application of real options valuation to r&d investments in ...

application of real options valuation to r&d investments in ...

application of real options valuation to r&d investments in ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

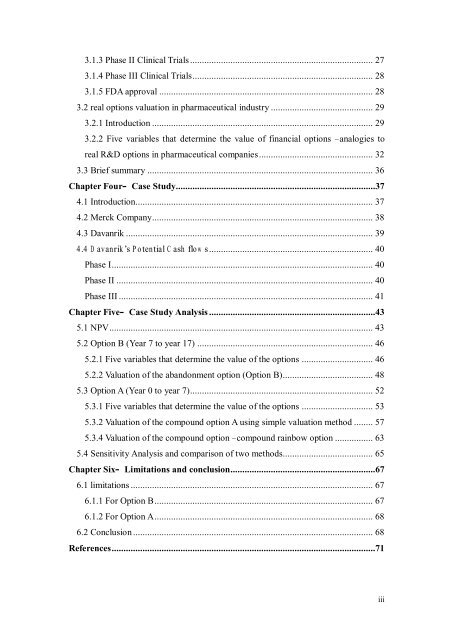

3.1.3 Phase II Cl<strong>in</strong>ical Trials ............................................................................. 273.1.4 Phase III Cl<strong>in</strong>ical Trials ............................................................................ 283.1.5 FDA approval .......................................................................................... 283.2 <strong>real</strong> <strong>options</strong> <strong>valuation</strong> <strong>in</strong> pharmaceutical <strong>in</strong>dustry ........................................... 293.2.1 Introduction ............................................................................................. 293.2.2 Five variables that determ<strong>in</strong>e the value <strong>of</strong> f<strong>in</strong>ancial <strong>options</strong> –analogies <strong>to</strong><strong>real</strong> R&D <strong>options</strong> <strong>in</strong> pharmaceutical companies ................................................ 323.3 Brief summary ............................................................................................... 36Chapter Four— Case Study ....................................................................................374.1 Introduction.................................................................................................... 374.2 Merck Company ............................................................................................. 384.3 Davanrik ........................................................................................................ 394.4 D avanrik’s P otential C ash flow s ..................................................................... 40Phase I .............................................................................................................. 40Phase II ............................................................................................................ 40Phase III ........................................................................................................... 41Chapter Five— Case Study Analysis ......................................................................435.1 NPV ............................................................................................................... 435.2 Option B (Year 7 <strong>to</strong> year 17) .......................................................................... 465.2.1 Five variables that determ<strong>in</strong>e the value <strong>of</strong> the <strong>options</strong> .............................. 465.2.2 Valuation <strong>of</strong> the abandonment option (Option B) ...................................... 485.3 Option A (Year 0 <strong>to</strong> year 7) ............................................................................. 525.3.1 Five variables that determ<strong>in</strong>e the value <strong>of</strong> the <strong>options</strong> .............................. 535.3.2 Valuation <strong>of</strong> the compound option A us<strong>in</strong>g simple <strong>valuation</strong> method ........ 575.3.4 Valuation <strong>of</strong> the compound option –compound ra<strong>in</strong>bow option ................ 635.4 Sensitivity Analysis and comparison <strong>of</strong> two methods ...................................... 65Chapter Six— Limitations and conclusion .............................................................676.1 limitations ...................................................................................................... 676.1.1 For Option B ............................................................................................ 676.1.2 For Option A ............................................................................................ 686.2 Conclusion ..................................................................................................... 68References ...............................................................................................................71iii