application of real options valuation to r&d investments in ...

application of real options valuation to r&d investments in ...

application of real options valuation to r&d investments in ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

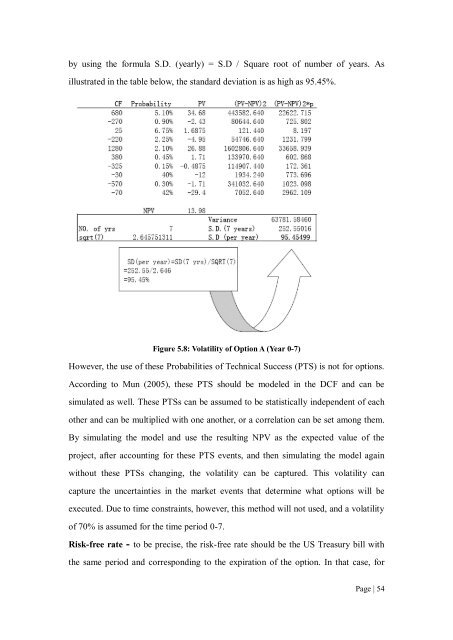

y us<strong>in</strong>g the formula S.D. (yearly) = S.D / Square root <strong>of</strong> number <strong>of</strong> years. Asillustrated <strong>in</strong> the table below, the standard deviation is as high as 95.45%.Figure 5.8: Volatility <strong>of</strong> Option A (Year 0-7)However, the use <strong>of</strong> these Probabilities <strong>of</strong> Technical Success (PTS) is not for <strong>options</strong>.Accord<strong>in</strong>g <strong>to</strong> Mun (2005), these PTS should be modeled <strong>in</strong> the DCF and can besimulated as well. These PTSs can be assumed <strong>to</strong> be statistically <strong>in</strong>dependent <strong>of</strong> eachother and can be multiplied with one another, or a correlation can be set among them.By simulat<strong>in</strong>g the model and use the result<strong>in</strong>g NPV as the expected value <strong>of</strong> theproject, after account<strong>in</strong>g for these PTS events, and then simulat<strong>in</strong>g the model aga<strong>in</strong>without these PTSs chang<strong>in</strong>g, the volatility can be captured. This volatility cancapture the uncerta<strong>in</strong>ties <strong>in</strong> the market events that determ<strong>in</strong>e what <strong>options</strong> will beexecuted. Due <strong>to</strong> time constra<strong>in</strong>ts, however, this method will not used, and a volatility<strong>of</strong> 70% is assumed for the time period 0-7.Risk-free rate – <strong>to</strong> be precise, the risk-free rate should be the US Treasury bill withthe same period and correspond<strong>in</strong>g <strong>to</strong> the expiration <strong>of</strong> the option. In that case, forPage | 54