application of real options valuation to r&d investments in ...

application of real options valuation to r&d investments in ...

application of real options valuation to r&d investments in ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

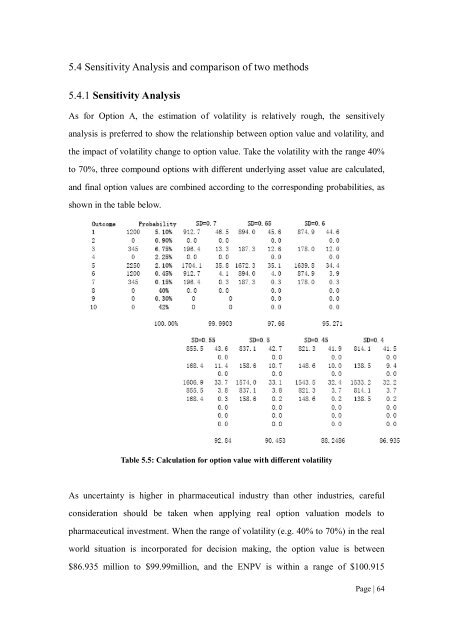

5.4 Sensitivity Analysis and comparison <strong>of</strong> two methods5.4.1 Sensitivity AnalysisAs for Option A, the estimation <strong>of</strong> volatility is relatively rough, the sensitivelyanalysis is preferred <strong>to</strong> show the relationship between option value and volatility, andthe impact <strong>of</strong> volatility change <strong>to</strong> option value. Take the volatility with the range 40%<strong>to</strong> 70%, three compound <strong>options</strong> with different underly<strong>in</strong>g asset value are calculated,and f<strong>in</strong>al option values are comb<strong>in</strong>ed accord<strong>in</strong>g <strong>to</strong> the correspond<strong>in</strong>g probabilities, asshown <strong>in</strong> the table below.Table 5.5: Calculation for option value with different volatilityAs uncerta<strong>in</strong>ty is higher <strong>in</strong> pharmaceutical <strong>in</strong>dustry than other <strong>in</strong>dustries, carefulconsideration should be taken when apply<strong>in</strong>g <strong>real</strong> option <strong>valuation</strong> models <strong>to</strong>pharmaceutical <strong>in</strong>vestment. When the range <strong>of</strong> volatility (e.g. 40% <strong>to</strong> 70%) <strong>in</strong> the <strong>real</strong>world situation is <strong>in</strong>corporated for decision mak<strong>in</strong>g, the option value is between$86.935 million <strong>to</strong> $99.99million, and the ENPV is with<strong>in</strong> a range <strong>of</strong> $100.915Page | 64