Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

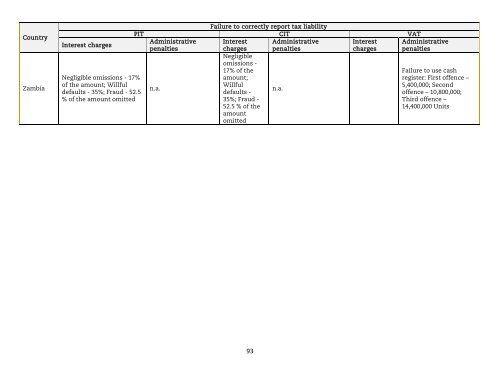

CountryZambiaInterest chargesNegligible omissions - 17%of the amount; Willfuldefaults - 35%; Fraud - 52.5% of the amount omittedFailure to correctly report tax liabilityPIT CIT VATAdm<strong>in</strong>istrative Interest Adm<strong>in</strong>istrativeInterestpenaltiescharges penaltieschargesNegligibleomissions -17% of theamount;n.a.Willfuldefaults -n.a.35%; Fraud -52.5 % of theamountomittedAdm<strong>in</strong>istrativepenaltiesFailure to use cashregister: First offence –5,400,000; Secondoffence – 10,800,000;Third offence –14,400,000 Units93