Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

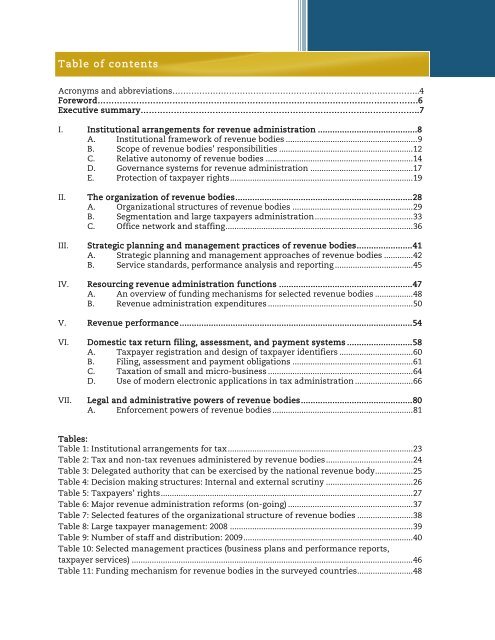

Table of contentsAcronyms and abbreviations………………………………………………………………………………..4Foreword………………………………………………………………………….………………………….6Executive summary………………………………………………………………………………………..7I. Institutional arrangements for revenue adm<strong>in</strong>istration ......................................... 8A. Institutional framework of revenue bodies ........................................................... 9B. Scope of revenue bodies’ responsibilities ............................................................ 12C. Relative autonomy of revenue bodies .................................................................. 14D. Governance systems for revenue adm<strong>in</strong>istration .............................................. 17E. Protection of taxpayer rights .................................................................................. 19II. The organization of revenue bodies ......................................................................... 28A. Organizational structures of revenue bodies ...................................................... 29B. Segmentation and large taxpayers adm<strong>in</strong>istration ............................................ 33C. Office network and staff<strong>in</strong>g .................................................................................... 36III. Strategic plann<strong>in</strong>g and management practices of revenue bodies ....................... 41A. Strategic plann<strong>in</strong>g and management approaches of revenue bodies ............. 42B. Service standards, performance analysis and report<strong>in</strong>g ................................... 45IV. Resourc<strong>in</strong>g revenue adm<strong>in</strong>istration functions ....................................................... 47A. An overview of fund<strong>in</strong>g mechanisms for selected revenue bodies ................. 48B. <strong>Revenue</strong> adm<strong>in</strong>istration expenditures ................................................................. 50V. <strong>Revenue</strong> performance ................................................................................................ 54VI. Domestic tax return fil<strong>in</strong>g, assessment, and payment systems ........................... 58A. <strong>Tax</strong>payer registration and design of taxpayer identifiers ................................. 60B. Fil<strong>in</strong>g, assessment and payment obligations ...................................................... 61C. <strong>Tax</strong>ation of small and micro-bus<strong>in</strong>ess ................................................................. 64D. Use of modern electronic applications <strong>in</strong> tax adm<strong>in</strong>istration .......................... 66VII. Legal and adm<strong>in</strong>istrative powers of revenue bodies .............................................. 80A. Enforcement powers of revenue bodies ............................................................... 81Tables:Table 1: Institutional arrangements for tax ................................................................................... 23Table 2: <strong>Tax</strong> and non-tax revenues adm<strong>in</strong>istered by revenue bodies ....................................... 24Table 3: Delegated authority that can be exercised by the national revenue body ................. 25Table 4: Decision mak<strong>in</strong>g structures: Internal and external scrut<strong>in</strong>y ....................................... 26Table 5: <strong>Tax</strong>payers’ rights ................................................................................................................. 27Table 6: Major revenue adm<strong>in</strong>istration reforms (on-go<strong>in</strong>g) ........................................................ 37Table 7: Selected features of the organizational structure of revenue bodies ......................... 38Table 8: Large taxpayer management: 2008 .................................................................................. 39Table 9: Number of staff and distribution: 2009 ............................................................................ 40Table 10: Selected management practices (bus<strong>in</strong>ess plans and performance reports,taxpayer services) .............................................................................................................................. 46Table 11: Fund<strong>in</strong>g mechanism for revenue bodies <strong>in</strong> the surveyed countries ......................... 48