1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

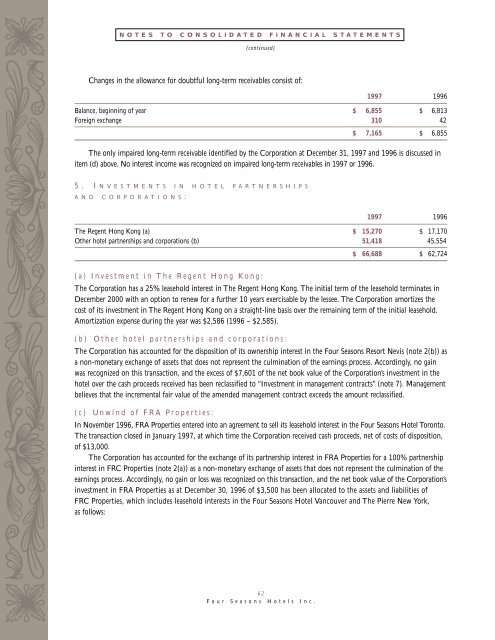

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(continued)Changes in the allowance for doubtful long-term receivables consist of:<strong>1997</strong> 1996Balance, beginning of year $ 6,855 $ 6,813Foreign exchange 310 42$ 7,165 $ 6,855The only impaired long-term receivable identified by the Corporation at December 31, <strong>1997</strong> <strong>and</strong> 1996 is discussed initem (d) above. No interest income was recognized on impaired long-term receivables in <strong>1997</strong> or 1996.5. I N V E S T M E N T S I N H O T E L P A R T N E R S H I P SA N D C O R P O R A T I O N S:<strong>1997</strong> 1996The Regent Hong Kong (a) $ 15,270 $ 17,170Other hotel partnerships <strong>and</strong> corporations (b) 51,418 45,554$ 66,688 $ 62,724(a) Investment in The Regent Hong Kong:The Corporation has a 25% leasehold interest in The Regent Hong Kong. The initial term of the leasehold terminates inDecember 2000 with an option to renew for a further 10 years exercisable by the lessee. The Corporation amortizes thecost of its investment in The Regent Hong Kong on a straight-line basis over the remaining term of the initial leasehold.Amortization expense during the year was $2,586 (1996 – $2,585).(b) Other hotel partnerships <strong>and</strong> corporations:The Corporation has accounted for the disposition of its ownership interest in the <strong>Four</strong> <strong>Seasons</strong> Resort Nevis (note 2(b)) asa non-monetary exchange of assets that does not represent the culmination of the earnings process. Accordingly, no gainwas recognized on this transaction, <strong>and</strong> the excess of $7,601 of the net book value of the Corporation’s investment in thehotel over the cash proceeds received has been reclassified to “Investment in management contracts” (note 7). Managementbelieves that the incremental fair value of the amended management contract exceeds the amount reclassified.(c) Unwind of FRA Properties:In November 1996, FRA Properties entered into an agreement to sell its leasehold interest in the <strong>Four</strong> <strong>Seasons</strong> Hotel Toronto.The transaction closed in January <strong>1997</strong>, at which time the Corporation received cash proceeds, net of costs of disposition,of $13,000.The Corporation has accounted for the exchange of its partnership interest in FRA Properties for a 100% partnershipinterest in FRC Properties (note 2(a)) as a non-monetary exchange of assets that does not represent the culmination of theearnings process. Accordingly, no gain or loss was recognized on this transaction, <strong>and</strong> the net book value of the Corporation’sinvestment in FRA Properties as at December 30, 1996 of $3,500 has been allocated to the assets <strong>and</strong> liabilities ofFRC Properties, which includes leasehold interests in the <strong>Four</strong> <strong>Seasons</strong> Hotel Vancouver <strong>and</strong> The Pierre New York,as follows:62<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.