1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

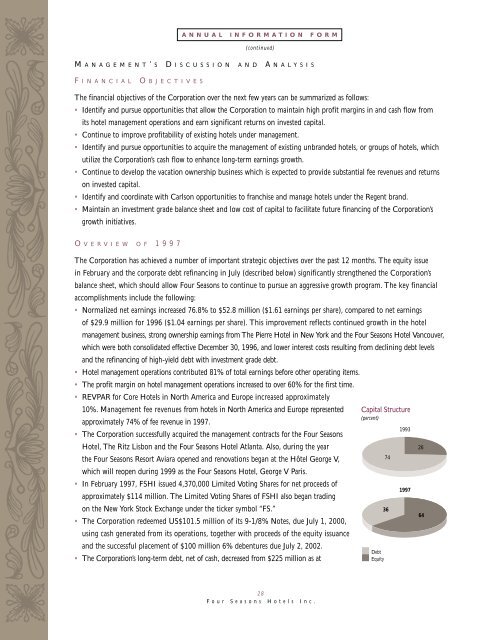

ANNUAL INFORMATION FORM(continued)M A N A G E M E N T’ S D I S C U S S I O N A N D A N A L Y S I SF I N A N C I A LO B J E C T I V E SThe financial objectives of the Corporation over the next few years can be summarized as follows:• Identify <strong>and</strong> pursue opportunities that allow the Corporation to maintain high profit margins in <strong>and</strong> cash flow fromits hotel management operations <strong>and</strong> earn significant returns on invested capital.• Continue to improve profitability of existing hotels under management.• Identify <strong>and</strong> pursue opportunities to acquire the management of existing unbr<strong>and</strong>ed hotels, or groups of hotels, whichutilize the Corporation’s cash flow to enhance long-term earnings growth.• Continue to develop the vacation ownership business which is expected to provide substantial fee revenues <strong>and</strong> returnson invested capital.• Identify <strong>and</strong> coordinate with Carlson opportunities to franchise <strong>and</strong> manage hotels under the Regent br<strong>and</strong>.• Maintain an investment grade balance sheet <strong>and</strong> low cost of capital to facilitate future financing of the Corporation’sgrowth initiatives.O V E R V I E W O F <strong>1997</strong>The Corporation has achieved a number of important strategic objectives over the past 12 months. The equity issuein February <strong>and</strong> the corporate debt refinancing in July (described below) significantly strengthened the Corporation’sbalance sheet, which should allow <strong>Four</strong> <strong>Seasons</strong> to continue to pursue an aggressive growth program. The key financialaccomplishments include the following:• Normalized net earnings increased 76.8% to $52.8 million ($1.61 earnings per share), compared to net earningsof $29.9 million for 1996 ($1.04 earnings per share). This improvement reflects continued growth in the hotelmanagement business, strong ownership earnings from The Pierre Hotel in New York <strong>and</strong> the <strong>Four</strong> <strong>Seasons</strong> Hotel Vancouver,which were both consolidated effective December 30, 1996, <strong>and</strong> lower interest costs resulting from declining debt levels<strong>and</strong> the refinancing of high-yield debt with investment grade debt.• Hotel management operations contributed 81% of total earnings before other operating items.• The profit margin on hotel management operations increased to over 60% for the first time.• REVPAR for Core <strong>Hotels</strong> in North America <strong>and</strong> Europe increased approximately10%. Management fee revenues from hotels in North America <strong>and</strong> Europe represented Capital Structureapproximately 74% of fee revenue in <strong>1997</strong>.(percent)• The Corporation successfully acquired the management contracts for the <strong>Four</strong> <strong>Seasons</strong>1993Hotel, The Ritz Lisbon <strong>and</strong> the <strong>Four</strong> <strong>Seasons</strong> Hotel Atlanta. Also, during the year26the <strong>Four</strong> <strong>Seasons</strong> Resort Aviara opened <strong>and</strong> renovations began at the Hôtel George V,74which will reopen during 1999 as the <strong>Four</strong> <strong>Seasons</strong> Hotel, George V Paris.• In February <strong>1997</strong>, FSHI issued 4,370,000 Limited Voting Shares for net proceeds of<strong>1997</strong>approximately $114 million. The Limited Voting Shares of FSHI also began tradingon the New York Stock Exchange under the ticker symbol “FS.”• The Corporation redeemed US$101.5 million of its 9-1/8% Notes, due July 1, 2000,using cash generated from its operations, together with proceeds of the equity issuance<strong>and</strong> the successful placement of $100 million 6% debentures due July 2, 2002.• The Corporation’s long-term debt, net of cash, decreased from $225 million as at36742664DebtEquity28<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.