1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

1997 Annual Report - Four Seasons Hotels and Resorts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

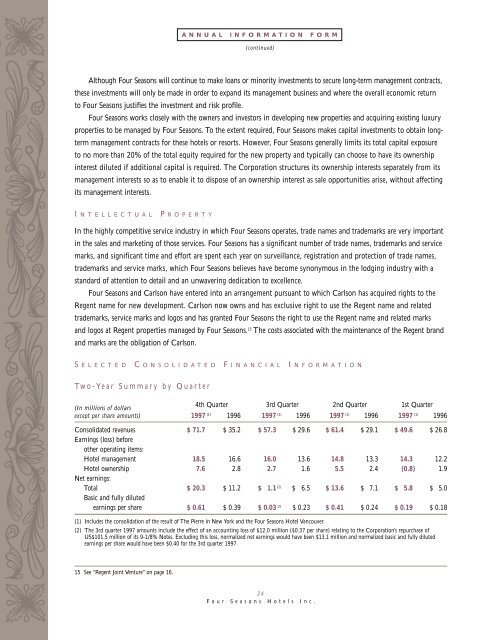

ANNUAL INFORMATION FORM(continued)Although <strong>Four</strong> <strong>Seasons</strong> will continue to make loans or minority investments to secure long-term management contracts,these investments will only be made in order to exp<strong>and</strong> its management business <strong>and</strong> where the overall economic returnto <strong>Four</strong> <strong>Seasons</strong> justifies the investment <strong>and</strong> risk profile.<strong>Four</strong> <strong>Seasons</strong> works closely with the owners <strong>and</strong> investors in developing new properties <strong>and</strong> acquiring existing luxuryproperties to be managed by <strong>Four</strong> <strong>Seasons</strong>. To the extent required, <strong>Four</strong> <strong>Seasons</strong> makes capital investments to obtain longtermmanagement contracts for these hotels or resorts. However, <strong>Four</strong> <strong>Seasons</strong> generally limits its total capital exposureto no more than 20% of the total equity required for the new property <strong>and</strong> typically can choose to have its ownershipinterest diluted if additional capital is required. The Corporation structures its ownership interests separately from itsmanagement interests so as to enable it to dispose of an ownership interest as sale opportunities arise, without affectingits management interests.I N T E L L E C T U A LP ROPERTYIn the highly competitive service industry in which <strong>Four</strong> <strong>Seasons</strong> operates, trade names <strong>and</strong> trademarks are very importantin the sales <strong>and</strong> marketing of those services. <strong>Four</strong> <strong>Seasons</strong> has a significant number of trade names, trademarks <strong>and</strong> servicemarks, <strong>and</strong> significant time <strong>and</strong> effort are spent each year on surveillance, registration <strong>and</strong> protection of trade names,trademarks <strong>and</strong> service marks, which <strong>Four</strong> <strong>Seasons</strong> believes have become synonymous in the lodging industry with ast<strong>and</strong>ard of attention to detail <strong>and</strong> an unwavering dedication to excellence.<strong>Four</strong> <strong>Seasons</strong> <strong>and</strong> Carlson have entered into an arrangement pursuant to which Carlson has acquired rights to theRegent name for new development. Carlson now owns <strong>and</strong> has exclusive right to use the Regent name <strong>and</strong> relatedtrademarks, service marks <strong>and</strong> logos <strong>and</strong> has granted <strong>Four</strong> <strong>Seasons</strong> the right to use the Regent name <strong>and</strong> related marks<strong>and</strong> logos at Regent properties managed by <strong>Four</strong> <strong>Seasons</strong>. 15 The costs associated with the maintenance of the Regent br<strong>and</strong><strong>and</strong> marks are the obligation of Carlson.S E L E C T E D C O N S O L I D A T E D F I N A N C I A L I N F O R M A T I O NTwo-Year Summary by Quarter(In millions of dollars4th Quarter 3rd Quarter 2nd Quarter 1st Quarterexcept per share amounts) <strong>1997</strong> (1) 1996 <strong>1997</strong> (1) 1996 <strong>1997</strong> (1) 1996 <strong>1997</strong> (1) 1996Consolidated revenues $ 71.7 $ 35.2 $ 57.3 $ 29.6 $ 61.4 $ 29.1 $ 49.6 $ 26.8Earnings (loss) beforeother operating items:Hotel management 18.5 16.6 16.0 13.6 14.8 13.3 14.3 12.2Hotel ownership 7.6 2.8 2.7 1.6 5.5 2.4 (0.8) 1.9Net earnings:Total $ 20.3 $ 11.2 $ 1.1 (2) $ 6.5 $ 13.6 $ 7.1 $ 5.8 $ 5.0Basic <strong>and</strong> fully dilutedearnings per share $ 0.61 $ 0.39 $ 0.03 (2) $ 0.23 $ 0.41 $ 0.24 $ 0.19 $ 0.18(1) Includes the consolidation of the result of The Pierre in New York <strong>and</strong> the <strong>Four</strong> <strong>Seasons</strong> Hotel Vancouver.(2) The 3rd quarter <strong>1997</strong> amounts include the effect of an accounting loss of $12.0 million ($0.37 per share) relating to the Corporation’s repurchase ofUS$101.5 million of its 9-1/8% Notes. Excluding this loss, normalized net earnings would have been $13.1 million <strong>and</strong> normalized basic <strong>and</strong> fully dilutedearnings per share would have been $0.40 for the 3rd quarter <strong>1997</strong>.15 See “Regent Joint Venture” on page 16.24<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.