Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

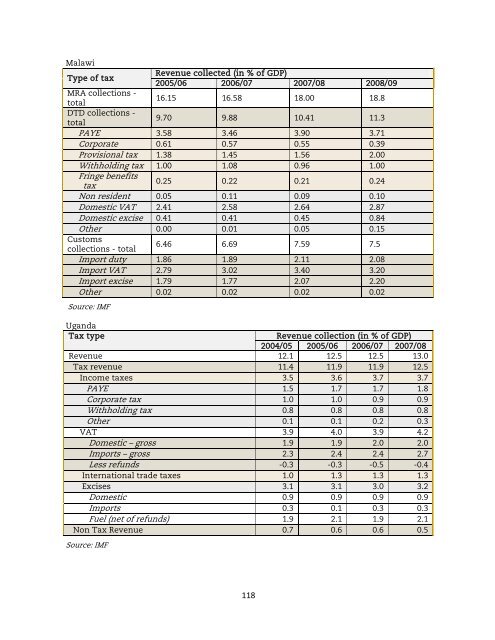

MalawiType of tax<strong>Revenue</strong> collected (<strong>in</strong> % of GDP)2005/06 2006/07 2007/08 2008/09MRA collections -total16.15 16.58 18.00 18.8DTD collections -total9.70 9.88 10.41 11.3PAYE 3.58 3.46 3.90 3.71Corporate 0.61 0.57 0.55 0.39Provisional tax 1.38 1.45 1.56 2.00Withhold<strong>in</strong>g tax 1.00 1.08 0.96 1.00Fr<strong>in</strong>ge benefitstax0.25 0.22 0.21 0.24Non resident 0.05 0.11 0.09 0.10Domestic VAT 2.41 2.58 2.64 2.87Domestic excise 0.41 0.41 0.45 0.84Other 0.00 0.01 0.05 0.15Customscollections - total6.46 6.69 7.59 7.5Import duty 1.86 1.89 2.11 2.08Import VAT 2.79 3.02 3.40 3.20Import excise 1.79 1.77 2.07 2.20Other 0.02 0.02 0.02 0.02Source: IMFUganda<strong>Tax</strong> type<strong>Revenue</strong> collection (<strong>in</strong> % of GDP)2004/05 2005/06 2006/07 2007/08<strong>Revenue</strong> 12.1 12.5 12.5 13.0<strong>Tax</strong> revenue 11.4 11.9 11.9 12.5Income taxes 3.5 3.6 3.7 3.7PAYE 1.5 1.7 1.7 1.8Corporate tax 1.0 1.0 0.9 0.9Withhold<strong>in</strong>g tax 0.8 0.8 0.8 0.8Other 0.1 0.1 0.2 0.3VAT 3.9 4.0 3.9 4.2Domestic – gross 1.9 1.9 2.0 2.0Imports – gross 2.3 2.4 2.4 2.7Less refunds -0.3 -0.3 -0.5 -0.4<strong>International</strong> trade taxes 1.0 1.3 1.3 1.3Excises 3.1 3.1 3.0 3.2Domestic 0.9 0.9 0.9 0.9Imports 0.3 0.1 0.3 0.3Fuel (net of refunds) 1.9 2.1 1.9 2.1Non <strong>Tax</strong> <strong>Revenue</strong> 0.7 0.6 0.6 0.5Source: IMF118