Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Revenue Administration in Sub-Saharan Africa - International Tax ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

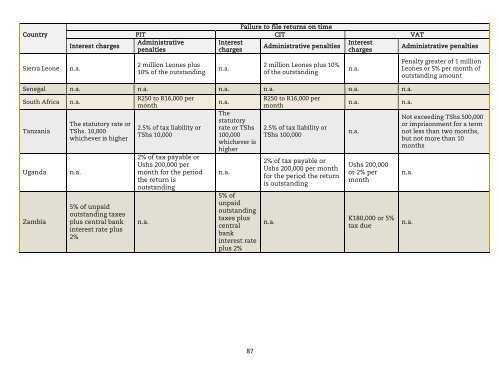

CountryInterest chargesFailure to file returns on timePIT CIT VATAdm<strong>in</strong>istrativeInterestInterestAdm<strong>in</strong>istrative penaltiespenaltieschargeschargesAdm<strong>in</strong>istrative penaltiesSierra Leonen.a.2 million Leones plus10% of the outstand<strong>in</strong>gn.a.2 million Leones plus 10%of the outstand<strong>in</strong>gn.a.Penalty greater of 1 millionLeones or 5% per month ofoutstand<strong>in</strong>g amountSenegal n.a. n.a. n.a. n.a. n.a. n.a.South <strong>Africa</strong>TanzaniaUgandaZambian.a.The statutory rate orTShs. 10,000whichever is highern.a.5% of unpaidoutstand<strong>in</strong>g taxesplus central bank<strong>in</strong>terest rate plus2%R250 to R16,000 permonth2.5% of tax liability orTShs 10,0002% of tax payable orUshs 200,000 permonth for the periodthe return isoutstand<strong>in</strong>gn.a.n.a.Thestatutoryrate or TShs100,000whichever ishighern.a.5% ofunpaidoutstand<strong>in</strong>gtaxes pluscentralbank<strong>in</strong>terest rateplus 2%R250 to R16,000 permonth2.5% of tax liability orTShs 100,0002% of tax payable orUshs 200,000 per monthfor the period the returnis outstand<strong>in</strong>gn.a.n.a.n.a.Ushs 200,000or 2% permonthK180,000 or 5%tax duen.a.Not exceed<strong>in</strong>g TShs.500,000or imprisonment for a termnot less than two months,but not more than 10monthsn.a.n.a.87