confidence - Investing In Africa

confidence - Investing In Africa

confidence - Investing In Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

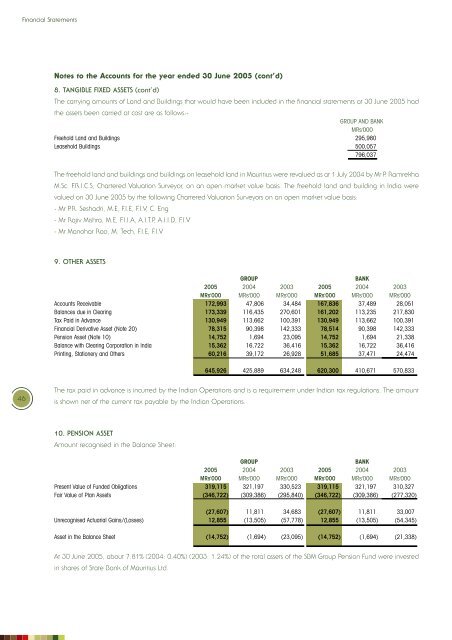

Financial StatementsNotes to the Accounts for the year ended 30 June 2005 (cont’d)8. TANGIBLE FIXED ASSETS (cont’d)The carrying amounts of Land and Buildings that would have been included in the financial statements at 30 June 2005 hadthe assets been carried at cost are as follows:-GROUP AND BANKMRs'000Freehold Land and Buildings 295,980Leasehold Buildings 500,057796,037The freehold land and buildings and buildings on leasehold land in Mauritius were revalued as at 1 July 2004 by Mr P. RamrekhaM.Sc. F.R.I.C.S, Chartered Valuation Surveyor, on an open market value basis. The freehold land and building in <strong>In</strong>dia werevalued on 30 June 2005 by the following Chartered Valuation Surveyors on an open market value basis:- Mr P.R. Seshadri, M.E, F.I.E, F.I.V, C. Eng- Mr Rajiv Mishra, M.E, F.I.I.A, A.I.T.P, A.I.I.D, F.I.V- Mr Manohar Rao, M. Tech, F.I.E, F.I.V9. OTHER ASSETSGROUPBANK2005 2004 2003 2005 2004 2003MRs'000 MRs'000 MRs'000 MRs'000 MRs'000 MRs'000Accounts Receivable 172,993 47,806 34,484 167,836 37,489 28,051Balances due in Clearing 173,339 116,435 270,601 161,202 113,235 217,830Tax Paid in Advance 130,949 113,662 100,391 130,949 113,662 100,391Financial Derivative Asset (Note 20) 78,315 90,398 142,333 78,514 90,398 142,333Pension Asset (Note 10) 14,752 1,694 23,095 14,752 1,694 21,338Balance with Clearing Corporation in <strong>In</strong>dia 15,362 16,722 36,416 15,362 16,722 36,416Printing, Stationery and Others 60,216 39,172 26,928 51,685 37,471 24,474645,926 425,889 634,248 620,300 410,671 570,83346The tax paid in advance is incurred by the <strong>In</strong>dian Operations and is a requirement under <strong>In</strong>dian tax regulations. The amountis shown net of the current tax payable by the <strong>In</strong>dian Operations.10. PENSION ASSETAmount recognised in the Balance Sheet:GROUPBANK2005 2004 2003 2005 2004 2003MRs'000 MRs'000 MRs'000 MRs'000 MRs'000 MRs'000Present Value of Funded Obligations 319,115 321,197 330,523 319,115 321,197 310,327Fair Value of Plan Assets (346,722) (309,386) (295,840) (346,722) (309,386) (277,320)(27,607) 11,811) 34,683) (27,607) 11,811) 33,007)Unrecognised Actuarial Gains/(Losses) 12,855) (13,505) (57,778) 12,855) (13,505) (54,345)Asset in the Balance Sheet (14,752) (1,694) (23,095) (14,752) (1,694) (21,338)At 30 June 2005, about 7.81% (2004: 0.40%) (2003: 1.24%) of the total assets of the SBM Group Pension Fund were investedin shares of State Bank of Mauritius Ltd.