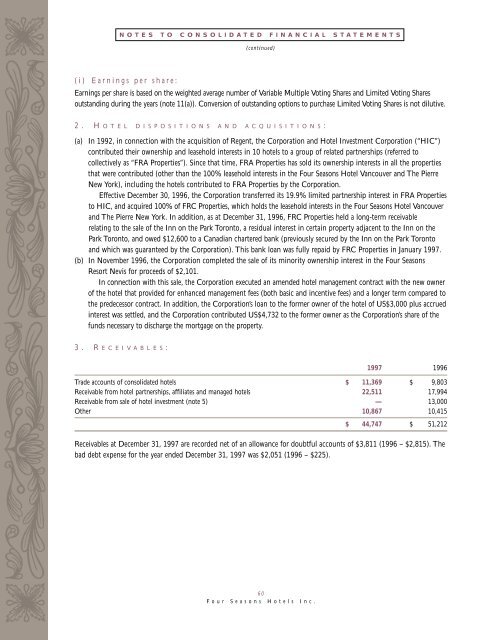

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(continued)(i) Earnings per share:Earnings per share is based on the weighted average number of Variable Multiple Voting Shares <strong>and</strong> Limited Voting Sharesoutst<strong>and</strong>ing during the years (note 11(a)). Conversion of outst<strong>and</strong>ing options to purchase Limited Voting Shares is not dilutive.2. H O T E L D I S P O S I T I O N S A N D A C Q U I S I T I O N S:(a) In 1992, in connection with the acquisition of Regent, the Corporation <strong>and</strong> Hotel Investment Corporation (“HIC”)contributed their ownership <strong>and</strong> leasehold interests in 10 hotels to a group of related partnerships (referred tocollectively as “FRA Properties”). Since that time, FRA Properties has sold its ownership interests in all the propertiesthat were contributed (other than the 100% leasehold interests in the <strong>Four</strong> <strong>Seasons</strong> Hotel Vancouver <strong>and</strong> The PierreNew York), including the hotels contributed to FRA Properties by the Corporation.Effective December 30, 1996, the Corporation transferred its 19.9% limited partnership interest in FRA Propertiesto HIC, <strong>and</strong> acquired 100% of FRC Properties, which holds the leasehold interests in the <strong>Four</strong> <strong>Seasons</strong> Hotel Vancouver<strong>and</strong> The Pierre New York. In addition, as at December 31, 1996, FRC Properties held a long-term receivablerelating to the sale of the Inn on the Park Toronto, a residual interest in certain property adjacent to the Inn on thePark Toronto, <strong>and</strong> owed $12,600 to a Canadian chartered bank (previously secured by the Inn on the Park Toronto<strong>and</strong> which was guaranteed by the Corporation). This bank loan was fully repaid by FRC Properties in January <strong>1997</strong>.(b) In November 1996, the Corporation completed the sale of its minority ownership interest in the <strong>Four</strong> <strong>Seasons</strong>Resort Nevis for proceeds of $2,101.In connection with this sale, the Corporation executed an amended hotel management contract with the new ownerof the hotel that provided for enhanced management fees (both basic <strong>and</strong> incentive fees) <strong>and</strong> a longer term compared tothe predecessor contract. In addition, the Corporation’s loan to the former owner of the hotel of US$3,000 plus accruedinterest was settled, <strong>and</strong> the Corporation contributed US$4,732 to the former owner as the Corporation’s share of thefunds necessary to discharge the mortgage on the property.3. R E C E I V A B L E S:<strong>1997</strong> 1996Trade accounts of consolidated hotels $ 11,369 $ 9,803Receivable from hotel partnerships, affiliates <strong>and</strong> managed hotels 22,511 17,994Receivable from sale of hotel investment (note 5) — 13,000Other 10,867 10,415$ 44,747 $ 51,212Receivables at December 31, <strong>1997</strong> are recorded net of an allowance for doubtful accounts of $3,811 (1996 – $2,815). Thebad debt expense for the year ended December 31, <strong>1997</strong> was $2,051 (1996 – $225).60<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.

4. L O N G- T E R M R E C E I V A B L E S:<strong>1997</strong> 1996Secured cash flow bond, due 2005, interest at 10%, £11.6 million(1996 – £12.6 million) (a) $ 27,454 $ 29,377Secured loans:Secured, interest at 6%, French francs 161.6 million (b) 39,219 —Secured by a hotel property sold (c) 6,940 7,000Due from directors, officers <strong>and</strong> employees, non-interest bearing notes <strong>and</strong> mortgages 5,643 5,024Unsecured loans:To managed hotels, non-interest bearing loans, US$5,291 (1996 – US$5,020) (d) 7,581 6,88386,837 48,284Less allowance for doubtful long-term receivables (d) (7,165) (6,855)$ 79,672 $ 41,429(a)(b)(c)(d)The cash flow bond was received by the Corporation in 1995 as consideration for the sale of its 50% interest inthe <strong>Four</strong> <strong>Seasons</strong> Hotel London to an affiliate of Kingdom Investments Inc. (“Kingdom”), which is a significantshareholder of FSHI. Principal <strong>and</strong> interest on the bond is payable annually out of the purchaser’s 50% portion ofthe available cash flow (as defined in the bond indenture) from the hotel. The bond is secured by the purchaser’sinvestment in the hotel. During <strong>1997</strong>, principal repayment of £1.0 million was received by the Corporation as wellas all interest accrued on the bond to March <strong>1997</strong>. Interest income from the bonds has been fully accrued in <strong>1997</strong>,as the Corporation believes there is reasonable assurance the interest will be received in March 1998.In connection with the acquisition of the Hôtel George V in Paris by an affiliate of Kingdom, the Corporationadvanced, in <strong>1997</strong>, a loan to an affiliate of Kingdom in the amount of approximately French francs 161.6 million.The loan is secured by Kingdom’s indirect interest in the hotel.Following an extensive renovation program, the Corporation expects that it will manage the hotel pursuant to along-term management agreement. When <strong>and</strong> if this occurs, the Corporation will reclassify the loan to “Investmentin management contracts” <strong>and</strong> amortize it over 40 years. The loan will be repaid in accordance with an agreed uponformula if the management agreement is terminated for any reason, or if the renovation program is not completed.FRC Properties received a promissory note relating to the sale of the Inn on the Park Toronto (note 2 (a)). The notehas a face value of $10,000, bears interest at 9% per annum <strong>and</strong> is repayable over the period to January 17, 2001.At maturity, the debtor has the option to extend the note for a further five years, <strong>and</strong> the debtor has the option toprepay any or all of the principal <strong>and</strong> interest outst<strong>and</strong>ing, without penalty, at any time. If the debtor achievesspecified capital spending targets at the hotel, the interest rate is reduced. The Corporation believes that the debtorwill likely achieve these capital spending targets; therefore, the note has been recorded at a discounted amount, usinga rate of interest that takes into account the risks associated with the note. During <strong>1997</strong>, principal of $60 wasreceived by the Corporation.As at December 31, <strong>1997</strong> <strong>and</strong> 1996, the Corporation had advanced a total of US$5,000 to the owner ofThe Regent Hotel Jakarta which opened in late 1995. This loan is unsecured, non-interest bearing, <strong>and</strong> convertibleinto a 5% equity interest in the hotel, subject to regulatory approval. If the loan is not converted into equityof the hotel, the loan is repayable in full on December 14, 2003. The Corporation has fully reserved for the loan asat December 31, <strong>1997</strong> <strong>and</strong> 1996.61<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.