Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

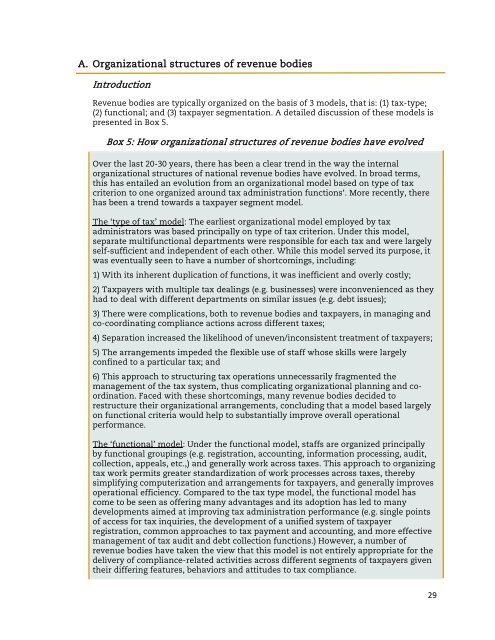

A. Organizational structures of revenue bodiesIntroduction<strong>Revenue</strong> bodies are typically organized on the basis of 3 models, that is: (1) tax-type;(2) functional; and (3) taxpayer segmentation. A detailed discussion of these models ispresented <strong>in</strong> Box 5.Box 5: How organizational structures of revenue bodies have evolvedOver the last 20-30 years, there has been a clear trend <strong>in</strong> the way the <strong>in</strong>ternalorganizational structures of national revenue bodies have evolved. In broad terms,this has entailed an evolution from an organizational model based on type of taxcriterion to one organized around tax adm<strong>in</strong>istration functions‘. More recently, therehas been a trend towards a taxpayer segment model.The ‘type of tax’ model: The earliest organizational model employed by taxadm<strong>in</strong>istrators was based pr<strong>in</strong>cipally on type of tax criterion. Under this model,separate multifunctional departments were responsible for each tax and were largelyself-sufficient and <strong>in</strong>dependent of each other. While this model served its purpose, itwas eventually seen to have a number of shortcom<strong>in</strong>gs, <strong>in</strong>clud<strong>in</strong>g:1) With its <strong>in</strong>herent duplication of functions, it was <strong>in</strong>efficient and overly costly;2) <strong>Tax</strong>payers with multiple tax deal<strong>in</strong>gs (e.g. bus<strong>in</strong>esses) were <strong>in</strong>convenienced as theyhad to deal with different departments on similar issues (e.g. debt issues);3) There were complications, both to revenue bodies and taxpayers, <strong>in</strong> manag<strong>in</strong>g andco-coord<strong>in</strong>at<strong>in</strong>g compliance actions across different taxes;4) Separation <strong>in</strong>creased the likelihood of uneven/<strong>in</strong>consistent treatment of taxpayers;5) The arrangements impeded the flexible use of staff whose skills were largelyconf<strong>in</strong>ed to a particular tax; and6) This approach to structur<strong>in</strong>g tax operations unnecessarily fragmented themanagement of the tax system, thus complicat<strong>in</strong>g organizational plann<strong>in</strong>g and coord<strong>in</strong>ation.Faced with these shortcom<strong>in</strong>gs, many revenue bodies decided torestructure their organizational arrangements, conclud<strong>in</strong>g that a model based largelyon functional criteria would help to substantially improve overall operationalperformance.The ‘functional’ model: Under the functional model, staffs are organized pr<strong>in</strong>cipallyby functional group<strong>in</strong>gs (e.g. registration, account<strong>in</strong>g, <strong>in</strong>formation process<strong>in</strong>g, audit,collection, appeals, etc.,) and generally work across taxes. This approach to organiz<strong>in</strong>gtax work permits greater standardization of work processes across taxes, therebysimplify<strong>in</strong>g computerization and arrangements for taxpayers, and generally improvesoperational efficiency. Compared to the tax type model, the functional model hascome to be seen as offer<strong>in</strong>g many advantages and its adoption has led to manydevelopments aimed at improv<strong>in</strong>g tax adm<strong>in</strong>istration performance (e.g. s<strong>in</strong>gle po<strong>in</strong>tsof access for tax <strong>in</strong>quiries, the development of a unified system of taxpayerregistration, common approaches to tax payment and account<strong>in</strong>g, and more effectivemanagement of tax audit and debt collection functions.) However, a number ofrevenue bodies have taken the view that this model is not entirely appropriate for thedelivery of compliance-related activities across different segments of taxpayers giventheir differ<strong>in</strong>g features, behaviors and attitudes to tax compliance.29