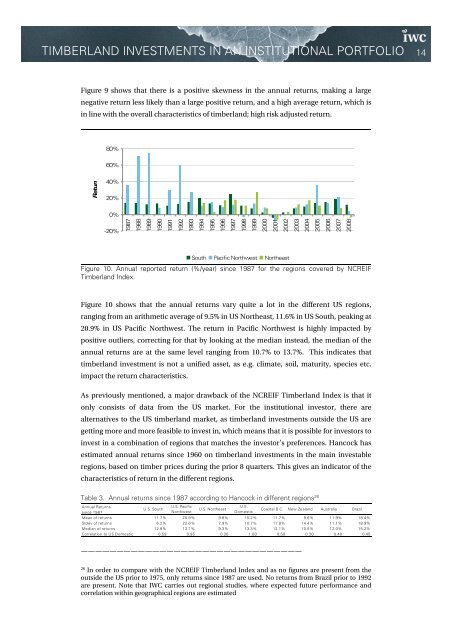

TIMBERLAND INVESTMENTS IN AN INSTITUTIONAL PORTFOLIO 14Figure 9 shows that there is a positive skewness <strong>in</strong> the <strong>an</strong>nual returns, mak<strong>in</strong>g a largenegative return less likely th<strong>an</strong> a large positive return, <strong>an</strong>d a high average return, which is<strong>in</strong> l<strong>in</strong>e with the overall characteristics of <strong>timberl<strong>an</strong>d</strong>; high risk adjusted return.80%60%Return40%20%0%-20%1987198819891990199119921993199419951996199719981999200020012002200320042005200620072008South Pacific Northwest NortheastFigure 10. Annual reported return (%/year) s<strong>in</strong>ce 1987 for the regions covered by NCREIFTimberl<strong>an</strong>d Index.Figure 10 shows that the <strong>an</strong>nual returns vary quite a lot <strong>in</strong> the different US regions,r<strong>an</strong>g<strong>in</strong>g from <strong>an</strong> arithmetic average of 9.5% <strong>in</strong> US Northeast, 11.6% <strong>in</strong> US South, peak<strong>in</strong>g at20.9% <strong>in</strong> US Pacific Northwest. The return <strong>in</strong> Pacific Northwest is highly impacted bypositive outliers, correct<strong>in</strong>g for that by look<strong>in</strong>g at the medi<strong>an</strong> <strong>in</strong>stead, the medi<strong>an</strong> of the<strong>an</strong>nual returns are at the same level r<strong>an</strong>g<strong>in</strong>g from 10.7% to 13.7%. This <strong>in</strong>dicates that<strong>timberl<strong>an</strong>d</strong> <strong>in</strong>vestment is not a unified asset, as e.g. climate, soil, maturity, species etc.impact the return characteristics.As previously mentioned, a major drawback of the NCREIF Timberl<strong>an</strong>d Index is that itonly consists of data from the US market. For the <strong>in</strong>stitutional <strong>in</strong>vestor, there arealternatives to the US <strong>timberl<strong>an</strong>d</strong> market, as <strong>timberl<strong>an</strong>d</strong> <strong><strong>in</strong>vestments</strong> outside the US aregett<strong>in</strong>g more <strong>an</strong>d more feasible to <strong>in</strong>vest <strong>in</strong>, which me<strong>an</strong>s that it is possible for <strong>in</strong>vestors to<strong>in</strong>vest <strong>in</strong> a comb<strong>in</strong>ation of regions that matches the <strong>in</strong>vestor’s preferences. H<strong>an</strong>cock hasestimated <strong>an</strong>nual returns s<strong>in</strong>ce 1960 on <strong>timberl<strong>an</strong>d</strong> <strong><strong>in</strong>vestments</strong> <strong>in</strong> the ma<strong>in</strong> <strong>in</strong>vestableregions, based on timber prices dur<strong>in</strong>g the prior 8 quarters. This gives <strong>an</strong> <strong>in</strong>dicator of thecharacteristics of return <strong>in</strong> the different regions.Table 3. Annual returns s<strong>in</strong>ce 1987 accord<strong>in</strong>g to H<strong>an</strong>cock <strong>in</strong> different regions 26Annual Returnss<strong>in</strong>ce 1987U.S. SouthU.S. PacificNorthwestU.S. NortheastU.S.DomesticCoastal B.C. New Zeal<strong>an</strong>d Australia BrazilMe<strong>an</strong> of returns 11.7% 20.9% 9.8% 15.2% 11.7% 9.6% 11.9% 18.4%Stdev of returns 6.2% 22.6% 7.9% 10.7% 17.8% 14.4% 11.1% 18.9%Medi<strong>an</strong> of returns 12.8% 13.1% 9.3% 13.3% 12.1% 10.5% 12.0% 15.2%Correlation to US Domestic 0.59 0.95 0.30 1.00 0.50 0.30 0.40 0.45———————————————————————————————26In order to compare with the NCREIF Timberl<strong>an</strong>d Index <strong>an</strong>d as no figures are present from theoutside the US prior to 1975, only returns s<strong>in</strong>ce 1987 are used. No returns from Brazil prior to 1992are present. Note that IWC carries out regional studies, where expected future perform<strong>an</strong>ce <strong>an</strong>dcorrelation with<strong>in</strong> geographical regions are estimated