confidence - Investing In Africa

confidence - Investing In Africa

confidence - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

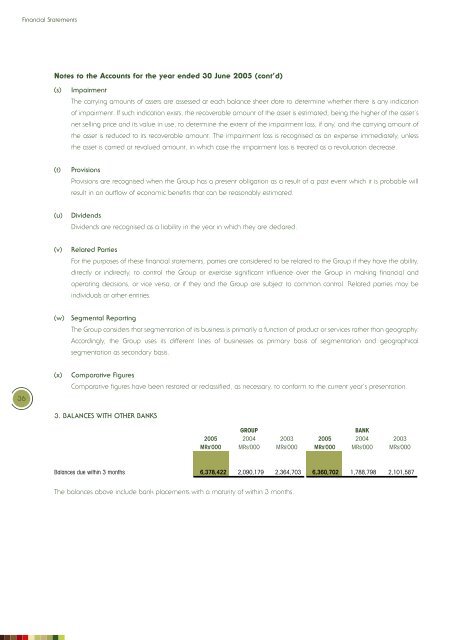

Financial StatementsNotes to the Accounts for the year ended 30 June 2005 (cont’d)(s)ImpairmentThe carrying amounts of assets are assessed at each balance sheet date to determine whether there is any indicationof impairment. If such indication exists, the recoverable amount of the asset is estimated, being the higher of the asset’snet selling price and its value in use, to determine the extent of the impairment loss, if any, and the carrying amount ofthe asset is reduced to its recoverable amount. The impairment loss is recognised as an expense immediately, unlessthe asset is carried at revalued amount, in which case the impairment loss is treated as a revaluation decrease.(t)ProvisionsProvisions are recognised when the Group has a present obligation as a result of a past event which it is probable willresult in an outflow of economic benefits that can be reasonably estimated.(u)DividendsDividends are recognised as a liability in the year in which they are declared.(v)Related PartiesFor the purposes of these financial statements, parties are considered to be related to the Group if they have the ability,directly or indirectly, to control the Group or exercise significant influence over the Group in making financial andoperating decisions, or vice versa, or if they and the Group are subject to common control. Related parties may beindividuals or other entities.(w)Segmental ReportingThe Group considers that segmentation of its business is primarily a function of product or services rather than geography.Accordingly, the Group uses its different lines of businesses as primary basis of segmentation and geographicalsegmentation as secondary basis.36(x)Comparative FiguresComparative figures have been restated or reclassified, as necessary, to conform to the current year’s presentation.3. BALANCES WITH OTHER BANKSGROUPBANK2005 2004 2003 2005 2004 2003MRs'000 MRs'000 MRs'000 MRs'000 MRs'000 MRs'000Balances due within 3 months 6,378,422 2,090,179 2,364,703 6,360,702 1,788,798 2,101,587The balances above include bank placements with a maturity of within 3 months.