Untitled - Banco Mercantil

Untitled - Banco Mercantil

Untitled - Banco Mercantil

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

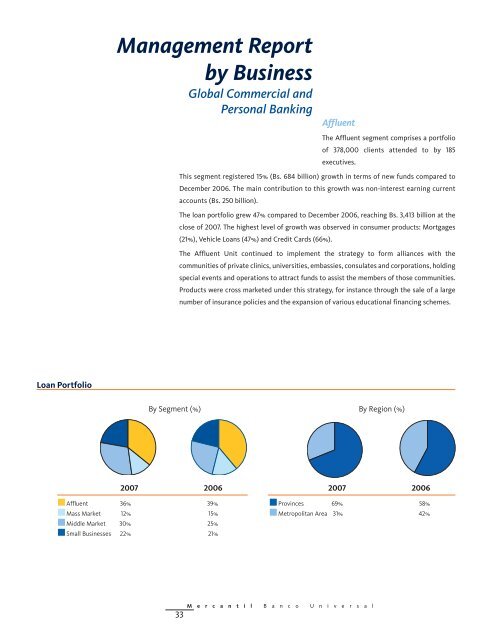

Loan Portfolio<br />

Management Report<br />

by Business<br />

Global Commercial and<br />

Personal Banking<br />

Affluent 36% 39%<br />

Mass Market 12% 15%<br />

Middle Market 30% 25%<br />

Small Businesses 22% 21%<br />

Affluent<br />

M e r c a n t i l B a n c o U n i v e r s a l<br />

33<br />

The Affluent segment comprises a portfolio<br />

of 378,000 clients attended to by 185<br />

executives.<br />

This segment registered 15% (Bs. 684 billion) growth in terms of new funds compared to<br />

December 2006. The main contribution to this growth was non-interest earning current<br />

accounts (Bs. 250 billion).<br />

The loan portfolio grew 47% compared to December 2006, reaching Bs. 3,413 billion at the<br />

close of 2007. The highest level of growth was observed in consumer products: Mortgages<br />

(21%), Vehicle Loans (47%) and Credit Cards (66%).<br />

The Affluent Unit continued to implement the strategy to form alliances with the<br />

communities of private clinics, universities, embassies, consulates and corporations, holding<br />

special events and operations to attract funds to assist the members of those communities.<br />

Products were cross marketed under this strategy, for instance through the sale of a large<br />

number of insurance policies and the expansion of various educational financing schemes.<br />

By Segment (%) By Region (%)<br />

2007 2006<br />

2007 2006<br />

Provinces 69% 58%<br />

Metropolitan Area 31% 42%