Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

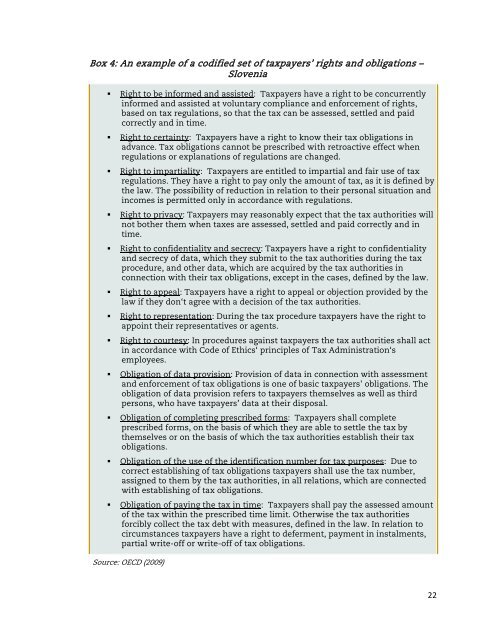

Box 4: An example of a codified set of taxpayers’ rights and obligations –Slovenia• Right to be <strong>in</strong>formed and assisted: <strong>Tax</strong>payers have a right to be concurrently<strong>in</strong>formed and assisted at voluntary compliance and enforcement of rights,based on tax regulations, so that the tax can be assessed, settled and paidcorrectly and <strong>in</strong> time.• Right to certa<strong>in</strong>ty: <strong>Tax</strong>payers have a right to know their tax obligations <strong>in</strong>advance. <strong>Tax</strong> obligations cannot be prescribed with retroactive effect whenregulations or explanations of regulations are changed.• Right to impartiality: <strong>Tax</strong>payers are entitled to impartial and fair use of taxregulations. They have a right to pay only the amount of tax, as it is def<strong>in</strong>ed bythe law. The possibility of reduction <strong>in</strong> relation to their personal situation and<strong>in</strong>comes is permitted only <strong>in</strong> accordance with regulations.• Right to privacy: <strong>Tax</strong>payers may reasonably expect that the tax authorities willnot bother them when taxes are assessed, settled and paid correctly and <strong>in</strong>time.• Right to confidentiality and secrecy: <strong>Tax</strong>payers have a right to confidentialityand secrecy of data, which they submit to the tax authorities dur<strong>in</strong>g the taxprocedure, and other data, which are acquired by the tax authorities <strong>in</strong>connection with their tax obligations, except <strong>in</strong> the cases, def<strong>in</strong>ed by the law.• Right to appeal: <strong>Tax</strong>payers have a right to appeal or objection provided by thelaw if they don‘t agree with a decision of the tax authorities.• Right to representation: Dur<strong>in</strong>g the tax procedure taxpayers have the right toappo<strong>in</strong>t their representatives or agents.• Right to courtesy: In procedures aga<strong>in</strong>st taxpayers the tax authorities shall act<strong>in</strong> accordance with Code of Ethics‘ pr<strong>in</strong>ciples of <strong>Tax</strong> <strong>Adm<strong>in</strong>istration</strong>‘semployees.• Obligation of data provision: Provision of data <strong>in</strong> connection with assessmentand enforcement of tax obligations is one of basic taxpayers' obligations. Theobligation of data provision refers to taxpayers themselves as well as thirdpersons, who have taxpayers’ data at their disposal.• Obligation of complet<strong>in</strong>g prescribed forms: <strong>Tax</strong>payers shall completeprescribed forms, on the basis of which they are able to settle the tax bythemselves or on the basis of which the tax authorities establish their taxobligations.• Obligation of the use of the identification number for tax purposes: Due tocorrect establish<strong>in</strong>g of tax obligations taxpayers shall use the tax number,assigned to them by the tax authorities, <strong>in</strong> all relations, which are connectedwith establish<strong>in</strong>g of tax obligations.• Obligation of pay<strong>in</strong>g the tax <strong>in</strong> time: <strong>Tax</strong>payers shall pay the assessed amountof the tax with<strong>in</strong> the prescribed time limit. Otherwise the tax authoritiesforcibly collect the tax debt with measures, def<strong>in</strong>ed <strong>in</strong> the law. In relation tocircumstances taxpayers have a right to deferment, payment <strong>in</strong> <strong>in</strong>stalments,partial write-off or write-off of tax obligations.Source: OECD (2009)22