1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

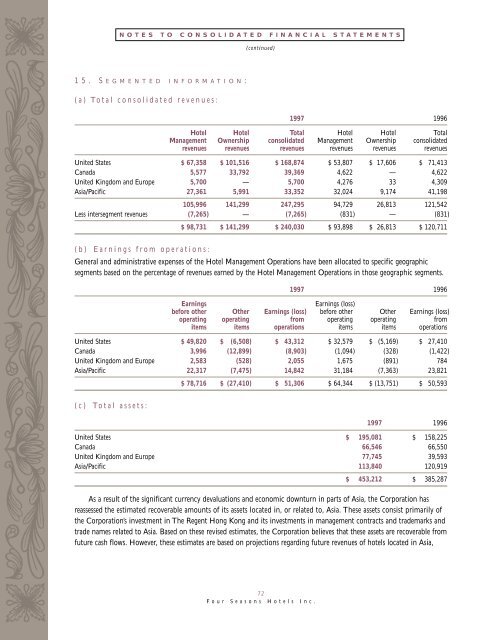

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(continued)15. S E G M E N T E D I N F O R M A T I O N:(a) Total consolidated revenues:<strong>1997</strong> 1996Hotel Hotel Total Hotel Hotel TotalManagement Ownership consolidated Management Ownership consolidatedrevenues revenues revenues revenues revenues revenuesUnited States $ 67,358 $ 101,516 $ 168,874 $ 53,807 $ 17,606 $ 71,413Canada 5,577 33,792 39,369 4,622 — 4,622United Kingdom <strong>and</strong> Europe 5,700 — 5,700 4,276 33 4,309Asia/Pacific 27,361 5,991 33,352 32,024 9,174 41,198105,996 141,299 247,295 94,729 26,813 121,542Less intersegment revenues (7,265) — (7,265) (831) — (831)$ 98,731 $ 141,299 $ 240,030 $ 93,898 $ 26,813 $ 120,711(b) Earnings from operations:General <strong>and</strong> administrative expenses of the Hotel Management Operations have been allocated to specific geographicsegments based on the percentage of revenues earned by the Hotel Management Operations in those geographic segments.<strong>1997</strong> 1996EarningsEarnings (loss)before other Other Earnings (loss) before other Other Earnings (loss)operating operating from operating operating fromitems items operations items items operationsUnited States $ 49,820 $ (6,508) $ 43,312 $ 32,579 $ (5,169) $ 27,410Canada 3,996 (12,899) (8,903) (1,094) (328) (1,422)United Kingdom <strong>and</strong> Europe 2,583 (528) 2,055 1,675 (891) 784Asia/Pacific 22,317 (7,475) 14,842 31,184 (7,363) 23,821$ 78,716 $ (27,410) $ 51,306 $ 64,344 $ (13,751) $ 50,593(c)Total assets:<strong>1997</strong> 1996United States $ 195,081 $ 158,225Canada 66,546 66,550United Kingdom <strong>and</strong> Europe 77,745 39,593Asia/Pacific 113,840 120,919$ 453,212 $ 385,287As a result of the significant currency devaluations <strong>and</strong> economic downturn in parts of Asia, the Corporation hasreassessed the estimated recoverable amounts of its assets located in, or related to, Asia. These assets consist primarily ofthe Corporation’s investment in The Regent Hong Kong <strong>and</strong> its investments in management contracts <strong>and</strong> trademarks <strong>and</strong>trade names related to Asia. Based on these revised estimates, the Corporation believes that these assets are recoverable fromfuture cash flows. However, these estimates are based on projections regarding future revenues of hotels located in Asia,72<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.