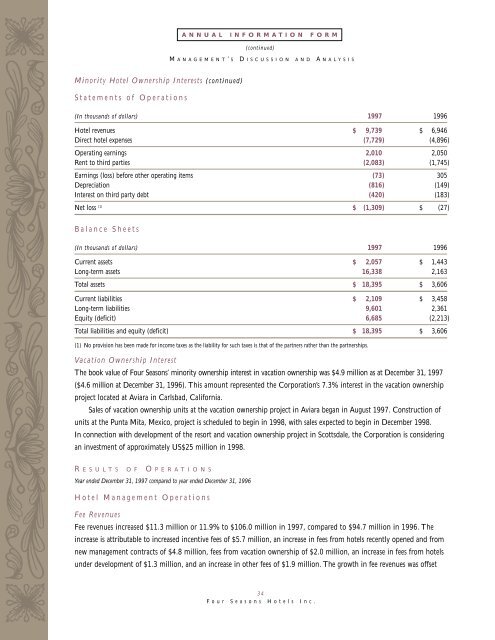

ANNUAL INFORMATION FORM(continued)M ANAGEMENT’ S D ISCUSSION AND A NALYSISMinority Hotel Ownership Interests (continued)Statements of Operations(In thous<strong>and</strong>s of dollars) <strong>1997</strong> 1996Hotel revenues $ 9,739 $ 6,946Direct hotel expenses (7,729) (4,896)Operating earnings 2,010 2,050Rent to third parties (2,083) (1,745)Earnings (loss) before other operating items (73) 305Depreciation (816) (149)Interest on third party debt (420) (183)Net loss (1) $ (1,309) $ (27)Balance Sheets(In thous<strong>and</strong>s of dollars) <strong>1997</strong> 1996Current assets $ 2,057 $ 1,443Long-term assets 16,338 2,163Total assets $ 18,395 $ 3,606Current liabilities $ 2,109 $ 3,458Long-term liabilities 9,601 2,361Equity (deficit) 6,685 (2,213)Total liabilities <strong>and</strong> equity (deficit) $ 18,395 $ 3,606(1) No provision has been made for income taxes as the liability for such taxes is that of the partners rather than the partnerships.Vacation Ownership InterestThe book value of <strong>Four</strong> <strong>Seasons</strong>’ minority ownership interest in vacation ownership was $4.9 million as at December 31, <strong>1997</strong>($4.6 million at December 31, 1996). This amount represented the Corporation’s 7.3% interest in the vacation ownershipproject located at Aviara in Carlsbad, California.Sales of vacation ownership units at the vacation ownership project in Aviara began in August <strong>1997</strong>. Construction ofunits at the Punta Mita, Mexico, project is scheduled to begin in 1998, with sales expected to begin in December 1998.In connection with development of the resort <strong>and</strong> vacation ownership project in Scottsdale, the Corporation is consideringan investment of approximately US$25 million in 1998.R E S U L T S O F O P E R A T I O N SYear ended December 31, <strong>1997</strong> compared to year ended December 31, 1996Hotel Management OperationsFee RevenuesFee revenues increased $11.3 million or 11.9% to $106.0 million in <strong>1997</strong>, compared to $94.7 million in 1996. Theincrease is attributable to increased incentive fees of $5.7 million, an increase in fees from hotels recently opened <strong>and</strong> fromnew management contracts of $4.8 million, fees from vacation ownership of $2.0 million, an increase in fees from hotelsunder development of $1.3 million, <strong>and</strong> an increase in other fees of $1.9 million. The growth in fee revenues was offset34<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.

primarily by the termination during 1996 of management contracts for Regent hotels in Melbourne, Auckl<strong>and</strong>, <strong>and</strong> Fiji,<strong>and</strong> the Inn on the Park in Toronto (which together accounted for a reduction of $4.4 million of fee revenues). Incentivefees contributed 23.2% of the total fee revenues in <strong>1997</strong>, compared to 20.2% in 1996.Total revenues of all managed hotels increased to $2.1 billion in <strong>1997</strong>, compared to $1.9 billion in 1996. Growth in revenuewas driven by continued strong performance in both the North American <strong>and</strong> European markets, offset by a weak performancein the Asian market in the last half of <strong>1997</strong>. The weakness in a number of the Asian markets caused a decline in REVPAR of 8.2%<strong>and</strong> a decline in gross operating profit of 9.4% in hotels under management in that region in <strong>1997</strong>. Compared to 1996,this resulted in a reduction of approximately $1 million in fee revenues from the Asian hotels in <strong>1997</strong>. The Corporation’sCore <strong>Hotels</strong> showed an average increase of approximately 5% in REVPAR in <strong>1997</strong>, compared to 1996, primarily as a resultof increases in room rates. The REVPAR increase realized in <strong>1997</strong>, combined with enhanced operating efficiencies, resultedin an increase of approximately 10% in the gross operating profit of Core <strong>Hotels</strong> in <strong>1997</strong>, compared to 1996.The Corporation expects REVPAR in Core <strong>Hotels</strong> to increase approximately 7% in North America <strong>and</strong> Europe in1998, compared to <strong>1997</strong>, primarily due to an increase in room rates, offset by an expected reduction of approximately15% to 20% in Asia. Overall, REVPAR is expected to increase marginally in 1998 by approximately 2%, compared to<strong>1997</strong>, in Core <strong>Hotels</strong>. Gross operating profit of the same hotels is expected to increase by over 10% in North America<strong>and</strong> 5% in Europe, <strong>and</strong> decrease by approximately 20% in Asia, in 1998, compared to <strong>1997</strong>.The Corporation expects that fee revenues should increase by approximately 15% in 1998 over <strong>1997</strong> primarily as a resultof (i) increased fees from the improved performance of hotels in North America <strong>and</strong> Europe, (ii) the fees to be earnedfrom the new or relaunched hotels in Bali at Sayan, Goa, India, Lisbon <strong>and</strong> the Maldives, (iii) a full year of fee revenuesfrom the resort <strong>and</strong> vacation ownership property in Aviara <strong>and</strong> the management contract in Atlanta, <strong>and</strong> (iv) theincremental fees to be earned from enhanced management contracts in London <strong>and</strong> Chicago. These increased revenueswill be offset by the expected reduction in fees from the Asian hotels.General <strong>and</strong> Administrative ExpensesGeneral <strong>and</strong> administrative expenses increased by $3.3 million or 8.4% in <strong>1997</strong>, compared to 1996, due to increasing stafflevels, certain regional moves necessary to allow for the Corporation’s expansion into Europe, the Middle East <strong>and</strong> India,<strong>and</strong> as a result of the incentives earned by management in respect of the financial performance of the Corporation in <strong>1997</strong>. In1998, the increase in general <strong>and</strong> administrative expenses is expected to be approximately 8% as the increase in staffing <strong>and</strong>regional moves are finalized.Hotel Management EarningsAs a result of the changes in fee revenues <strong>and</strong> expenses discussed above, the Corporation’s hotel management earningsincreased by $8.0 million or 14.3% to $63.7 million in <strong>1997</strong>. Hotel management earnings represented 80.9% of theCorporation’s earnings before other operating items in <strong>1997</strong>, compared with 86.5% in 1996. The decrease was due tothe consolidation of the Corporation’s 100% leasehold interests in The Pierre in New York <strong>and</strong> the <strong>Four</strong> <strong>Seasons</strong> HotelVancouver in <strong>1997</strong>. It is estimated that this percentage will increase in 1998 to approximately 90%, due to an expectedincrease in hotel management earnings combined with an expected reduction in hotel ownership earnings due to theplanned disposition of the Corporation’s 25% interest in The Ritz-Carlton Hotel Chicago <strong>and</strong> the inclusion of the start-uplosses from the <strong>Four</strong> <strong>Seasons</strong> Hotel Berlin (see Hotel Ownership Operations on page 36). As a result of the above-mentionedfactors, hotel management fee revenues <strong>and</strong> hotel management earnings in 1998 are expected to exceed <strong>1997</strong> levels byapproximately 15%. In 1998, the hotel management profit margin is expected to exceed the <strong>1997</strong> margin of 60.1%.35<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.