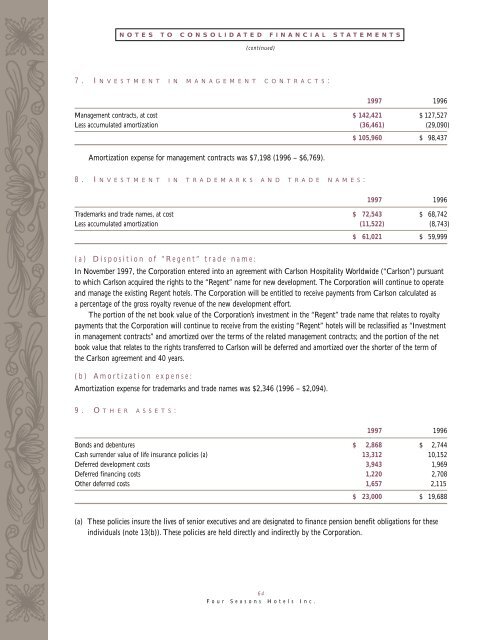

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(continued)7. I N V E S T M E N T I N M A N A G E M E N T C O N T R A C T S:<strong>1997</strong> 1996Management contracts, at cost $ 142,421 $ 127,527Less accumulated amortization (36,461) (29,090)Amortization expense for management contracts was $7,198 (1996 – $6,769).$ 105,960 $ 98,4378. I N V E S T M E N T I N T R A D E M A R K S A N D T R A D E N A M E S:<strong>1997</strong> 1996Trademarks <strong>and</strong> trade names, at cost $ 72,543 $ 68,742Less accumulated amortization (11,522) (8,743)$ 61,021 $ 59,999(a) Disposition of “Regent” trade name:In November <strong>1997</strong>, the Corporation entered into an agreement with Carlson Hospitality Worldwide (“Carlson”) pursuantto which Carlson acquired the rights to the “Regent” name for new development. The Corporation will continue to operate<strong>and</strong> manage the existing Regent hotels. The Corporation will be entitled to receive payments from Carlson calculated asa percentage of the gross royalty revenue of the new development effort.The portion of the net book value of the Corporation’s investment in the “Regent” trade name that relates to royaltypayments that the Corporation will continue to receive from the existing “Regent” hotels will be reclassified as “Investmentin management contracts” <strong>and</strong> amortized over the terms of the related management contracts; <strong>and</strong> the portion of the netbook value that relates to the rights transferred to Carlson will be deferred <strong>and</strong> amortized over the shorter of the term ofthe Carlson agreement <strong>and</strong> 40 years.(b) Amortization expense:Amortization expense for trademarks <strong>and</strong> trade names was $2,346 (1996 – $2,094).9. O T H E R A S S E T S:<strong>1997</strong> 1996Bonds <strong>and</strong> debentures $ 2,868 $ 2,744Cash surrender value of life insurance policies (a) 13,312 10,152Deferred development costs 3,943 1,969Deferred financing costs 1,220 2,708Other deferred costs 1,657 2,115$ 23,000 $ 19,688(a) These policies insure the lives of senior executives <strong>and</strong> are designated to finance pension benefit obligations for theseindividuals (note 13(b)). These policies are held directly <strong>and</strong> indirectly by the Corporation.64<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.

10. L O N G- T E R M D E B T:<strong>1997</strong> 1996Unsecured debentures (a) $ 100,000 $ —Unsecured notes (b) 8,598 147,383Bank credit facility (c) — 54,155Mortgage (d) 15,879 10,283Bank loan (note 2(a)) — 12,600Other long-term liabilities 15,764 15,568140,241 239,989Less amounts due within one year (1,290) (13,403)$ 138,951 $ 226,586(a) Unsecured debentures:The unsecured debentures, with a face value of $100,000, were issued on July 2, <strong>1997</strong> at a discount for $99,723, <strong>and</strong> are dueon July 2, 2002. The debentures bear interest at 6%, payable semi-annually, <strong>and</strong> are redeemable at the option of theCorporation, in whole or in part, at any time, at redemption prices provided for in the indenture.(b) Unsecured notes:The unsecured notes, with a face value at December 31, <strong>1997</strong> of US$6,000 (1996 – US$107,500), were issued onJune 30, 1993 at a discount, <strong>and</strong> are due on July 1, 2000. The notes bear interest at 9-1/8%, payable semi-annually, <strong>and</strong>are redeemable at the option of the Corporation, in whole or in part, at any time on or after July 1, 1998, at redemptionprices provided for in the indenture. The Corporation repurchased notes with a face value of US$101,500 during <strong>1997</strong>(1996 – US$7,500) for US$108,178, which resulted in an accounting loss of $12,021. The notes repurchased have beencancelled by the Corporation. The repurchase was partly funded from the proceeds of the unsecured debentures issued inJuly <strong>1997</strong> (note (a) above).(c) Bank credit facility:The Corporation has a US$100,000 committed bank credit facility which matures in July 2002. As at December 31, <strong>1997</strong>,no amounts (1996 – US$39,500) had been borrowed by the Corporation under this credit facility. Borrowings under thiscredit facility bear interest at LIBOR plus a spread ranging between 0.3% <strong>and</strong> 1% (LIBOR plus 1/2% during <strong>1997</strong> <strong>and</strong> 1996)depending upon certain criteria specified in the loan agreement, <strong>and</strong> are secured by a charge over virtually all of theCorporation’s Canadian assets.The balance outst<strong>and</strong>ing under the bank credit facility as at December 31, 1996 was repaid from the proceeds of theequity issuance that the Corporation completed on February 12, <strong>1997</strong> (note 11(b)).(d) Mortgage:This amount in 1996 represents the Corporation’s proportionate share of a mortgage on The Ritz-Carlton Hotel Chicago.US$7,500 was due in <strong>1997</strong>, <strong>and</strong> bore interest at the lower of LIBOR plus 2% <strong>and</strong> US prime plus 1%. The Corporationhad jointly <strong>and</strong> severally guaranteed US$3,000 of this proportionately consolidated debt.In January <strong>1997</strong>, the mortgage was refinanced <strong>and</strong> the Corporation’s proportionately consolidated amount of therefinanced non-recourse mortgage was US$11,250. The refinanced mortgage bears interest at rates ranging from thelower of LIBOR plus 1.50% <strong>and</strong> US prime plus 0.50%, up to the lower of LIBOR plus 2.25% <strong>and</strong> US prime plus 1.25%,depending on certain financial tests. The mortgage is due in 2002, with annual repayments of US$225, payable in equalquarterly instalments. As at December 31, <strong>1997</strong>, the outst<strong>and</strong>ing mortgage was US$11,081. As a result of the refinancing,the Corporation was released from its guarantee of US$3,000, <strong>and</strong> US$3,461 was distributed to the Corporation.65<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.