Orientation guide for newcomers to New Brunswick - Government of ...

Orientation guide for newcomers to New Brunswick - Government of ...

Orientation guide for newcomers to New Brunswick - Government of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

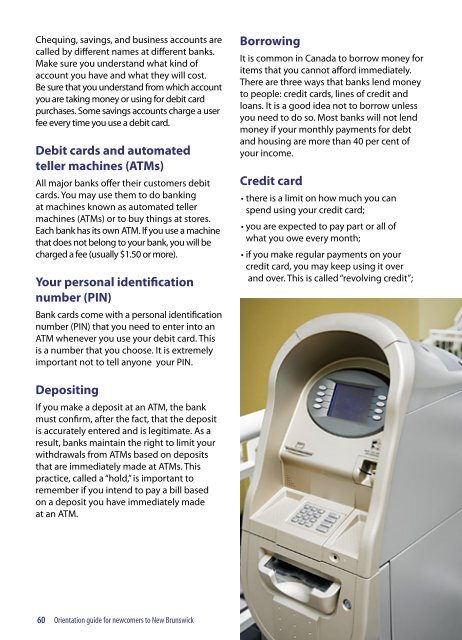

Chequing, savings, and business accounts arecalled by different names at different banks.Make sure you understand what kind <strong>of</strong>account you have and what they will cost.Be sure that you understand from which accountyou are taking money or using <strong>for</strong> debit cardpurchases. Some savings accounts charge a userfee every time you use a debit card.Debit cards and au<strong>to</strong>matedteller machines (ATMs)All major banks <strong>of</strong>fer their cus<strong>to</strong>mers debitcards. You may use them <strong>to</strong> do bankingat machines known as au<strong>to</strong>mated tellermachines (ATMs) or <strong>to</strong> buy things at s<strong>to</strong>res.Each bank has its own ATM. If you use a machinethat does not belong <strong>to</strong> your bank, you will becharged a fee (usually $1.50 or more).Your personal identificationnumber (PIN)Bank cards come with a personal identificationnumber (PIN) that you need <strong>to</strong> enter in<strong>to</strong> anATM whenever you use your debit card. Thisis a number that you choose. It is extremelyimportant not <strong>to</strong> tell anyone your PIN.BorrowingIt is common in Canada <strong>to</strong> borrow money <strong>for</strong>items that you cannot af<strong>for</strong>d immediately.There are three ways that banks lend money<strong>to</strong> people: credit cards, lines <strong>of</strong> credit andloans. It is a good idea not <strong>to</strong> borrow unlessyou need <strong>to</strong> do so. Most banks will not lendmoney if your monthly payments <strong>for</strong> debtand housing are more than 40 per cent <strong>of</strong>your income.Credit card• there is a limit on how much you canspend using your credit card;• you are expected <strong>to</strong> pay part or all <strong>of</strong>what you owe every month;• if you make regular payments on yourcredit card, you may keep using it overand over. This is called “revolving credit”;DepositingIf you make a deposit at an ATM, the bankmust confirm, after the fact, that the depositis accurately entered and is legitimate. As aresult, banks maintain the right <strong>to</strong> limit yourwithdrawals from ATMs based on depositsthat are immediately made at ATMs. Thispractice, called a “hold,” is important <strong>to</strong>remember if you intend <strong>to</strong> pay a bill basedon a deposit you have immediately madeat an ATM.60<strong>Orientation</strong> <strong>guide</strong> <strong>for</strong> <strong>newcomers</strong> <strong>to</strong> <strong>New</strong> <strong>Brunswick</strong>