1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

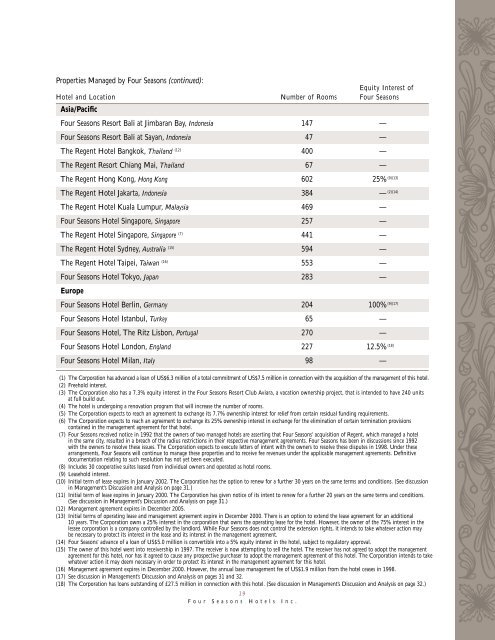

Properties Managed by <strong>Four</strong> <strong>Seasons</strong> (continued):Equity Interest ofHotel <strong>and</strong> Location Number of Rooms <strong>Four</strong> <strong>Seasons</strong>Asia/Pacific<strong>Four</strong> <strong>Seasons</strong> Resort Bali at Jimbaran Bay, Indonesia 147 —<strong>Four</strong> <strong>Seasons</strong> Resort Bali at Sayan, Indonesia 47 —The Regent Hotel Bangkok, Thail<strong>and</strong> (12) 400 —The Regent Resort Chiang Mai, Thail<strong>and</strong> 67 —The Regent Hong Kong, Hong Kong 602 25% (9)(13)The Regent Hotel Jakarta, Indonesia 384 — (2)(14)The Regent Hotel Kuala Lumpur, Malaysia 469 —<strong>Four</strong> <strong>Seasons</strong> Hotel Singapore, Singapore 257 —The Regent Hotel Singapore, Singapore (7) 441 —The Regent Hotel Sydney, Australia (15) 594 —The Regent Hotel Taipei, Taiwan (16) 553 —<strong>Four</strong> <strong>Seasons</strong> Hotel Tokyo, Japan 283 —Europe<strong>Four</strong> <strong>Seasons</strong> Hotel Berlin, Germany 204 100% (9)(17)<strong>Four</strong> <strong>Seasons</strong> Hotel Istanbul, Turkey 65 —<strong>Four</strong> <strong>Seasons</strong> Hotel, The Ritz Lisbon, Portugal 270 —<strong>Four</strong> <strong>Seasons</strong> Hotel London, Engl<strong>and</strong> 227 12.5% (18)<strong>Four</strong> <strong>Seasons</strong> Hotel Milan, Italy 98 —(1) The Corporation has advanced a loan of US$6.3 million of a total commitment of US$7.5 million in connection with the acquisition of the management of this hotel.(2) Freehold interest.(3) The Corporation also has a 7.3% equity interest in the <strong>Four</strong> <strong>Seasons</strong> Resort Club Aviara, a vacation ownership project, that is intended to have 240 unitsat full build out.(4) The hotel is undergoing a renovation program that will increase the number of rooms.(5) The Corporation expects to reach an agreement to exchange its 7.7% ownership interest for relief from certain residual funding requirements.(6) The Corporation expects to reach an agreement to exchange its 25% ownership interest in exchange for the elimination of certain termination provisionscontained in the management agreement for that hotel.(7) <strong>Four</strong> <strong>Seasons</strong> received notice in 1992 that the owners of two managed hotels are asserting that <strong>Four</strong> <strong>Seasons</strong>’ acquisition of Regent, which managed a hotelin the same city, resulted in a breach of the radius restrictions in their respective management agreements. <strong>Four</strong> <strong>Seasons</strong> has been in discussions since 1992with the owners to resolve these issues. The Corporation expects to execute letters of intent with the owners to resolve these disputes in 1998. Under thesearrangements, <strong>Four</strong> <strong>Seasons</strong> will continue to manage these properties <strong>and</strong> to receive fee revenues under the applicable management agreements. Definitivedocumentation relating to such resolution has not yet been executed.(8) Includes 30 cooperative suites leased from individual owners <strong>and</strong> operated as hotel rooms.(9) Leasehold interest.(10) Initial term of lease expires in January 2002. The Corporation has the option to renew for a further 30 years on the same terms <strong>and</strong> conditions. (See discussionin Management’s Discussion <strong>and</strong> Analysis on page 31.)(11) Initial term of lease expires in January 2000. The Corporation has given notice of its intent to renew for a further 20 years on the same terms <strong>and</strong> conditions.(See discussion in Management’s Discussion <strong>and</strong> Analysis on page 31.)(12) Management agreement expires in December 2005.(13) Initial terms of operating lease <strong>and</strong> management agreement expire in December 2000. There is an option to extend the lease agreement for an additional10 years. The Corporation owns a 25% interest in the corporation that owns the operating lease for the hotel. However, the owner of the 75% interest in thelessee corporation is a company controlled by the l<strong>and</strong>lord. While <strong>Four</strong> <strong>Seasons</strong> does not control the extension rights, it intends to take whatever action maybe necessary to protect its interest in the lease <strong>and</strong> its interest in the management agreement.(14) <strong>Four</strong> <strong>Seasons</strong>’ advance of a loan of US$5.0 million is convertible into a 5% equity interest in the hotel, subject to regulatory approval.(15) The owner of this hotel went into receivership in <strong>1997</strong>. The receiver is now attempting to sell the hotel. The receiver has not agreed to adopt the managementagreement for this hotel, nor has it agreed to cause any prospective purchaser to adopt the management agreement of this hotel. The Corporation intends to takewhatever action it may deem necessary in order to protect its interest in the management agreement for this hotel.(16) Management agreement expires in December 2000. However, the annual base management fee of US$1.9 million from the hotel ceases in 1998.(17) See discussion in Management’s Discussion <strong>and</strong> Analysis on pages 31 <strong>and</strong> 32.(18) The Corporation has loans outst<strong>and</strong>ing of £27.5 million in connection with this hotel. (See discussion in Management’s Discussion <strong>and</strong> Analysis on page 32.)19<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.